In-store beacons are growing as an industry. Mobile marketing platform Swirl just raised $18 million in its latest funding round to expand its beacon technology; more companies are coming together to figure out how a strong beacon network can revitalize the deserted shopping malls of America.

Since we’re still a few years off from total beacon domination, it’s too soon to tell which platform will emerge as the primary beacon technology at every major retailer (assuming Facebook doesn’t swoop in and steamroll them all). But here is a look at how GPShopper, Swirl and Gimbal are reaching customers in the current in-store mobile marketing industry. We grade them each on the content of their messaging, their reach and their usefulness to retailers.

(Not caught up yet as to what in-store beacons actually are? Click here.)

GPShopper

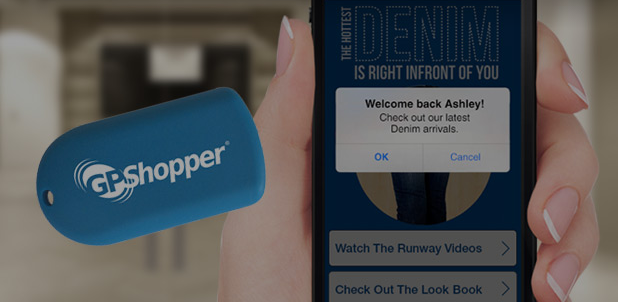

GPShopper is focusing on developing a smarter way for its beacons, which are the size and shape of key fobs (the company helps retailers decide where in the store to put them), to send out messages to shoppers. Rather than targeting customers based on their proximity to a store’s display or section, the team is figuring out how to target customers based on their dwell time – where they’re lingering in a store, according to co-founder Maya Mikhailov.

GPShopper’s beacon model also puts emphasis on the idea that every shopper is different, and a catch-all 10 percent off coupon that’s pinged to every customers’ phone as they walk in the door isn’t effective enough. Mikhailov called coupons and promotions “a 1.0 solution” for beacon technology.

“The same exact message won’t work for everyone,” said Jeremy Sigel, Essence’s mobile lead. “In order for these notifications to have value, we have to know more about those consumers, in a respectful manner.”

However, GPShopper hasn’t tapped into the major retailers and locations yet, like Swirl and Gimbal have. Swirl is rolling out in Lord & Taylor department stores and other retailers like Urban Outfitters; Gimbal is capitalizing on hugely frequented venues and gatherings like Madison Square Garden and SXSW.

While GPShopper works with clients like The North Face, Charlotte Russe and Bebe, these retailers’ store layouts aren’t as effective for beacons as readily to a big-box retailer or department store. (No matter the store’s layout, however, shoppers have to opt in upon entering to receive beacon messages.)

“Beacons are most intriguing in superstores,” said Sigel. “Where the layout makes it feel like its own world. I don’t see it being as effective in smaller retailers.”

Content of messages: A. GPShopper is looking well past the coupon to more effective beacon messaging.

Reach: D. The company works with major brands but not the type that lend themselves as readily to beacon technology, like a department store.

Advantages for retailers: A. GPShopper has analytics and management for retailers at the front of mind.

Swirl

Swirl’s beacon marketing platform gives retailers’ beacon messages better reach by bringing publishers into the loop. Publishers, as a way to earn mobile ad revenue, can install the Swirl technology into their mobile apps and team up with Swirl retailers to act as an external platform for the in-store marketing model. When the customer shops in that retailer, the publisher’s app will ping them with an in-store offer. Swirl, then, effectively expands its reach by opening its technology up to different industries.

The platform also works with agencies to improve the beacon messages that appear in department stores like Lord & Taylor. Agency partnerships enable brands like Estée Lauder and Michael Kors to ping consumers with their own beacon messages while they shop in Lord & Taylor’s cosmetics or handbag department.

No matter whether consumers are being pinged by beacons from the retailer, publisher or agency, messages that appears on shoppers’ phones is always rich and content-driven, according to Swirl CEO Hilmi Ozguc.

“We give them a blank slate to work with,” he said.

However, Swirl is focused primarily on the content aspect of beacon technology. While consumer data, like figuring out how customers are moving through a store or interacting with a display, is offered on the Swirl platform, Ozguc framed it as a byproduct.

But putting too much emphasis on push notifications comes with a risk. While customers must opt in to receive any messages at all on Swirl, retailers need to think outside of the box, and be a little less self-absorbed, when it comes to sending messages directly to consumers’ phones on any platform, according to Sigel.

“Brands think that the customer is always going to want to hear what they have to say, and that’s where they get in trouble,” he said. “Retailers are going to have a hard time drawing that line.”

Content of messages: A. Swirl’s notifications are nice to look at, and they can come from a variety of sources: retailers, brands, agencies and publishers.

Reach: A. By bringing on publishers and agencies, Swirl makes sure that messages can reach the consumer. It’s also working with more major retailers than GPShopper and Gimbal.

Advantages for retailers: B. The analytics are there, but they’re not Swirl’s focus.

Gimbal

Gimbal’s in-store beacon technology taps into all of the important points for retailers and consumers. The company works with retailers to create messages that welcome customers to the store, provide product information as they shop, target the consumer on an individual level through history and loyalty programs, and use beacon transmissions to optimize store layout and customer service.

According to Gimbal’s COO Kevin Hunter, the platform is suited to “bridge the physical and digital,” and scale across many different verticals. As a result, Gimbal is also one of the most present beacon platforms, currently taking up real estate in major league baseball stadiums, Apple’s retail stores and festivals like SXSW.

But that also means Gimbal’s primary focus isn’t on the in-store beacon experience, like Swirl’s or GPShopper’s. While Hunter said that support is available for retailers employing Gimbal’s beacons, the company’s main verticals are not only retail, but venues, like Madison Square Garden, as well.

“It’s already hard enough to know exactly what people want,” said Sigel. “And as soon as someone finds at disruptive, rather than additive, they’ll shut it down.”

Content of messages: A. Gimbal’s focus is in the right place: beyond the entry-level discount and looking at the customer on an individual level.

Reach: A. Of all the platforms, Gimbal is appearing across the most verticals.

Advantages for retailers: B. With that cross-vertical reach, the attention retailers’ receive from Gimbal isn’t exclusive.

Image via Swirl

More in Marketing

‘Still not a top tier ad platform’: Advertisers on Linda Yaccarino’s departure as CEO of X

Linda Yaccarino — the CEO who was never really in charge.

Questions swirl after X CEO Linda Yaccarino departs from the platform

Her departure marks the end of two tumultuous years at the platform.

Creator marketing has the reach — CMOs want the rigor

The creator economy got big enough to be taken seriously.