Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: The outlook for outcome-based measurement — and outcome-based buying

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how TV network and streaming service owners like AMC Networks are placing bigger bets on outcome-based measurement heading into this year’s upfront and the potential for outcome-based buying.

- The outlook for outcomes

- Nielsen updates The Gauge’s streaming rankings (again)

- Creators vs. deepfakes, MLB’s and F1’s rights talks and more

The outlook for outcomes

Outcome-based measurement is becoming more commonplace in the TV and streaming ad market. So how long until business outcomes – which range from search and sales lifts to online and in-store visits – become the currency on which TV and streaming ads are bought and sold?

Maybe someday soon; maybe never.

“Any entity that does [outcome-based billing] is gaming the attribution. That’s always been my thing with outcome billing models: You would have to be a terrible businessman to build a revenue model on top of an action that isn’t necessarily human nature, which is to buy products prompted immediately by ads,” said an agency executive.

The challenge with outcome-based buying is that both ad buyer and seller are making riskier-than-normal bets. The buyer, as implied above, is wagering that the outcomes they are paying for are not only genuine but are a direct result of ads that ran on the seller’s property, not a happy accident that they were shown to an existing recurring customer. And the seller is gambling on factors beyond their control not scuttling sales or whatever the chosen outcome metric is.

“There’s so many things that are out of our control,” said Evan Adlman, evp of commercial sales and revenue operations at AMC Networks, said on stage at last month’s Digiday Publishing Summit in Vail, Colorado.

That doesn’t mean outcomes are on the outs just when they were inserting themselves in the TV and streaming ad market. The aforementioned agency executive’s aversion to outcome-based billing comes down to some sellers that offer outcome-based billing requiring the agency executive’s clients to rely on the sellers’ own measurements for outcomes. “To trust their measurement, you gotta be an idiot,” said the agency executive.

Other sellers are wise to this, though. And they’re enlisting outside measurement firms and data providers and data clean rooms to provide more reliable outcome-based measurement – and aren’t ruling out the potential for outcome-based billing.

AMC Networks, for example, earlier this year introduced an outcome-based measurement system that will allow advertisers to track outcomes in real time tied to their campaigns running across the media company’s traditional TV networks and streaming properties. To do so, AMC Networks is working with LiveRamp, NCSolutions, Polk Automotive Solutions and Snowflake to connect its audience via LiveRamp’s Ramp ID to NCS’s shopper data and Polk’s car buyer data through Snowflake’s data clean room technology in order to connect ad exposures to sales.

“If you are a studio and you have a movie release on Thursday and you want to drive feet into the theater, we will be able to tell you that in the next day and optimize the campaign the next day based on where the ticket sales are happening,” said Adlman. He cited a campaign for Post Consumer Brands’ Fruity Pebbles cereal that generated a 14% sales lift.

Given all that, what’s the likelihood for AMC Networks to eventually sell ads based on the outcomes it can deliver to advertisers? “It depends on the category. It’s an interesting concept, though. I think it’s not impossible,” said Adlman.

OK, not an all-in bet, but the chips are on the table. And not just at AMC Networks.

An executive at a separate TV network and streaming service owner was similarly open to outcome-based buying. Their company also offers outcome-based measurement and has been working with third-party data providers to enable that measurement in real time for certain categories of advertisers, such as movie studios. “That’s allowing us to actually do a lot more and scale a more outcome-based solution pricing off of things like cost per acquisition,” said this executive.

“We have the premium content. We have the tech and tools. Let’s actually put that all together and truly bill off of outcomes to drive your business,” said the TV and streaming exec. “I think that’s a big push in the right direction for the TV ecosystem overall.”

This article has been updated to reflect that Nielsen Catalina Solutions has rebranded to NCSolutions.

What we’ve heard

“When a brand asks to do a TikTok, I would rather do a Snapchat where I have 2 million followers, and I think that they’re going to get a million times more exposure.”

— TikTok creator Alyssa McKay on the latest Digiday Podcast

Nielsen updates The Gauge’s streaming rankings (again)

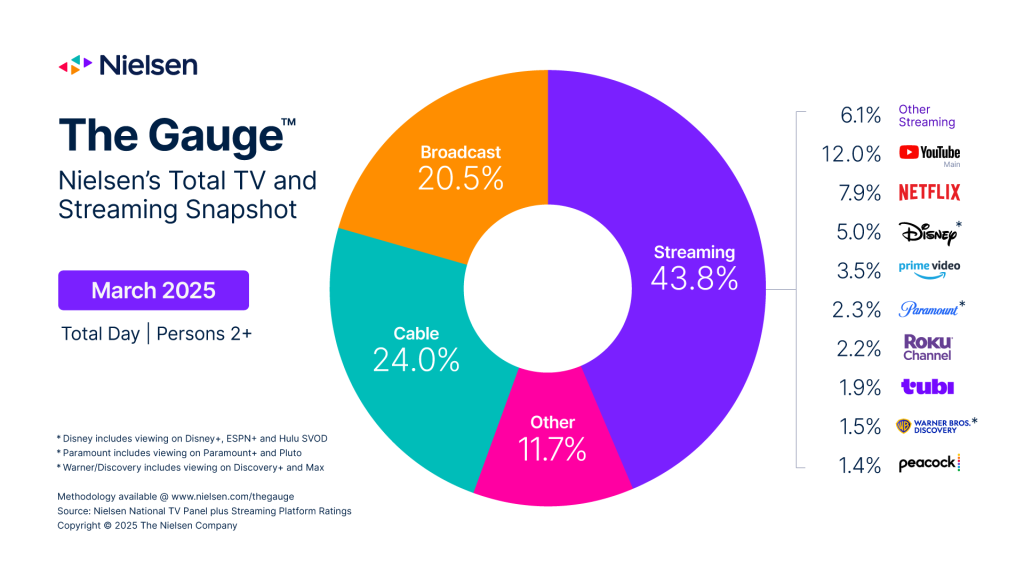

The biggest change found in the March edition of Nielsen’s The Gauge viewership report can be found in its streaming rankings. Not because anyone unseated YouTube to become the top-ranked streamer by share of watch time on a TV screen (YouTube actually added to its lead). No, the change — or changes — can be seen in how Paramount’s and Warner Bros. Discovery’s various streaming services have been rolled up into single company-level entries, as Nielsen had previously done for Disney.

The change made much more of a difference for Paramount, which can now tout a 2.3% share of TV watch time for its streaming portfolio. WBD’s share, meanwhile, inched up by 0.3 percentage points from Max’s standalone showing in the previous month. Nonetheless, a bigger number is a bigger number, and when better to notch that bigger number than a month out from this year’s upfront presentations (gee, I wonder if that had anything to do with anything…).

Beyond the taxonomy tweaks, the latest Gauge report looks a lot like the other recent editions. Streaming continued to eat away at traditional TV’s watch time share in March, and overall people spent less time in front of their TV screens than they did the month before.

Numbers to know

$9 billion: How much ad revenue Netflix hopes to be generating annually by 2030.

42%: Percentage decline in TV writing jobs for the 2023-24 season compared to the 2022-23 season.

$12 billion: How much ad revenue traditional TV networks could lose out on this year if the U.S. falls into a recession.

22%: Percentage year-over-year decline in the number of film, TV and commercial shooting days in the Los Angeles area in the first quarter of 2025.

What we’ve covered

What now for TikTok creators after the latest ban delay, with Alyssa McKay:

- McKay has more than 10 million followers on TikTok but isn’t all that worried about the platform being banned in the U.S.

- The creator joined the Digiday Podcast to discuss the viewership she’s receiving on Snapchat and Instagram.

Listen to the latest Digiday Podcast here.

Brands, creators hold their own NewFronts-style sales pitches to win over more ad dollars:

- Brands are open to longer-term deals with creators, but the corresponding costs are giving them pause.

- Upfront-style deals seem exclusively suited to the top 1% of creators.

Read more about creators’ upfront efforts here.

Kick’s co-founder talks creator push and growing pains:

- Kick has more than 57 million users, compared to rival Twitch’s estimated 240 million users.

- The livestreaming platform is making moves to attract more small- and mid-sized creators.

Read more about Kick here.

Creators rethink revenue mix in anticipation of economic slump:

- Some creators are looking to attract more brand deals to reduce their reliance on revenue from fans.

- The creators are wary of asking fans to directly support them financially given the potential for a recession.

Read more about creators’ revenue mixes here.

Can principal media actually become the hero (for some) in upfront negotiations?:

- If agencies assume upfront commitments instead of deals being done at the client level, that could alleviate some of the risks associated with this year’s upfront given recession concerns.

- Auto and CPG advertisers may pull back upfront budgets to deal with Trump’s tariffs.

Read more about principal-based buying here.

What we’re reading

Korean skincare brand Skaind used deepfakes to feature two creators in ads without the creators’ permission, according to The Publish Press.

Major League Baseball is looking to sell its MLB.TV game package — its version of the NFL’s Sunday Ticket package — to a TV network or streaming service, according to The Athletic.

The car racing league’s owner Liberty Media is looking to secure $150 million to $180 million per year for rights to air F1 races starting next year, according to The Wall Street Journal.

The broadcast TV network owner is pitching it cable TV news network Fox News as a rival to other broadcast TV networks ahead of this year’s upfront market, according to Variety.

The streaming service is testing the use of OpenAI’s technology to improve the search results and recommendations that Netflix feeds viewers, according to Bloomberg.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.