Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Retail Briefing: For Amazon sellers, the prospect of delisting stokes fears

Sign up to get the Digiday Retail Briefing in your inbox each week.

For Amazon sellers, there’s no greater threat than being delisted from the marketplace. And thanks to Amazon’s shadowy business strategies and customer service, sellers always have to be on guard.

Ryan Grant, a third-party Amazon seller, launched an online seller community called “The Online Selling Experiment” to use what he’s learned to help other small business owners on Amazon succeed. His business, which sells a variety of items in the home, apparel and toy categories, has grown to $5 million in revenue on Amazon in five years. In that time, he’s had his account suspended once due to a single complaint from a customer that something his business sold was inauthentic. He had to gather the proper paperwork showing where he sourced the item and submit it to Amazon to get it reinstated. The entire episode took about two days, and his account was brought back.

“The loss of sales can be detrimental, even for just a few days,” said Grant. “In that time, everything has come to a halt, but you’re still incurring fees for the Fulfillment by Amazon warehouse overhead, you still have employees you need to pay, and you’re just locked out. Knowing what to do from there is critical, and lots of sellers don’t know what to do.”

For Brian Hemmert, the CMO at keto snack brand Fat Snax, said that selling quality products on time should be enough to keep sellers in good standing on Amazon, but that things happen outside of the company’s control. When a shipment in an Amazon warehouse got wet and moldy, it got suspended.

“We’re taken off Amazon until they figured it out. Now we’re not shipping tens of thousands of orders that we should have shipped. We can’t just get on the phone with Amazon and say, ‘Hey this was a mistake.’ That’s the fear.”

Grant said the problem is not that Amazon has no customer service, it’s that it uses the same generic seller information no matter each case’s specific nuances. That’s what’s spurred the robust industry for seller-support communities and forums. Some are free and housed on LinkedIn and Facebook, while others are membership-based and provide more in-depth one-on-one consultation for a monthly fee. The admins can help sellers who have never been suspended before getting back on their feet by knowing what information Amazon wants to see from delisted accounts in order to be reinstated, as well as knowing changes in Amazon’s policies that could affect sellers before it becomes common knowledge.

“Sellers’ business could be here today, gone tomorrow,” said one Amazon consultant. “You can have a large business with millions of dollars in sales with dozens of employees, insurance for your warehouse, employee insurance, account managers and — blink; you’re gone. That fear is what keeps sellers in line.”

Stop and ship the roses

Amazon is known for creating breakneck shipping standards that the rest of the industry has to keep up with. But one subset of online retail has been working on rush delivery even without Amazon’s pressures: Ordering flowers from e-commerce sites is sneakily competitive.

According to Phil Irvine, the director of CRM for The Bouqs Company, an online floral retailer, 85 percent of orders placed are for same-day or next-day delivery. Bouqs and its competitors, including 1-800-Flowers and Pro Flowers, have short windows of time to win over customer orders, and their delivery standards have to be sealed tight. If you miss a delivery window, you likely lose that customer forever, said Irvine. At its start, Bouqs was able to compete on free shipping and delivery, but the cost involved became too high for the retailer to handle on its own. Now, it charges delivery fees, meaning it’s playing in the muck of SEO ad placement and retargeting strategies. The two most high-stakes holidays for floral retailers are Valentine’s Day and Mother’s Day, and Irvine said it comes down to a pricing war: Customers click on the lowest-priced option that surfaces in a Google search.

To make up for that, Bouqs is focusing on customer retention in the non-peak season through collaborations, a sustainability bent (all flowers are locally sourced) and customer data plays to get and use information like a customer’s mother’s birthdate. All’s fair in love and online flower delivery.

3 questions with Andrew Dudum, founder and CEO, Hims

What guides your product and brand development process?

We’re guided by answering a few different questions. For us, it’s this: How do you do a few things well? How do you serve men and women healthcare experiences that are incredible versus terrible? Getting a prescription has never been a good experience. It’s timely, it’s expensive. How do you approach that with a modern brand in a way that makes people happy? That guides the product piece. Then, we consider: How do we continue to offer new services? We’ve gone from offering two products to 40 to 50, so you can get a plethora of options from us now. And so, how do we continue to get access to people that they otherwise couldn’t afford, and bring to market those experiences that people need?

How do you communicate all of that to the customer?

Investing in a brand that can exist for 100 years is about long-term relationships. We do a lot in person — subway ads and other out of home ads in locker rooms and other targeted locations. Given our aspirations of being a trusted brand, and the mix of trust and education required for the pharmaceuticals and skin care categories, the ability to have an in-person presence where people can come and get to know us is paramount. So it’s something we think about in that the existing business is an incredible rocket ship, and how do we add fuel to that? There’s even more of an opportunity to build brand connections and trusted relationships.

So customer trust comes from seeing the brand out in the world?

You have to think about all of the channels. For us, it’s like two to three dozen channels necessary to help optimize the brand and sell the benefits we offer to the customer at different points in the journey. We ask, ‘What’s the state of mind that the customer is in when they’re spending time scrolling on Facebook vs. Instagram?’ And then it’s about how you apply that to your brand. But it’s very necessary that an individual sees and hears and learns about you in a lot of different ways.

First-party state of mind

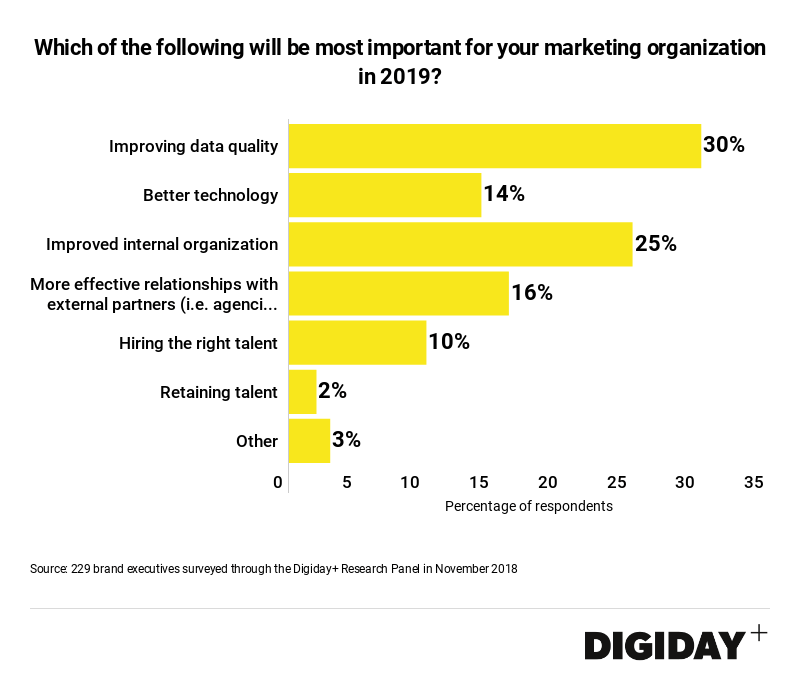

According to Digiday+ Research, first-party data is now more valuable than ever, as online giants Amazon, Facebook and Google have demonstrated in recent years. As a result, marketers now say improving the quality of their data and their data collection practices is now a key priority for 2019.

In a survey of 229 brand marketers by Digiday this November, 30 percent of respondents said improving their data quality will be their organization’s top marketing goal for 2019, ahead of other initiatives such as improving their technology and hiring and retaining talent.

What we’ve covered

Macy’s will stop selling on Tmall at the end of the year, ending all business the department store still had in China.

- In an email, a Macy’s spokeswoman said the move was linked to keeping its core U.S. business profitable. She added that Macy’s rolled out new functions to Macys.com to let Chinese customers buy items there. That may be true, but analysts see it as a case of a multi-brand retailer being unable to crack the local market.

- For a market heavily reliant on e-commerce, direct-to-consumer brands often stand a better chance of success since customers can easily go directly to the merchants through these platforms.

Retail startups are competing to reinvent the convenient store.

- As traditional convenience stores struggle (the $550 billion industry last year recorded its weakest merchandise sales growth since 2013, per Bloomberg), these new companies are differentiating through curation based on insights and behavior, brand partnerships and service offerings.

- It’s tricky territory: How do you win over customer affinity in a category dominated by mindless purchasing? These companies are banking on the promise of dealing data to brands, and that service-driven benefits will set a new standard of convenience.

With changes coming to Amazon’s marketplace, sellers have to balance the site’s undeniable reach with unease around how the company controls their businesses.

- What Amazon cares about first and foremost is its customer. Unlike a traditional retailer, it’s not competing on the brands and sellers it can court. Reach grants control: Amazon dictates seller strategy. And no matter how much Amazon makes sellers squirm, they’re not taking their business elsewhere, at least not as long as they’re still profiting through the marketplace.

- According to one seller: “We’re the Amazon Choice brand, but what if that changes or if we get delisted for something out of our control? We could be totally screwed. So that’s the fear: You lose the SEO rank, you don’t have a customer email list, so you can’t activate those customers again, and they’re gone.”

By the numbers

TD Bank released holiday data after surveying 1,000 shoppers to learn more about their habits. Here’s what they found.

- The average American shopper will spend $530 on holiday shopping this year.

- Credit and debit transactions were up 13 and 10 percent, respectively, over Black Friday weekend this year.

- Eighty percent of holiday shoppers will make at least one purchase online, while 72 percent will do so in a big-box store, and 53 percent in a local shop.

- The biggest retail purchase drivers are discount days, credit card offers and financing options.

- The top-purchased holiday gift categories are gift cards, tech and clothing.

More in Marketing

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.