Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

5 things to know from this week: Amazon’s new API, Snapchat’s ad rates and more

This week’s things to know cover Amazon’s new application programming interface for self-serve ads, Snapchat’s ad rates and more.

Amazon bolsters its ad business with new API

Amazon is beta testing an API for Amazon Marketing Services, the part of its ad business that encompasses self-served Amazon ads, including its paid search platform. The API is another sign of growth for Amazon’s programmatic ad business — and a key automation tool that will get ad buyers pumping more money into Amazon’s media side.

The API will open to everyone in the industry in early 2018, one buyer said. APIs are the price of entry for large ad platforms to compete against more mature platforms like Google and Facebook.

Snapchat’s ad rates plummet

Maybe Snapchat should have taken the money from Facebook when it could.

Key numbers:

- CPMs for Snapchat inventory sold in open auctions run $3-$8, according to three ad buyers requesting anonymity. Those rates are similar to Facebook’s.

- Facebook, however, has more scale. In the third quarter, Snapchat reported 178 million daily active users, while Facebook claims to have 1.4 billion.

- Snapchat said its CPMs in the third quarter dropped 60 percent year over year.

Melissa Wisehart, director of biddable media at ad agency 22squared, said as pressure from Facebook and Instagram diminished Snapchat’s leverage to charge a premium for inventory, it “simply just flooded the market with supply by opening up inventory to more players.”

Speaking of Snapchat …

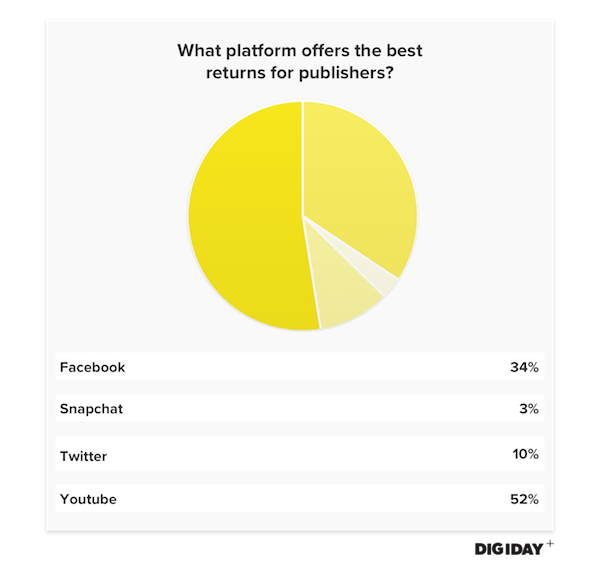

Digiday asked top publishers at the Digiday Publishing Summit Europe about which platform provided the strongest monetization potential, and the responses were damning for Snapchat: Only 3 percent selected it as the platform offering the best revenue returns.

To get more research like this, subscribe to become a Digiday+ member risk-free for your first 30 days.

Publishers fall for ads.txt fraud

Publishers said unauthorized third-party sellers are asking to be listed on their ads.txt files, which list publishers’ authorized inventory sellers to help ad buyers avoid fraud. But the publishers did not have direct relationships with these companies, which said they were trying to approach new business partners or form direct relationships with publishers whose inventory they already resell. Welcome to the wonderful world of programmatic.

Agency verdict: “It’s definitely a reseller trying to not just game but cheat the system,” said Dan de Sybel, CTO of programmatic agency Infectious Media.

Industry outlook: “I think absolutely there will be more and more buy-side companies doing this, and inevitably, quite a few publishers doing what they ask,” said Matt O’Neill, gm of ad verification company The Media Trust.

Competition heats up for branded video content dollars

Branded content is pivoting to video, pitting traditional publishers still making their own shifts to video against more established entertainment studios and production houses for those marketing dollars.

Publishers’ pitch:

- Driven by their voice and the audience, it centers around how they can help the advertiser.

- They know their audience best. (But this limits their pitch to advertisers that want to run on those publishers’ sites, which have established editorial points of view.)

Studios’ pitch: They present a star and big idea, ready-made for a brand to integrate into.

“Everyone’s your competition,” said Peter Corbett, president of video and digital production studio Click 3X. “The demand is there, but so is the ease with which you can create the content. You can shoot 4K [resolution] on your brand-new iPhone 8.”

Barstool Sports ventures into pay-per-view amateur boxing

Who needs ESPN? Following its acquisition of the Rough N Rowdy Brawl, a local amateur boxing competition in West Virginia, Barstool Sports plans to launch a live event and pay-per-view business that will produce at least 12 live boxing tournaments yearly. Besides selling tickets to the events, Barstool will produce a live pay-per-view broadcast of each one that will stream on its website.

The Rough N Rowdy Brawl acquisition comes after 12,500 people spent $5 on a Barstool-produced broadcast in March that featured a Barstool employee fighting a local prizefighter.

“It’s a perfect match for our crowd,” Barstool founder Dave Portnoy said.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.