Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: How flexibility could funnel more upfront dollars to Amazon & Netflix this year

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how Amazon and Netflix offer upfront advertisers more extensive cancelation options, which could affect how upfront dollars are allocated.

- Streamers’ upfront flex

- Streaming, YouTube gain more share of TV watch time

- CBS News chief exits, YouTube Shorts’ ad revenue milestone and more

Streamers’ upfront flex

Sports may be the main selling point in this year’s TV and streaming advertising upfront market, but cancelation options will be a key part of negotiations between buyers and sellers. And Amazon and Netflix appear to have an edge on that front.

Both Amazon and Netflix allow upfront advertisers to cancel 100% of their commitments up to 14 days before a guaranteed deal is slated to start running, in line with the Interactive Advertising Bureau’s standard cancelation terms for digital guaranteed deals, according to agency executives.

An Amazon spokesperson confirmed that the company adheres to the IAB’s cancelation standard for its upfront deals. A Netflix spokesperson declined to comment.

By contrast, TV networks typically require at least 30 days notice and limit the cancelation amount to usually 50% at most, and TV network owners have applied those more limited cancelation options to their streaming services.

To be clear, Amazon and Netflix had adhered to the IAB’s cancelation terms before this year but not for all inventory. Sports, for example, is not cancelable, though everything can be negotiated, according to agency executives. That being said, given the expectation among industry executives that this year’s upfront will favor the buy side in light of the economic downturn, Amazon’s and Netflix’s more flexible cancelation options could affect how upfront dollars are allocated to a greater degree.

“I think that is going to happen this year that we use Netflix as leverage,” said one agency executive.

“Streaming has been more flexible, so we are thinking how can we get clients to shift more there,” said a second agency executive.

Amazon and Netflix seem to recognize this opportunity. In addition to offering IAB terms, they have been willing in some cases to reduce cancelation windows to shorter than 14 days, though that has usually corresponded with advertisers not being able to cancel the full 100% of a deal, agency executives said.

Netflix has offered flexibility in other ways.

For example, Netflix offers 15-second ads at a discounted rate compared to 30-second spots, according to agency executives. It’s not a full 50% discount from the full 30-second CPM, but it does buck the typical practice in streaming of charging the same amount despite the different durations. The discounted 15-second CPM “is really rare and a huge benefit. [Not receiving that discounted rate across the streaming ad market] has been another barrier in getting clients to shift spend,” said the second agency executive.

“What Netflix is doing for us is very much what we want the rest of the industry to do,” said the first agency executive.

What we’ve heard

“One of my takeaways from this week of presentations were those numbers start to become so meaningless to me. My new favorite is the minutes viewed [metric]: billions of this and millions of this and trillions of this. Say what you want about Nielsen; there’s a consistent and understanding that an 8 rating’s a good rating for prime-time NFL. And that kind of consistency and context is just gone.”

— Horizon Media’s David Campanelli on Upfront Week presenters’ fuzzy metrics

Streaming, YouTube gain more share of TV watch time

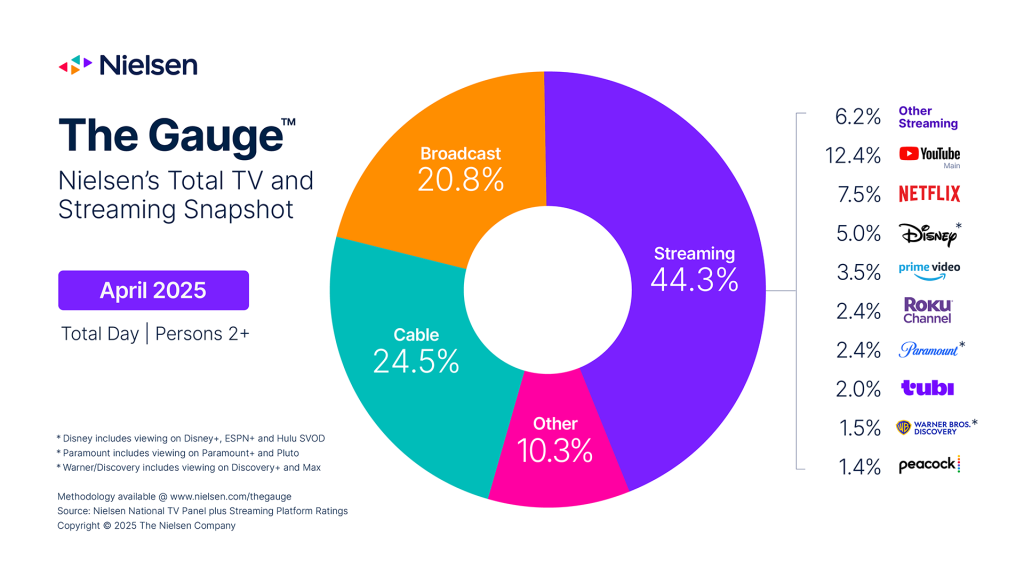

“The big get bigger” is the theme of Nielsen’s latest The Gauge viewership report. In April, people spent even more time watching streaming overall and YouTube in particular on their TV screens compared to prior months.

That pie chart may look more or less the same as every other month’s Gauge. But it’s actually worse for TV networks. While streaming gained 5.9 share points in April compared to March, broadcast TV ceded 1.4 share points and cable TV surrendered 4.6 share points, per Nielsen’s blog post announcing the latest The Gauge report.

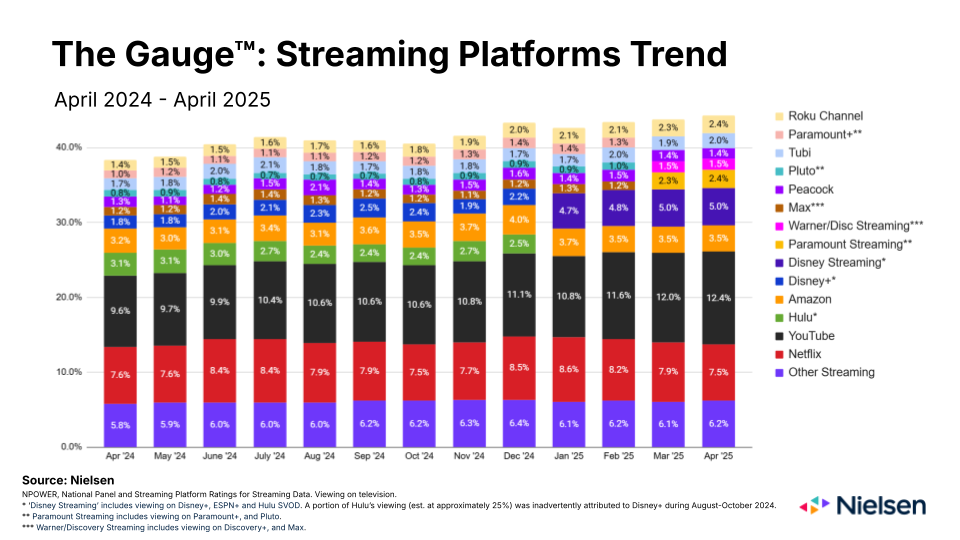

The story of leaders adding to their leads also applied to the breakdown of streaming services’ watch time shares.

Not only did YouTube add to its watch time lead in April, but it’s been adding to its lead pretty consistently over the past year. “Since January, YouTube has added 1.6 points to its share of TV, and is up 2.8 points since April 2024,” according to Nielsen’s blog post. YouTube’s gain seems to be particularly Netflix’s loss. While the latter retains the No. 2 spot in terms of watch time share among streamers, it was the only streaming service that lost share in April, giving up 0.4 percentage points — the same amount that YouTube gained.

Numbers to know

46%: Percentage share of premium streaming subscription sign-ups in April that were for ad-supported tiers.

94 million: Number of monthly active users that Netflix’s ad-supported tier has.

52%: Percentage share of surveyed people in the U.S. who said they use at least three of the top seven streaming services (Amazon Prime Video, Disney+, Hulu, Max, Netflix, Paramount+, Peacock).

$400 million: Valuation for influencer agency Whalar Group after selling a stake to Salesforce founder Marc Benioff.

56: Number of seasons that “Sesame Street” will have aired after premiering on Netflix later this year.

What we’ve covered

An Upfront Week recap and upfront market preview with Horizon Media’s David Campanelli:

- The media agency’s president of global investment offered his highs and lows from Upfront Week.

- He also assessed the state of play as this year’s upfront market gets underway.

Listen to the latest Digiday Podcast episode here.

Agency execs expect sports to push the upfront’s pace, pricing with up to double-digit spending increases:

- While ad buyers expect overall upfront spending to be flat or down this year, sports spending is likely to be up by single- to double-digit percentages.

- TV networks and streaming services are looking to use the increased demand for sports as leverage.

Read more about the upfront’s sports marketplace here.

In this year’s upfront, sports is playing offense, defense and referee:

- The NFL is especially in demand among advertisers in this year’s upfront.

- Amazon, Netflix and YouTube are asking for massive dollar volume increases.

Read even more about the upfront’s sports marketplace here.

How creator platforms are building tech infrastructure to keep pace with a maturing industry:

- CreatorIQ and Captiv8 expanded their measurement and AI functions recently.

- Other creator platforms are touting their commerce and affiliate marketing capabilities.

Read more about creator platforms here.

The Upfronts got a taste of the creator economy:

- Amazon announced the renewal of MrBeast’s reality competition show.

- Fox will air creator-led shows on its free, ad-supported streamer Tubi.

Read more about creators and Upfront Week here.

What we’re reading

CBS News CEO Wendy McMahon has stepped down as parent company Paramount Global puts pressure on its news division in response to Trump’s lawsuit against “60 Minutes,” according to CNBC.

YouTube Shorts’ ad revenue milestone:

When taking into account how much time people spend watching YouTube Shorts compared to traditional YouTube videos, the short-form format is generating an equal amount of revenue for the Google-owned video platform, according to Variety.

Warner Bros. Discovery’s HBO Max reversal:

WBD’s decision to return HBO to the branding of its flagship streaming service could be part of the company’s potential plan to spin off its cable TV network business, according to Bloomberg.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.