Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Future of TV Briefing: FAST channels’ ad fill rates have slipped in 2024

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at how free, ad-supported streaming TV channels are filling less of their available ad slots this year.

- Freefall

- Snapchat combines Stories and Spotlight into new feed

- Olympics lift TV watch time in August — a little

- Spotify courts video creators, The Trade Desk secure CTV hardware partner, Netflix signs product placement deals and more

Freefall

Free, ad-supported streaming TV channels may be growing in viewership, but that growth is outstripping advertiser demand.

This year viewership of FAST channels has increased the amount of available ad slots to the point that a larger share of those impressions are going unfilled, according to Wurl, a streaming technology provider that powers FAST channels from media companies including A+E Networks, Canela Media and Curiosity Inc.

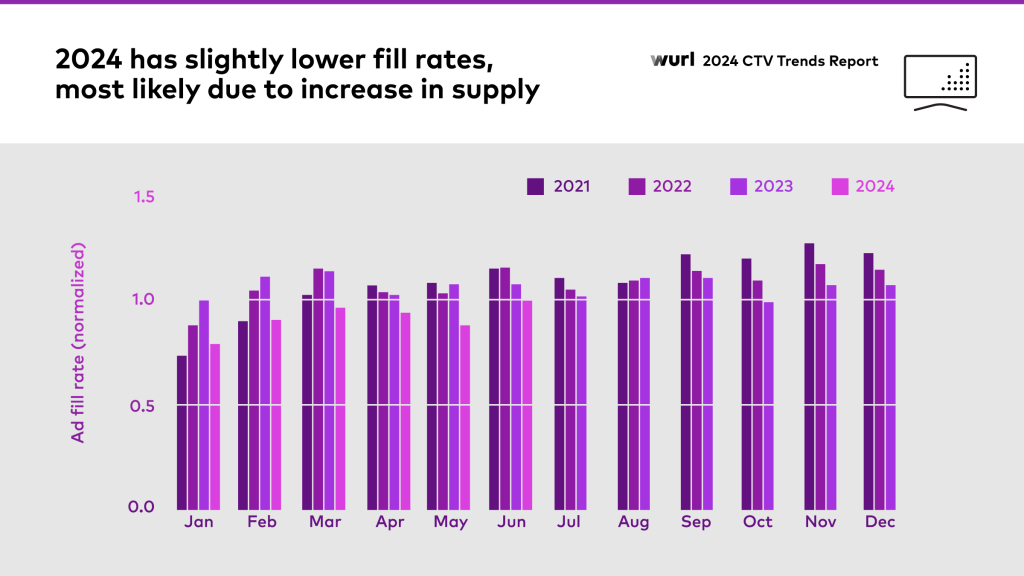

“There is an increase in inventory, and it doesn’t always automatically correlate to more advertisers,” said Wurl CEO Ron Gutman. He said that FAST channels’ ad loads – the volume of ads per hour of programming – “has not increased by channel that much,” which would leave viewership growth as the main cause for the inventory surplus. Wurl was unable to provide raw figures for ad fill rates because of its agreements with FAST channel owners, he said. The chart below plots the fill rates by month and year on a normalized basis relative to the June 2024 mark.

The lower fill rates for FAST channels fits an overall supply-demand imbalance trend in the streaming ad market. While advertiser demand for streaming inventory has continued to grow, the increasing amount of streaming ad inventory has outpaced that growth, with the likes of Disney+, Netflix and especially Amazon Prime Video adding ad-supported tiers in the past two years.

“Prime Video is probably stealing [ad dollars] from both the top end and the FAST channel allocation,” said Madelaine Robinson, group director of media & analytics at ad agency Duncan Channon.

Moreover, the top tier ad-supported streamers have been lowering their prices to better compete for advertisers’ dollars in what has become a buyer’s market. Amazon Prime Video, for example, priced itself below Disney+, Netflix and Max when it entered the market earlier this year. And in this year’s upfront, Disney and Netflix lowered their streaming ad prices. That can make the most attractive inventory in advertisers’ eyes affordable for more advertisers.

“FAST channels and inventory sources play a role on every one of our audience-targeted [streaming] and CTV buys, though they’re not necessarily the first and most prominent inventory source on those buys. That would be some of the more premium [ad-supported] streamers,” said Kevin Cahn, head of the media center of excellence at ad agency Kepler Group.

To be clear, FAST inventory remains significantly cheaper than the top-tier streamers. FAST ad CPMs typically range between $10 and $12, whereas the top-tier streamers are usually in the high $20s up to the low $40s (though settling more in the low $30s lately with the upfront price cuts), according to agency executives. But the CPM chasm is not as wide as it once was.

“We’ve seen a narrowing of the price gap,” said Cahn.

That cheaper FAST inventory comes at a cost, though: transparency. FAST advertisers notoriously don’t know which specific shows their ads are airing in. That can kneecap spending from more cautious marketers that are generally taking harder looks at where their ads are running amid the made-for-advertising sites and inventory obfuscation controversies of the past year.

“FAST channels feel like the biggest Wild West when it comes to where’s our ad running? A) Are we running on brand-safe platforms? And B) How are we able to track and detect ad fraud? It feels like you’re taking a little bit of a risk to go to those channels sometimes,” said Robinson.

And cases like Paramount-owned FAST platform Pluto TV reportedly duplicating bids in order to juice its ad sales doesn’t help matters. “My understanding of the reporting [on Pluto TV’s alleged bid duplication practice] was that it was really about bid duplication and potential manipulation of the bid stream. That’s something that, to us, falls very much under that brand safety and suitability umbrella,” said Cahn.

All of which is to say: FAST channels have more impressions to sell at a time when advertisers are directing more dollars to streaming. But for FAST channels to secure a larger share of that spending and fill their inventory, they will need to offer a better line of sight to advertisers into what exactly that inventory is.

What we’ve heard

“If I tell you we have a [free, ad-supported streaming TV] channel on Roku[’s The Roku Channel], I’m not sure it’s as simple as ‘go here, home, channels, and then you land in it.’”

— Streaming executive on the discoverability challenge facing FAST channels

Snapchat combines Stories and Spotlight into new feed

The original vertical video platform is combining its Stories and Spotlight video sections into a single feed, Snapchat announced during its Snap Partner Summit on Tuesday.

The new unified feed will first be made available to Snapchat+ subscribers as well as non-subscribers in “a handful of early markets,” said Jim Shepherd, director of global creator and content partnerships at Snap, in an interview ahead of Tuesday’s announcement.

“When we launched Spotlight, it was built on a separate [tech] stack. And so now by unifying these two pages, I think it’s going to make it a lot easier for us to show the right content to the right people,” Shepherd said.

To that end, the new unified feed comes with a new recommendation engine that will prioritize videos from people’s friends before those from creators, publishers and others. And for anyone having flashbacks to when Instagram rejiggered its algorithm to prioritize friends’ posts, Shepherd repeatedly made a point of saying that the new recommendation engine should help creators and publishers get in front of audiences.

“The unified content experience is going to be a great way for media partners and for creators to find new fans, and then those fans subscribe to them, and then they’ll see their content on the chat page. And that’s going to lead to depth of engagement,” Shepherd said.

Numbers to know

-1.7%: Expected percentage decline in national TV ad spend in 2024 compared to 2023.

>6 million: Number of Max subscribers that Warner Bros. Discovery expects to add in the third quarter of 2024.

58%: Percentage share of subscribers to niche streaming services that sign up through Amazon’s Prime Video Channels subscription resale program.

>50: Number of new brands that will advertise during Amazon’s “Thursday Night Football” streams this year.

Olympics lift TV watch time in August — a little

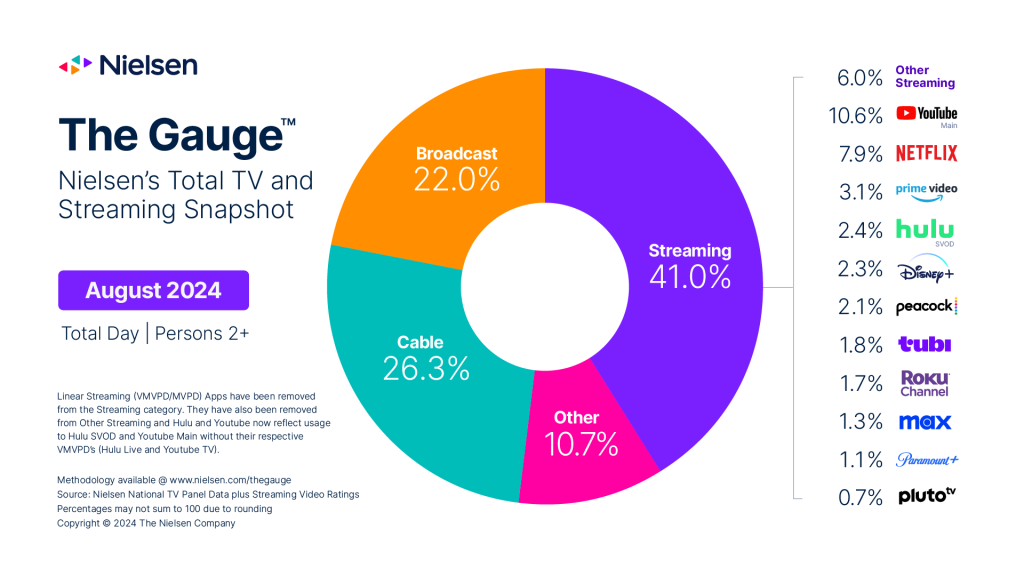

The dog days of August aren’t exactly a heyday for people to spend time in front of their TV screens. So while the Olympics did boost overall TV watch time by 3.5% year over year, the figure was pretty much flat from July, according to Nielsen’s latest The Gauge viewership report.

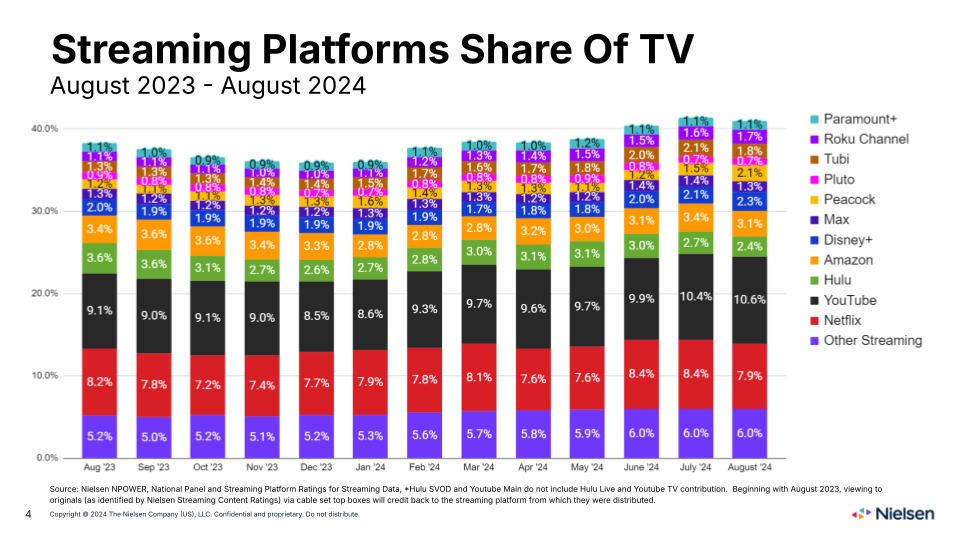

If you squint at the chart above, you may notice that broadcast TV’s watch time share inched up by 1.7 percentage points compared to July, while streaming notched a 0.4 percentage point uptick, the same amount that cable TV ceded. But it’s fine if you couldn’t tell. The watch time breakdown has looked fairly static all year. The same can be said of the streaming breakdown (which you actually do have to squint to suss out the shifts).

For those whose eyes went cross while staring at that chart, the two biggest shifts belonged to Peacock and Netflix, which head in opposing directions. Thanks to the Olympics, Peacock’s share increased by 0.6 percentage points compared to July, whereas Netflix’s share slipped by 0.5 percentage points. Everyone else hewed pretty close to their previous marks, including Paramount’s Pluto TV, which still has yet to return to a full percentage point in years.

What we’ve covered

How viral creators like ‘Hawk Tuah Girl’ stretch their 15 minutes of fame:

- Creators are trying to quickly convert the trends that gained them fame into intellectual property.

- They care capitalizing on their IP through podcasts, product lines and online courses.

Read more about viral creators here.

With AI, agencies advance CTV contextual targeting by seeking emotional connections:

- Agencies are using AI to assign emotions to streaming programming in order to target ads.

- The sentiment-based targeting is meant to make sure ads don’t come off as tone-deaf when interrupting what someone is watching.

Read more about CTV contextual targeting here.

The Trade Desk CEO denies Roku rival rumor amid reports it’s building a smart TV operating system:

- The ad tech firm is reportedly developing a CTV platform.

- Despite TTD’s CEO saying the company doesn’t want to compete with Roku, it has reportedly signed a deal to power an upcoming Sonos CTV device (more on that in the next section).

Read more about The Trade Desk here.

What we’re reading

Spotify courts video creators:

Spotify is offering to pay individual video creators sums up to seven figures to upload videos to the audio streaming service, according to Bloomberg.

The Trade Desk signs a TV hardware partner:

Speaker manufacturer Sonos is building a connected TV device that will be powered by the ad tech firm’s in-development CTV platform, according to Lowpass.

Netflix secures product placement deals:

“Emily in Paris” has become emblematic of how the streaming service is signing deals with brands like Google and McDonald’s that combine product placement, co-marketing and regular old ad placements, according to The Ankler.

Hollywood’s post-strike hangover:

Nearly a year after the writers’ strike ended, TV writers seem to be worse off with some gains mitigated by the belt-tightening among TV studios, according to Business Insider.

After Netflix popularized the upfront payment model that erased back-end earnings, Puck has drafted several ideas for new models by which producers can raise their financial upsides for shows.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: CTV identity matches are usually wrong

This week’s Future of TV Briefing looks at a Truthset study showing the error rate for matches between IP and deterministic IDs like email addresses can exceed 84%.

Future of TV Briefing: How AI agents prime TV advertising for ‘premium automation’

This week’s Future of TV Briefing looks at how agentic AI can enable TV networks to automate the sales of complex linear TV ad packages.

Inside NBCUniversal’s test to use AI agents to sell ads against a live NFL game

NBCUniversal’s Ryan McConville joined the Digiday Podcast to break down the mechanics of the company’s first-of-its-kind agentic AI ad sales test.