Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: Sports is becoming a bigger part of streaming services’ programming libraries

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the rise in sports-related content across streaming services as ESPN surrenders some sports rights.

- Streaming’s moneyball era

- YouTube’s subscription-lite plan, Disney’s and Warner Bros. Discovery’s bundle boost and more

Streaming’s moneyball era

Bleh. It’s definitely trite to describe the state of streaming businesses as being in the “moneyball” era. But it’s true (and I couldn’t think of a more original framing device).

For one thing, streaming service owners are being more discerning with their dollars when it comes to programming costs. Amazon, Apple, Disney and Paramount, for example, are expected to spend less money on programming in 2025 than in 2024, per MoffettNathanson. For another, more of the money they are spending is going toward live sports, which seems to provide the biggest bang-for-buck when it comes to acquiring subscribers.

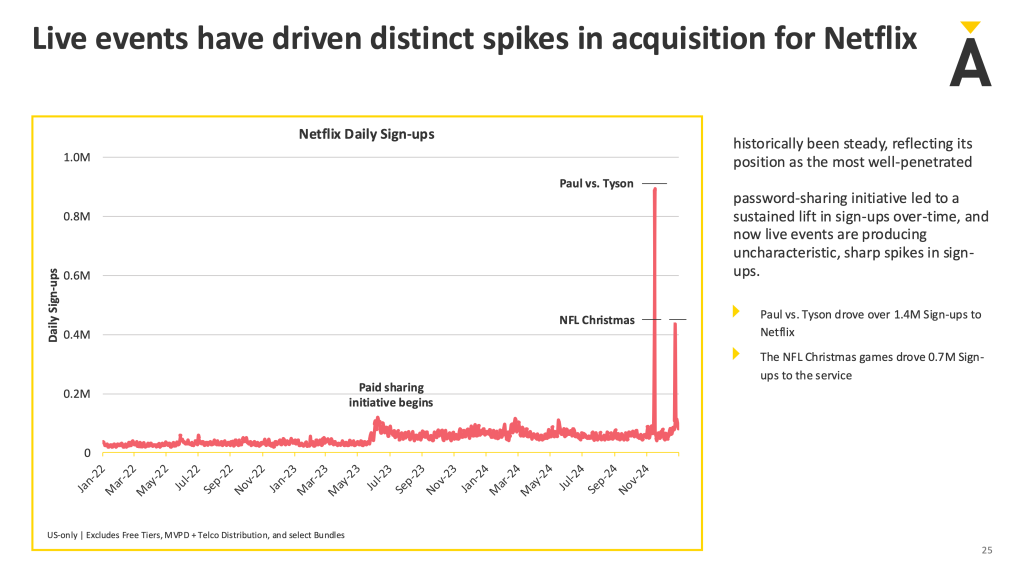

Take Netflix, for example. The streaming service gained more than 1.4 million subscribers around the time of the Mike Tyson vs. Jake Paul boxing match in November last year, according to the “State of Subscriptions” report released by research firm Antenna on Tuesday. Netflix received a similar subscriber boost around the time of its Christmas Day NFL games, as the chart below shows.

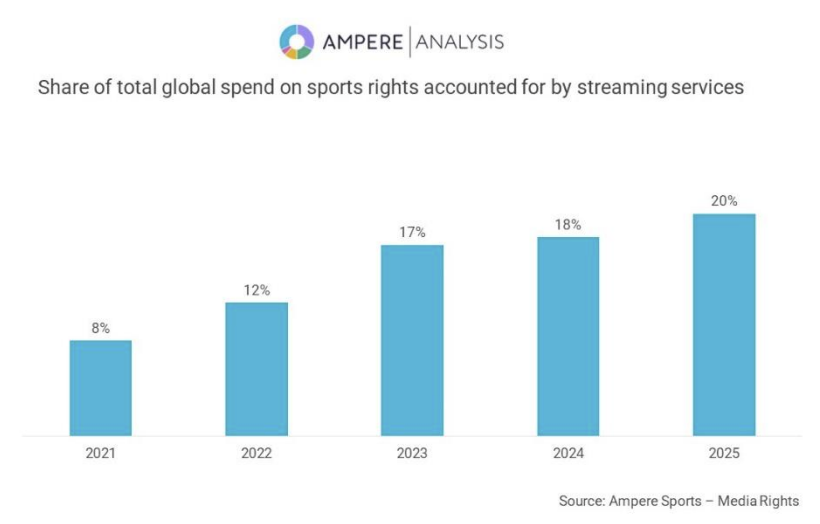

Little wonder then that streaming services are spending more money on live sports rights. This year streaming services will spend $12.5 billion on sports rights in 2025 to account for 20% of sports rights spending worldwide, according to Ampere Analysis.

Similarly, there’s just more sports-related programming on streaming services. In the first quarter of 2025, the amount of sports programs available across Amazon Prime Video, Apple TV+, Disney+, Netflix and Paramount+ has increased by more than 72% compared to Q4 2024, according a study released by Nielsen-owned Gracenote Data Hub on Wednesday.

So why then is Disney-owned ESPN pulling back on some sports programming? The predominant TV sports network has reportedly opted not to renew its rights deals for Formula 1 nor Major League Baseball.

The decision would seem counterintuitive to the notion that live sports spurs streaming subscriber growth, especially when considering that ESPN plans to roll out its standalone streaming service later this year. Until it’s viewed in the moneyball light.

“In making this decision, we applied the same discipline and fiscal responsibility that has built ESPN’s industry-leading live events portfolio as we continue to grow our audience across linear, digital and social platforms,” ESPN said in a statement to The Athletic.

Reading between the lines, ESPN seems to be saying: MLB rights don’t return as much on the investment as the network would like. And that may be true. According to Sportico, citing data from iSpot.tv, MLB programming accounted for 2.2% of ESPN’s national TV ad revenue in 2024 and was the 10th-largest ad revenue driver after not only NHL games but also original shows “Get Up” and “First Take.”

So for as much as there seems to be all the reason in the world for the likes of Amazon and Netflix to be loading up on sports programming, for one of the preeminent sports rights holders, the opposite seems to be true. To what extent that bet pays off (or doesn’t) will remain to be seen until after ESPN’s standalone streamer debuts – and someone else swoops in for the MLB rights.

What we’ve heard

“Regarding video CPMs, the average for 2024 was close to $40 on Amazon Prime..”

— Basis Technologies’ Robert Kurtz on streaming ad rates

Numbers to know

12%: Disney’s share of TV watch time in January 2025.

$1 billion: How much revenue TelevisaUnivision’s ViX streaming service generated in 2024.

$550 million: How much ESPN was estimated to pay Major League Baseball per year through 2028 to broadcast games.

What we’ve covered

Streaming TV ad rates are falling and Amazon’s the anchor:

- Amazon Prime Video’s entry into the ad market brought CPMs down among its rivals.

- However, some agency execs are now reporting higher CPMs for Amazon Prime Video inventory compared to Netflix and Disney+.

Read more about streaming ad rates here.

Snapchat’s SMB bet is paying off — but can it keep up the momentum?:

- Snap’s vp of SMB and mid-market Sid Malhotra said the number of active advertisers on Snapchat has doubled since the second quarter of 2024.

- The platform is working to become a “lower funnel-first ad revenue platform,” Malhotra said.

Read more about Snapchat here.

The Trump tariffs are forcing creators to overhaul their side businesses:

- The tariffs on Chinese imports is affecting creators’ commerce businesses.

- One creator has delayed their apparel brand’s launch, while another expects to raise prices for their products.

Read more about the tariffs impact on creators here.

Brands’ interest in “Grand Theft Auto” is mounting — but questions about brand safety remain:

- Brands have been asking agencies about potential marketing opportunities related to “Grand Theft Auto 6.”

- But many brands still have brand-safety concerns with the game.

Read more about “Grand Theft Auto” here.

What we’re reading

The sports TV network plans to let people upload their own videos to its upcoming standalone streaming service in a potential bid to compete with YouTube, according to CNBC.

YouTube’s subscription-lite plan:

The Google-owned video platform is testing a roughly half-priced version of its subscription tier that allows people to watch videos without ads except for music videos, according to Bloomberg.

Disney’s and Warner Bros. Discovery’s bundle boost:

The Disney+-Hulu-Max bundle held on to 80% of its subscribers three months after rolling out last July, according to The Wall Street Journal.

The newsletter platform is looking to become more of an option for video creators by adding options for people to post paywalled videos directly on Substack, according to TechCrunch.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.