Secure your place at the Digiday Publishing Summit in Vail, March 23-25

I recently had coffee with an agency that works with a retailer that sells on Amazon. While there are many, many issues with how Amazon works with brands, this one caught my attention. “When you work with Amazon, it is a good thing. But it’s also a bad thing. They’ll milk you out of info about your business and category. Then, they’ll go and build a private-label brand on their own and maybe even use your manufacturing facilities to make it happen.”

Amazon has a not-so-secret weapon in its arsenal in its top-secret private-label business. Recent estimates by SunTrust Robinson Humphrey analysts found that Amazon’s private-label brands — which include its AmazonBasics house brands as well as lingerie (Arabella), tools (Denali) and a host of women’s clothing labels — brought in $2.5 billion in sales for the company in 2016. The analyst note also predicted that sales will reach up to $20 billion by 2022.

The cruel part of the equation is that brands are almost voluntarily giving up their secrets to Amazon, giving the company data about which categories are popular and make sense — and which categories, therefore, it can apply its own might to. It’s ruthless and effective: Brands know they can’t afford not to be on Amazon in many cases, and they admit they sell to Amazon’s customers, not their own.

I’m also in a private LinkedIn group of Amazon vendors, who often gripe about the issue. Amazon is able to put major pricing pressure on these vendors as it builds its own labels. Vendors often complain that any cost increase they submit is rejected, forcing them to use hacks to get around rejections and other issues, such as increasing costs incrementally by 1.9 percent at a time and making sure Amazon has a 20 percent margin.

Bottom line: It’s an Amazon world, and we’re all just living in it. — Shareen Pathak

Are Snapchat shows posting ‘monster’ numbers?

Last week, Axios reported that NBC News’ daily Snapchat Discover news show, “Stay Tuned,” received 29 million unique viewers in its first month. Indeed, people seem to be watching Snapchat shows. Elisabeth Murdoch’s Vertical Networks has a reality show for Snap called “Phone Swap,” which averaged more than 10 million unique viewers per episode in its first season. (People are watching publisher editions, too: During its second-quarter earnings call, Snap highlighted that CNN and Bleacher Report’s U.S. Snapchat Discover channels were reaching 12 million and 16 million unique viewers per month, respectively.

On the surface, Snapchat, which has seen user growth slow down after being ruthlessly and relentlessly copied by Facebook, finally has a good story to tell. Yes, people are watching Snapchat Discover content, but the numbers aren’t as big as you might think. Snap counts a view once a piece of content has been opened — not three seconds after the video has started (how Facebook measures views) and not the average number of viewers watching per minute of video (how TV defines viewership).

Twenty-nine million viewers for “Stay Tuned” across an entire month’s worth of two- to three-minute episodes looks different — and should be treated differently — in this context. — Sahil Patel

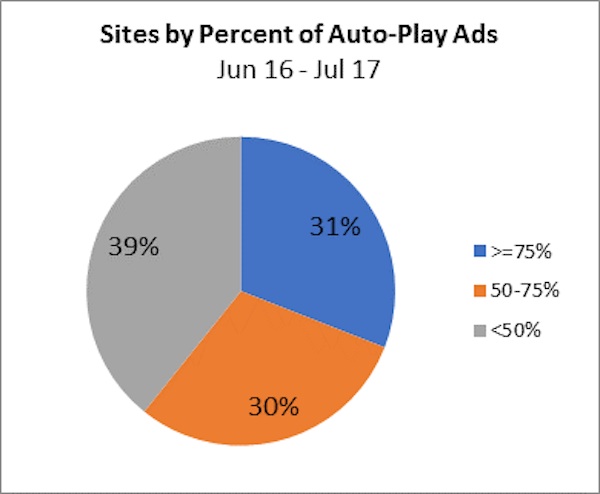

Autoplay crackdown

With Google and Apple getting ready to crack down on autoplay video with sound on in Chrome and Safari browsers, respectively, it’s a bad time for publishers to use the tactic, even if it’s easy money. A MediaRadar analysis showed that across sites that run video ads, two-thirds autoplay 50 percent or more of those ads. A broad range of mainstream media sites persist in using autoplay, including HuffPost, Refinery29 and Fox News, although niche sites and those that depend heavily on programmatic advertising are more likely to use autoplay, MediaRadar noted. Even for publishers that don’t auto-start ads with sound on, rising ad-blocking rates means a wide range of publishers may need to make plans for replacing that revenue stream. — Lucia Moses

Coming up

Join us next Thursday, Aug. 31 at 1 p.m. to chat all things product with Forbes’ Salah Zalatimo in the next Slack town hall.

And thanks for being a Digiday+ member. We’d love to get your feedback through this four-question member satisfaction survey.

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.