Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: A Q&A with Colin and Samir’s Samir Chaudry on the state of the creator economy

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing features a Q&A with Samir Chaudry from creator duo Colin & Samir discussing the state of the creator economy.

- The business of being a creator

- Sports drives across-the-board TV watch time increase

- How many people watched the Super Bowl, really?

- Video’s ChatGPT moment, Comcast-Paramount’s “Spulu” response, streamers’ increased ad loads and more

The business of being a creator

YouTube CEO Neal Mohan has described creators Colin Rosenblum and Samir Chaudry – better known by their YouTube channel’s name, Colin and Samir – as “connoisseurs of this creator economy.” And in January the duo, with the help of creator platform Kajabi, launched a four-week course on the business of being a creator.

“We talk about what we’re doing is like writing the textbook in real time of the creator economy. Putting that down into curriculum everything we’ve learned over the past 10 years, it really felt like producing something that was more similar to writing a book or making a movie,” said Chaudry.

So who better to assess the state of the creator economy? In the interview below, Chaudry discusses not only the creators’ decision to create a course on the business of being a creator but also how that course fits into the broader Colin and Samir business, how much revenue YouTube Shorts has contributed and how connected TV is accounting for a larger share of the YouTube channel’s viewership.

The transcript has been edited for length and clarity.

First off, why launch a course now?

We have been working on it for years. Could we have launched it earlier, we would have. But we were really, really aggressive when it came to the curriculum. We spent about 18 months crafting the curriculum, developing the worksheets, stress-testing it, shooting the videos, editing, reshooting at times. But the impetus for it was we consider ourselves an education media company; our mission statement is to educate and empower the next generation of creators.

Since the course isn’t geared at beginner creators but creators who have something of a business already, I was curious if the timing had anything at all to do with there’s more of that audience now than if you had launched in, say, 2021 when still a lot of folks were coming off the pandemic boom.

I do think the industry has matured to a point now where this curriculum makes sense for people and that it applies to a larger group of professional creatives. Without a doubt, there’s more professional creators today than there was two years ago.

The course is about the business of being a creator, but obviously having the course is part of yours and Colin’s business as creators. How significant is this course going to be from a revenue contribution standpoint for you all this year?

On the first cohort, we’re not yet at break-even, from the investment that we made in the course. We hired a dedicated team member as well as an outside agency called Course Studio to help us develop it. It’s a significant expense to launch a new part of our business. What we’re looking for is is this something that our audience deems valuable? Two weeks into this first cohort, the signals are all pointing to yes.

When this will become a revenue driver for us is if we continue this and are able to replicate this and scale it out to more students. It’s not far off. This calendar year it could become a profitable part of our business. It won’t stack up to our brand partnerships business in the short term, but it could in three years. 70 people signing up for the cohort is really awesome; it’s just shy of $100,000 in revenue on the first cohort.

Among all the different revenue sources you have, looking at this year, how do you expect your revenue to break down?

Brand deals will make up 50% if not 60%, of the revenue. AdSense [the revenue that YouTube shares from ads running against creators’ videos] should make up about 10%. And 30% is speaking, consulting and creative projects that aren’t necessarily distributed on our YouTube channel. The course is part of that 30%, which is like that “other” [category] right now.

The healthiest possible mix would be that the course actually – whether it’s course or even membership – this concept of direct-to-consumer content is actually a big piece of the next chapter, not only for our business but a lot of creator businesses.

When comes to AdSense, some people may be surprised that it only represents 10% of revenue because they may be of the mind that, for YouTube creators, all the money is AdSense. Is that becoming more important, for AdSense to be a minority of revenue because it can be so volatile?

From a revenue perspective, that is still a substantial amount of revenue. And that’s really exciting for us. When we first started out, we didn’t make much money on AdSense. In the past, we’ve always treated AdSense as found money. 2022 was the first year where it was like, “Okay, AdSense is now becoming substantial.” We made $268,000 on AdSense in 2022.

But it’s still a line item in your revenue that is [relatively unpredictable] – like, I can give you a sense of what I think we’ll make in March for AdSense, but I won’t know until the end of March.

From a projections [standpoint] and your ability to actually hire and get a studio and build a company, we really put our heads down and solved our brand partnerships business: How are we going to work with brands and how is that going to be the largest part of what we do? That gives us predictable revenue.

And AdSense now plays a really significant role in our ability to hire, even when when we look at giving bonuses to our team and being able to share in the growth of the channel. That’s a lot of the role that AdSense plays for us now.

It’s been a year since the YouTube Shorts rev-share program rolled out. Has that generated anything meaningful for you all?

In 2023, we made $3,300 in Shorts revenue.

That’s nice money, but…

It’s not nothing. But it’s not substantial enough. And I will say, we didn’t focus that heavily on Shorts. In terms of Shorts viewership, that [$3,300 in Shorts revenue] is on 61 million views. So it’s not that substantial, in terms of we really didn’t put that much effort into short-form in 2023.

To what extent do creators care about these short-form rev-share programs, including TikTok’s moving the needle as opposed to short-form being an opportunity to grow audience and push audience to long-form videos or other parts of the business?

If you have a format that works for short-form, it’s great. A lot of our subscribers come in via Shorts. With any business owner, if you said, “Hey, look, I can get you in front of 60 million people,” you’d probably go, “Okay, tell me more.” Shorts is a great way to get in front of a mass amount of people. The bread and butter, though, how the business is grown for us is in extremely long-form content right now. Our interview with Emma Chamberlain is three hours long.

Right now, what we’re looking for and optimizing for is long-form and connected TV. 30% of our viewership last year came from connected TV. When you look at watch time for 20223, 17 million watch hours, 102 million views on really long-form content: 30% of that coming on connected TV is really significant. And our average view durations are pushing into the 40-, 50-[minute] and even hour mark range.

I imagine the revenue per view is higher for a CTV view versus a mobile view. Is that right?

I would assume so, yes.

Seeing that CTV viewership and if the revenue is there as well – and having produced long-form documentaries like “I Spent 24 hours with MrBeast” – are you thinking about producing videos specifically for CTV or CTV-first videos?

It’s not necessarily that we think CTV-first. But we have an episode coming out in two weeks where we spent 48 hours with Ludwig; that’s more docu-style. I wouldn’t say that is strategic in the context of CTV or not CTV. Our background is in documentary. The Beast documentary is the thing we do, and so it’s more that is what we want to do. And we feel really lucky that right now that is what’s working.

It’s exciting to see that people are willing to watch 40 minutes of a YouTube video. That opens up and unlocks a lot for us as creators. And I think it’s going to come to light this year in a way that people don’t expect. I believe that YouTubers are becoming Hollywood faster than Hollywood is becoming YouTubers.

What we’ve heard

“FAST channels are not necessarily relevant to a younger viewer. But for older demos, it can be a transitional period: ‘It’s now time for me to cut the cord, and these FAST channels are a good replacement.’ But Gen Z typically are cord-nevers; they’re not familiar with [traditional TV-style program guides].”

— Streaming executive

Sports drives across-the-board TV watch time increase

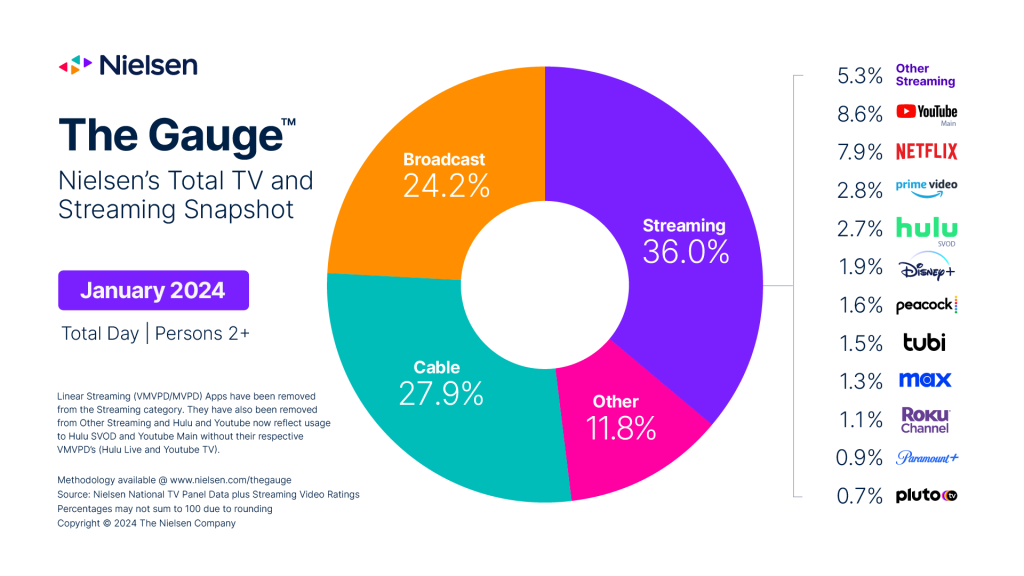

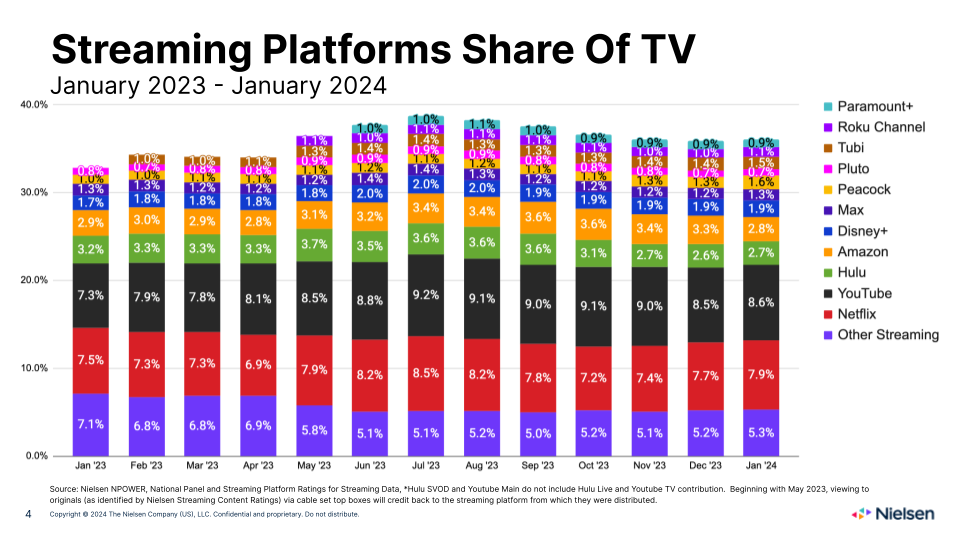

The amount of time people spend watching TV each month hit a high point in January 2024, with overall watch time up compared to December 2023 as well as January 2023, according to Nielsen’s latest The Gauge viewership report.

Watch time increased month over month across the board: 4.1% for streaming, 7.1% for broadcast TV and 2.7% for cable TV. Driving the increases was sports, which accounted for 28% of all broadcast TV viewing and was likely responsible for Peacock — which exclusively aired an NFL playoff game in January — seeing its watch time share increase by 29% month over month to hit 1.6%.

Within streaming, the watch time breakdowns stayed largely the same as recent months: YouTube leading Netflix, Paramount’s Pluto TV staying shy of the 1% share mark, etc. However — aside from the aforementioned Peacock bump — there was one notable change from December. Amazon Prime Video’s watch time share slipped by 0.5 percentage points in January, a month that ended with the streamer introducing its ad-supported tier.

Numbers to know

$2.3 billion: How much money Walmart will pay to acquire smart TV maker and CTV platform owner Vizio.

80 million: Number of active accounts that Roku’s connected TV platform had at the end of 2023.

80%: Percentage of studied influencers who failed to properly disclose sponsored posts as advertising under European law.

$8 million: How much money AMC Network will pay to settle a lawsuit alleging the TV network owner violated the Video Privacy Protection Act.

7 million: Number of paid subscribers that TelevisaUnivision-owned streamer ViX had at the end of 2023.

-267,000: Number of pay-TV subscribers that Altice lost in 2023.

How many people watched the Super Bowl, really?

To know how many people actually watched the Super Bowl would require a level of surveillance akin to “God’s Eye” in “The Dark Knight.” So it’s little wonder that different measurement providers put out differing viewership measures last week. That being said, I decided to have some fun with the latest example of how TV viewership measurement being a bit of a mess.

What we’ve covered

In a booming influencer economy, creators seek standardization for payment terms:

- To address late payment issues, some creators are opting to implement late payment fees and ask for upfront deposits.

- Typically brands agree to pay creators 30 to 90 days after the work is completed.

Read more about creator payments here.

Why Snapchat is pitching its platform as an alternative to social media:

- Snapchat’s latest brand campaign promotes the platform as being oriented around friends and family.

- The platform is running ads across traditional TV, out-of-home, print and digital.

Read more about Snapchat here.

What this year’s Super Bowl ads said about diversity, influencers and commerce:

- This year’s Super Bowl ads featured fewer people of color compared to previous years.

- The ads also skewed more masculine than feminine or non-conforming gender roles.

Read more about Super Bowl ads here.

What we’re reading

A little more than a year after ChatGPT opened people’s eyes to how advanced generative AI technology had become, OpenAI has done the same with respect to video through a preview of its generative video AI tool Sora, according to Wired.

Comcast-Paramount’s “Spulu” response:

With Disney, Fox and Warner Bros. Discovery coming together to create a sports-centric streaming service, two companies left out of the joint venture — NBCUniversal parent Comcast and Paramount Global — have discussed combining their respective streamers, Peacock and Paramount+, according to The Wall Street Journal.

Pay-TV providers’ “Spulu” response:

Pay-TV providers have complained to Disney, Fox and WBD that the latter companies’ streaming sports joint venture will further catalyze cord-cutting, according to CNBC.

Streamers’ increased ad loads:

A few years after the likes of Peacock, Discovery+ and Max rolled out promising to air fewer ads per hour of programming than traditional TV networks, streaming services have been increasing their ad loads, according to Insider.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.