Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: Streaming subscribers save $16 through bundles

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how much money people are actually saving through streaming subscription bundles and which streamers they plan to subscribe to in perpetuity.

- Bundle economics

- YouTube TV’s power play, Disney’s TV power play, Netflix’s WBD play and more

Bundle economics

Streaming services are getting so expensive that they are pushing more and more people to sign up for bundled subscriptions to save money.

In the past six months, 22% of streaming subscribers signed up for a bundle, which saves them on average $16.32 per month, according to a survey of 2,000 streaming subscribers conducted by subscription tech provider Bango.

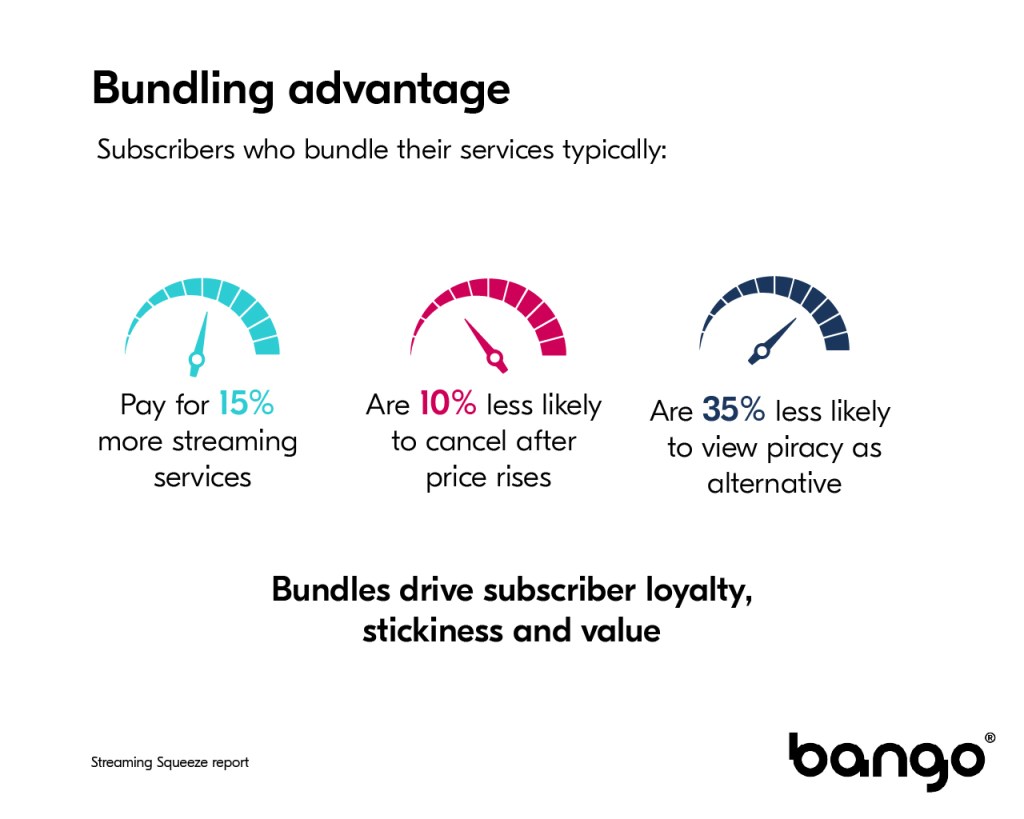

While $16 of savings may sound like streamers leaving money on the table, Bango CEO Paul Larbey said bundle subscribers are less likely to churn than the typical streaming subscriber.

“It gives the consumer more control over the subscriptions, but likewise, it gives the content provider a better lifetime value, because those subscribers churn a lot less,” he said.

A survey conducted by Hub Entertainment Research earlier this year found that bundle subscribers are 42% more likely to maintain a bundled subscription vs. a standalone subscription. That said, a larger share – 44% – said they were just as likely to retain or cancel a bundled subscription as a standalone subscription.

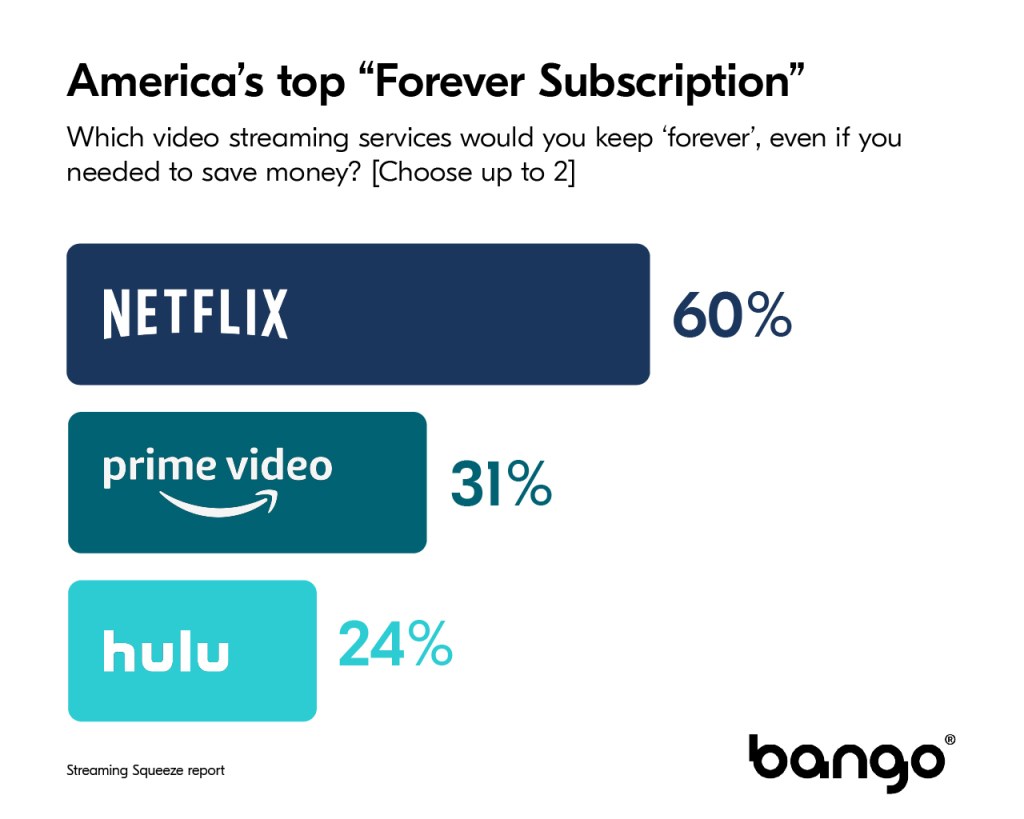

Whether or not a bundled subscription is any stickier than a standalone one, there are certain standalone subscriptions that are particularly sticky. Bango referred to these as “forever subscriptions.” Per the study, 60% of survey respondents said they will never cancel their subscriptions to Netflix.

Netflix being the predominant subscription-based streamer probably isn’t a shock whatsoever, but maybe more surprising is how much of an edge it has on the competition. The runner-up “forever subscription” was Amazon’s Prime Video, but with only 31% of respondents citing it compared to Netflix’s 60% (and that’s considering that a large share of those people probably get Prime Video as part of their broader Amazon Prime subscriptions). In third place was Disney-owned Hulu with 24%.

The dynamic flips somewhat when it comes to different generations of subscribers. Netflix still dominates, but among Gen Z subscribers, Disney+ has more of a hold, with 28% of Gen Z respondents citing it as a “forever subscription.” By contrast, 45% of Baby Boomers considered Amazon Prime Video to be a “forever subscription” (again, likely owning to the broader Amazon Prime subscription).

“Part of me wonders how much is that just a place in the lifetime you are, where the content on Disney is maybe more Gen Z-friendly,” said Larbey. “If you’re a Boomer and you’re a homeowner, then Amazon Prime is great because it also gives you other services like the [free two-day] delivery alongside the Prime Video.” Which would be another point in the bundle’s favor.

What we’ve heard

“[The NFL] has got to age down the product. Reimagine the product in different ways, the entertainment product. Because can you imagine 13-year-olds ever sitting down to watch a full NFL game in five years? No fucking way.”

— Entertainment industry consultant

Numbers to know

2000: Number of employees whom Paramount began laying off last week.

$10.3 billion: How much ad revenue YouTube generated in the third quarter of 2025.

$1.1 billion: How much platform revenue — including ad revenue — Roku generated in Q3 2025.

41 million: Number of subscribers that Peacock had at the end of Q3 2025, roughly the same as it had at the end of Q2 2025.

1.63 million: Number of subscribers in North America that Fubo had at the end of Q3 2025.

-64,000: Number of pay-TV subscribers that Charter lost in Q3 2025.

45%: Percentage share of Netflix’s U.S. subscriber base that use its ad-supported tier.

$425 million: The valuation of Diary of CEO host Steven Bartlett’s media company following its latest funding round.

$530,000: How much Sling TV will pay to settle a children’s privacy lawsuit related to its sale of children’s personal information and insufficient privacy protections.

27%: Year-over-year increase in Tubi’s revenue in Q3 2025.

What we’ve covered

The rise of micro dramas:

- Micro dramas generate 83% of their revenue from China, with the majority of that revenue coming from subscriptions and viewer payments.

- Nearly half of the audience for micro dramas is between the ages of 18 and 34 years old.

Read more about micro dramas here.

Advertisers react to holiday creep by pushing TV spend earlier:

- Brands are running upper-funnel holiday ads in October this year compared to recent years.

- Generally brands are stretching their spending, not increasing the budgets behind holiday campaigns.

Read more about advertisers’ holiday TV spending here.

What we’re reading

At the heart of YouTube TV’s distribution standoff with Disney, the Google-owned video platform is looking to shorten windows for its pay-TV distribution deals with TV networks from the typical 3- to 5-year-window to 1- to 2-year terms, according to The Wall Street Journal.

Amidst its YouTube TV stalemate, Disney has closed its acquisition of rival streaming pay-TV service Fubo, which the company will merge with its other YouTube TV rival Hulu + Live TV, according to Variety.

The streaming service is looking into making an offer to acquire Warner Bros. Discovery’s studio and streaming business, according to Reuters.

The platform is updating its core CTV app to promote serialized content a la a traditional streaming service, according to The Verge.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.