Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Amazon’s $3.5 billion ad business keeps growing.

In its latest expansion, Amazon has started to run Sponsored Products ads on its AmazonFresh e-commerce platform in the U.S. According to an email that Amazon has sent to ad buyers announcing the news, ads for AmazonFresh products will appear within Amazon’s regular search results and product details pages as well as within AmazonFresh’s search results.

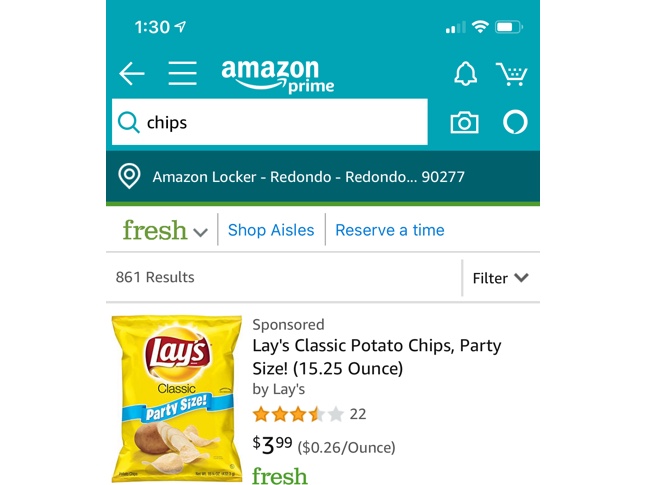

The Sponsored Products ads for AmazonFresh items are the same as the version already available for non-AmazonFresh products, which may make them easier for advertisers to adopt, according to Rina Yashayeva, vp of marketplace strategy at Stella Rising, an agency that specializes in Amazon advertising. The ads can be targeted based on keywords, and advertisers will pay when people click on the ads, even if they do not purchase the product. The ads can appear within Amazon’s regular search results and product details pages as well as within AmazonFresh’s search results, according to an email that Amazon has sent to ad buyers announcing the news. That marks the first time that Amazon has allowed ads within AmazonFresh search results. On Feb. 28, a search for “chips” in Amazon’s mobile app resulted in an AmazonFresh ad for Lay’s potato chips appearing atop the organic product listings. Typically, Amazon intersperses two to four Sponsored Products ads among the organic product listings on a search results page, according to Will Margaritis, svp of e-commerce at Dentsu Aegis Network.

The ads will only be shown to people in the U.S. who are eligible to shop AmazonFresh, which is only available in certain cities like Los Angeles and New York City, but that will include people who are not AmazonFresh members, said Yashayeva. Amazon’s grocery delivery service is only available to Amazon Prime customers, but those customers have to pay an extra $15 a month for AmazonFresh.

An Amazon spokesperson did not respond to a request for comment by press time.

Allowing food and CPG marketers to promote their AmazonFresh products could bolster Amazon’s position against rivals like Walmart, Kroger and Target that also operate grocery delivery and advertising businesses. “With food being one of the most underpenetrated digital sales categories in the country, Amazon has been increasing their share of the market by double digits,” said Yashayeva. She cited an estimate from e-commerce analytics firm One Click Retail that pegged Amazon’s grocery sales growing by 40 percent year over year to $650 million in the second quarter of 2018.

However, with the roll-out of AmazonFresh ads, Amazon may be more likely to steal ad dollars away from Kroger, Walmart and Target than actual product sales. People may browse food and CPG products on Amazon to check out reviews as a form of research, but they are more likely to purchase those products from a physical store, according to Margaritis. As a result, he advised that food and CPG brands should think of Amazon’s latest ad product as a way to raise people’s awareness of new products, like a food flavor or product feature. “Amazon really is a branding opportunity,” Margaritis said.

If it turns out that Amazon customers are much more likely to click on the AmazonFresh ads than to follow through and purchase the products through AmazonFresh, that would complicate advertisers’ abilities to judge the success of their campaigns. Advertisers typically evaluate their Amazon ads based on the sales they are able to deliver, but that’s only possible if the sale is made within Amazon’s platform. “It’s a problem with Amazon as a whole since Amazon gives you such a direct tie to a sale. Brands often struggle to understand the impact off-Amazon,” Margaritis said.

Amazon could use its ownership of Whole Foods to address this potential attribution issue for AmazonFresh ads. A person who clicks on an ad for an AmazonFresh product may not purchase it from AmazonFresh or even subscribe to the grocery delivery service, but they might stop in a Whole Foods store and purchase it there, potentially even scanning their Amazon Prime membership at checkout. In that situation, Amazon would be able to associate the in-store sale with the online ad. Walmart already provides that kind of insight for brands to see how online browsing contributes to in-store sales, said Margaritis, but for Amazon, “that’s probably a ways down the road.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.