Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Future of TV Briefing: 8 charts that sum up the state of streaming advertising

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing takes a visual look at the state of streaming ads.

- Data stream

- Olympics increase streaming watch time

- Fubo vs. Venu, animators v. AI, Byron Allen vs. bills and more

Data stream

The dog days of August are as good a time as any to step back and assess the state of things. And there have been a number of recent studies surrounding the TV, streaming and video ad landscape that seem to lay out the current conditions. So here’s a selection of charts that sum up the situation.

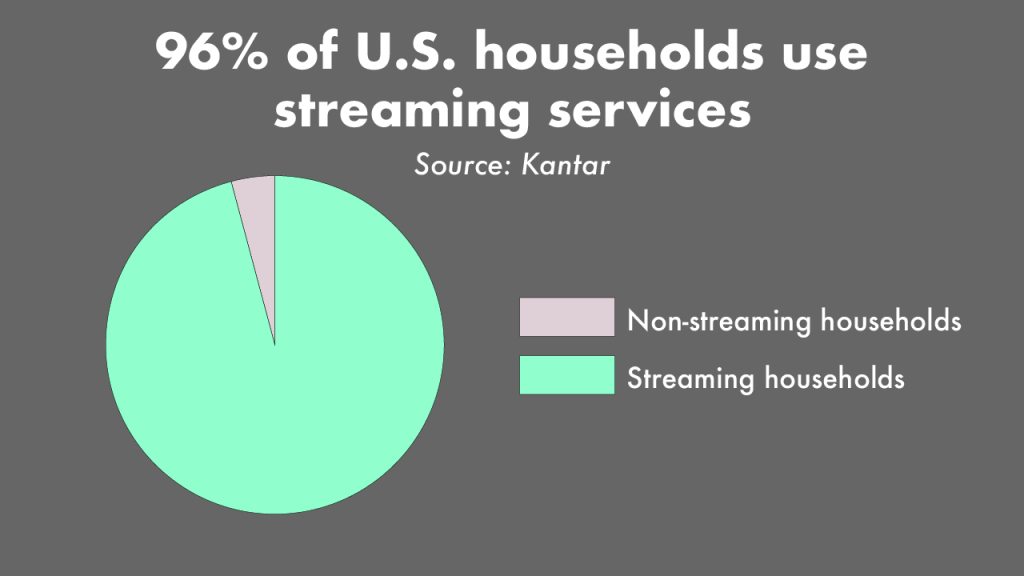

Streaming has reached critical mass

Virtually every household in the U.S. is streaming videos, movies and shows these days. To put a number on it, 96% of U.S. households – a.k.a. 124 million households – are streaming, according to Kantar.

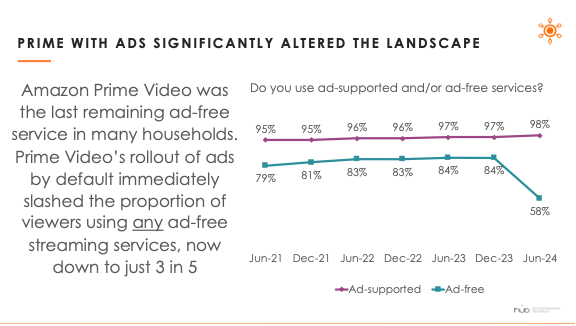

Viewership is skewing toward ad-supported

Historically, streaming has been a largely ad-free viewing experience. But as more streamers have introduced ad-supported tiers to supplement revenue, a lower percentage of viewers are tuning into ad-free services. And Amazon Prime Video’s ad-supported entry earlier this year has coincided with a sharp decline in ad-free viewing, according to Hub Entertainment Research.

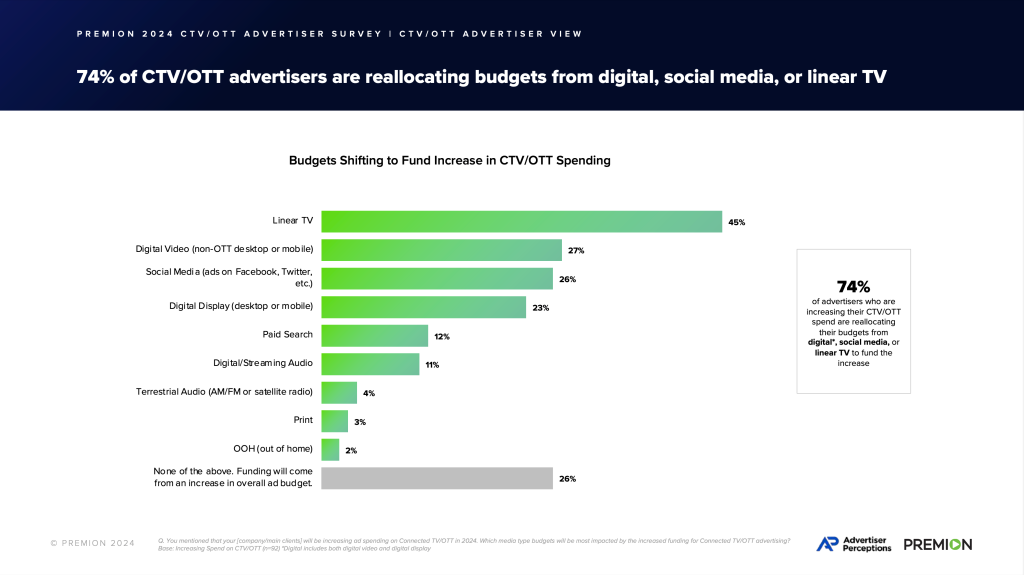

Streaming is drawing ad dollars away from traditional TV

Streaming’s saturation and ad-supported spurt have naturally made it more attractive to advertisers, which are primarily diverting dollars from traditional TV, according to a study Advertiser Perceptions conducted for Premion.

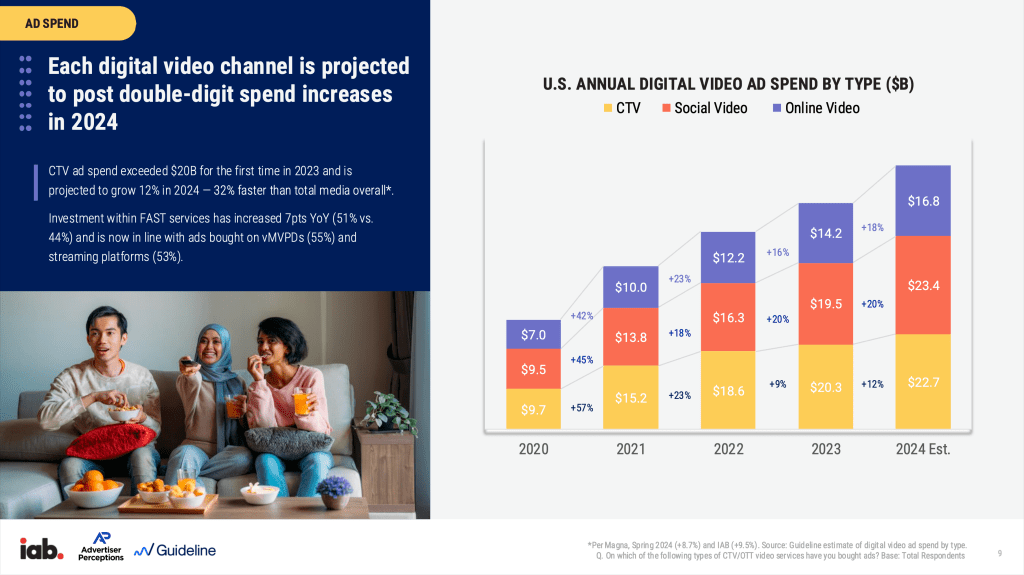

But streaming is still only a slice of advertisers’ overall video budgets

This year advertisers in the U.S. are expected to spend $62.9 billion on digital video ads, according to the 2024 IAB Digital Video Ad Spend & Strategy Report. But streaming – which the report confoundingly labels “CTV” and defines as “TV-like, Internet-delivered content” – will only receive 36% of that spending. (Of course, that share would likely be higher if YouTube were included in the “CTV” category instead of “social video.”)

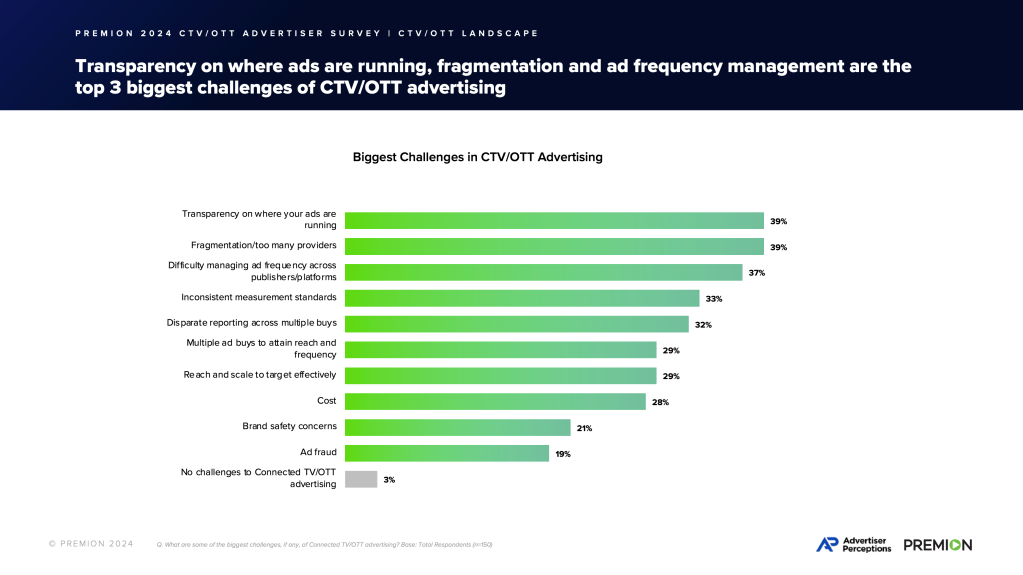

Because (in part) advertisers don’t have enough control over their streaming campaigns

Fragmentation takes the fall for why advertisers’ streaming spend is somewhat inhibited. Per Advertiser Perceptions/Premion, ad delivery transparency, streaming fragmentation and frequency management are the top challenges facing streaming advertisers – and inconsistent measurement and inconsistent reporting are the next two biggest challenges.

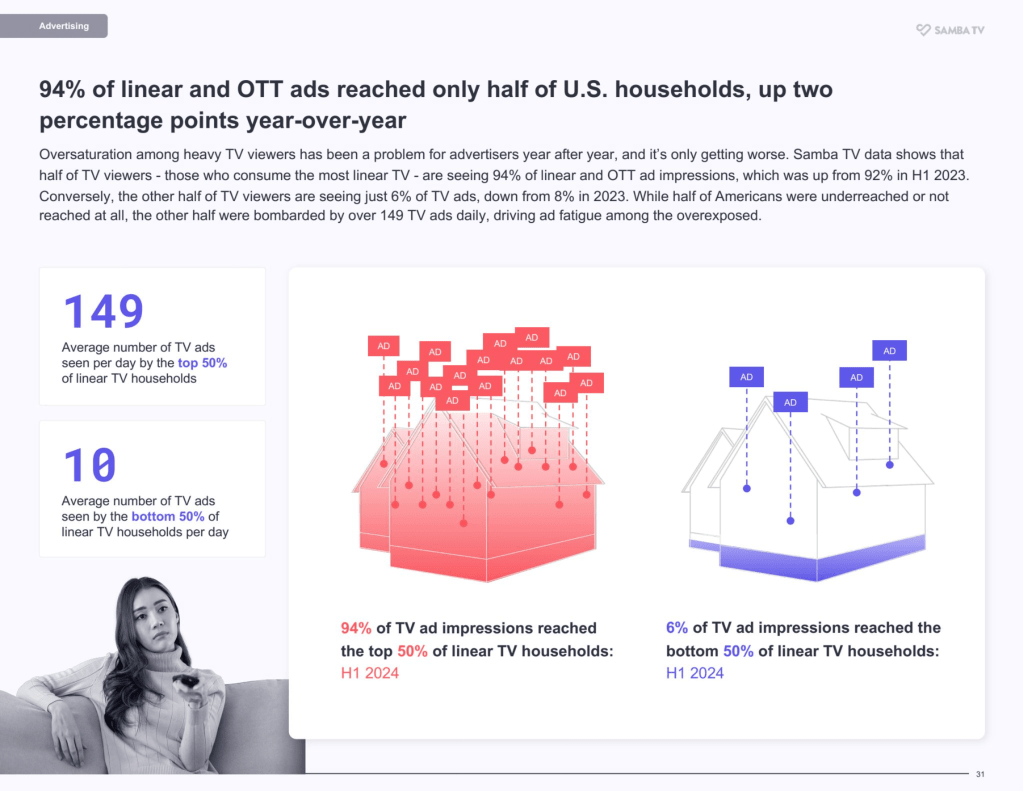

In fact, advertisers are either annoying or ignoring viewers

For as much as ad-supported streaming viewership has grown and is growing, advertisers are too often missing the enlarged mark. An overwhelming majority of TV and streaming ad impressions – 94% – are being served to the top 50% of U.S. households that spend the most time watching traditional TV, according to Samba TV. And yes, that’s based on households’ traditional TV watch time, but it includes streaming ad impressions. By contrast, only 6% of TV and streaming ads reached the bottom 50% of households.

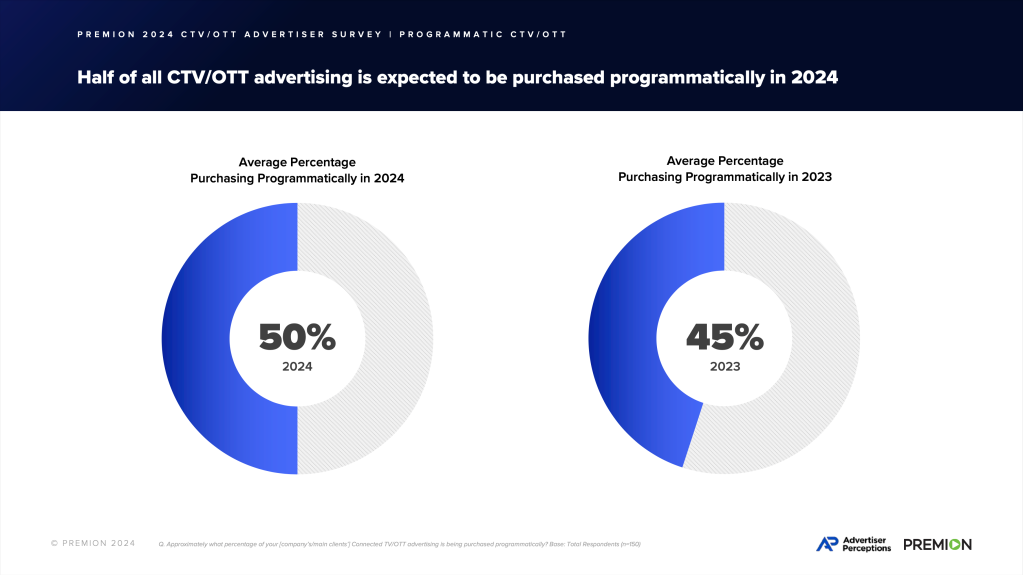

Streaming ad buying methods are evolving

A lot of the aforementioned issues seem symptomatic of a marketplace that’s underdeveloped. These issues are not alien to traditional TV advertising, but streaming is digital, and digital is supposed to be smarter. Enter programmatic, which is becoming a more primary way that advertisers are purchasing streaming inventory, according to Advertiser Perceptions/Premion.

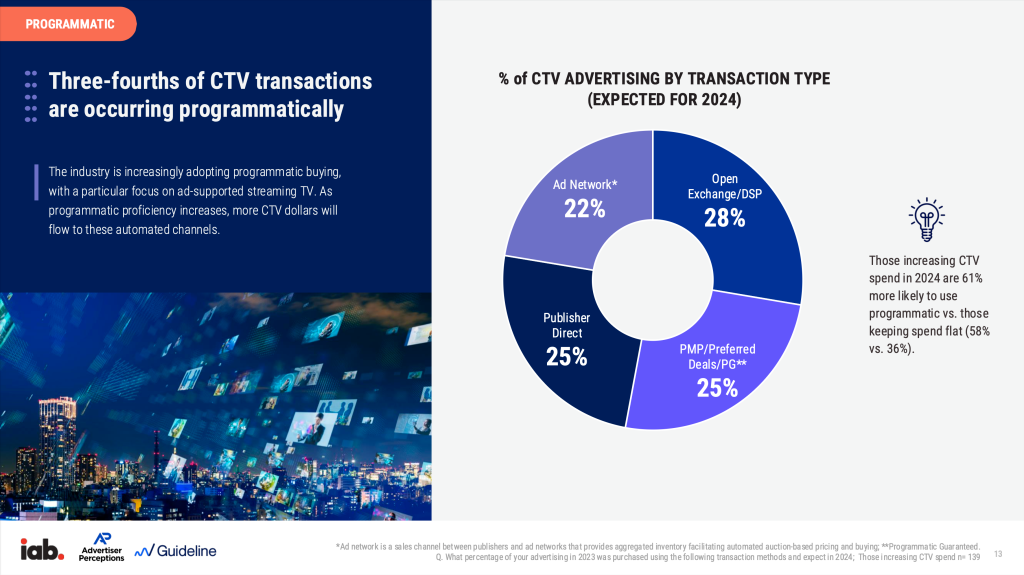

But will programmatic alleviate or exacerbate these issues?

Ostensibly, programmatic buying methods would help with managing frequency and fragmentation if advertisers are able to consolidate their buying to one or a few demand-side platforms in order to control their campaigns. And that’s particularly true when advertisers are opting for more controlled programmatic buying paths, like private marketplaces and programmatic guaranteed deals. But per the IAB report, half of streaming ad transactions this year are set to go through either ad networks or open exchanges, which aren’t exactly known for transparency and control.

What we’ve heard

“There needs to be an AI clause and creators need to make sure that that’s covered in there.”

— Team One brand partnerships and culture director Lindsay Calabrese on AI and influencer marketing

Olympics increase streaming watch time

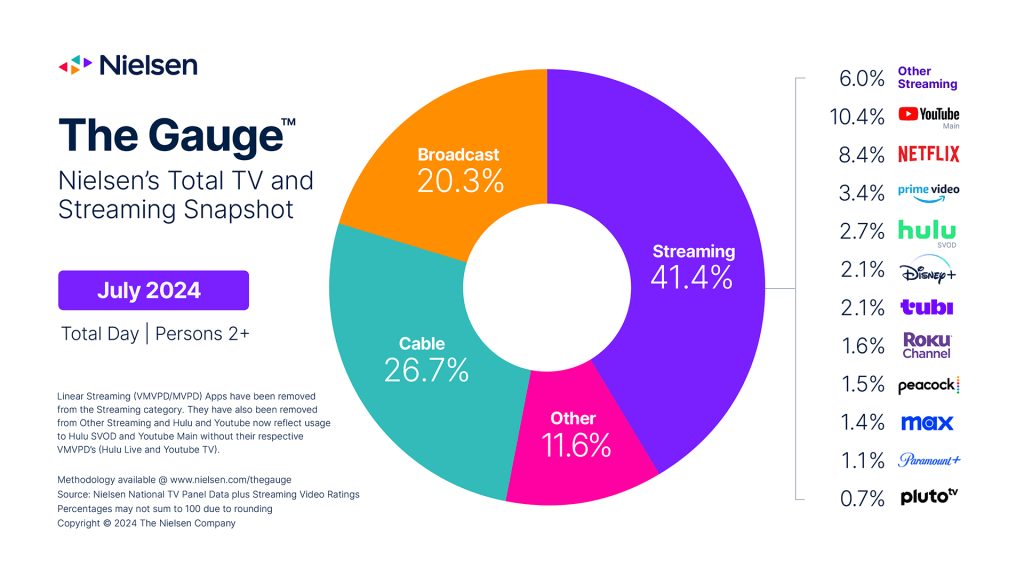

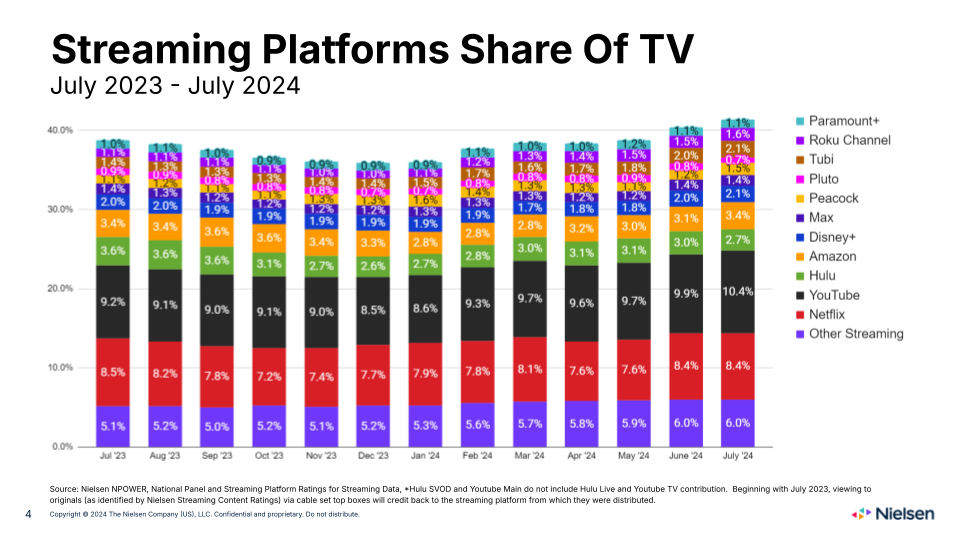

The Olympics only aired for six days in July, but that was enough to affect the amount of time people spent watching TV last month. And the biggest boost came to streaming, which reached a record high share of TV watch time, according to Nielsen’s latest The Gauge viewership report.

While streaming was the biggest recipient of the Olympics interest, traditional TV did also benefit. “When TV usage is isolated by week, the start of Olympics coverage in the final week of July pushed the broadcast average up to over 22% of total TV,” according to Nielsen.

But again, streaming was the bigger beneficiary. Look no further than Olympics rights holder NBCUniversal and the 0.3 percentage point share increase it notched in the month. OK, 0.3 percentage points sounds somewhat minimal, but that tied Amazon Prime Video for the second-biggest gain of any streamer in July. The biggest gainer? YouTube, which stretched its lead as the streamer with the most watch time past the 10% threshold.

Numbers to know

150%: Year-over-year increase in upfront ad commitments that Netflix secured during this year’s negotiations.

$4.3 billion: How much money Edgar Bronfman Jr. is willing to pay to acquire Paramount away from Skydance Media.

$9.42: How much money pay-TV providers pay Disney per subscriber to carry ESPN.

$170 million: How much money Kamala Harris’s campaign has reserved to spend on TV ads between Labor Day and Election Day.

>70%: Percentage share of Spotify’s video podcast audience that watches the videos in the foreground.

$0.9 billion: How much money people spent on short-form video apps in the first quarter of 2024.

What we’ve covered

TikTok moves ahead of YouTube for brands’ video-focused social media marketing:

- 67% of brand and retail professionals polled by Digiday+ Research posted content on TikTok in the past month.

- 60% posted content on YouTube in the same timeframe.

Read more about social video marketing here.

As sports enjoys a moment, buyers find new ways to get in via influencers and CTV:

- Streaming sports has opened up inventory to new advertisers.

- Athletes are available for influencer marketing deals (a.k.a. sponsorships and endorsements).

Read more about advertisers’ sports spending here.

AI hype sparks influencer contract overhauls for name, image and likeness:

- One creator is asking clients to agree not to train her voice on any AI technology.

- AI is part of a broader focus on content usage rights in influencer deals.

Read more about influencers’ AI contract terms here.

As the presidential election approaches, where do influencers come in?:

- Last week the White House hosted a summit for creators.

- This week the Democratic National Convention has given media credentials to creators.

Read more about influencers and election season here.

As political ad spend faucet opens, CTV media stands to be a major winner:

- Political ad spending had reached $385 million as of Aug. 8.

- Democrats are outspending Republicans so far.

Read more about political campaigns’ CTV ad spend here.

What we’re reading

Disney’s, Fox’s and Warner Bros. Discovery’s streaming sports joint venture won’t be able to launch, a judge ruled, until streaming pay-TV provider Fubo’s lawsuit against the companies is resolved, according to Bloomberg.

AI is once again a front-and-center issue as another Hollywood union — The Animation Guild — enters negotiations with film and TV studios, according to The Hollywood Reporter.

The Screen Actors Guild has signed a deal with AI company Narrativ so that the former’s members can have the latter’s AI trained on their voices in order to generate voiceovers for advertisers while compensating the actors, according to Variety.

The media mogul — who has tried to buy ABC, BET and Paramount in the past year — has been late in paying the TV network owners that carry Allen Media Group’s local TV stations, according to CNBC.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.

What’s behind Netflix’s CTV market share jump?

The streamer is set to grab almost 10% of global CTV ad spend. Media buyers say live sports, lower prices and DSP partnerships are making a difference.