Secure your place at the Digiday Publishing Summit in Vail, March 23-25

SoulCycle has decided to take public its brand of spandex-powered, celebrity-style boutique fitness workout. The brand, which runs fitness classes that involve stationary cycling in a candle-lit room, filed documents with the Securities and Exchange Commission this afternoon.

Here are five things learned about the brand from the filing:

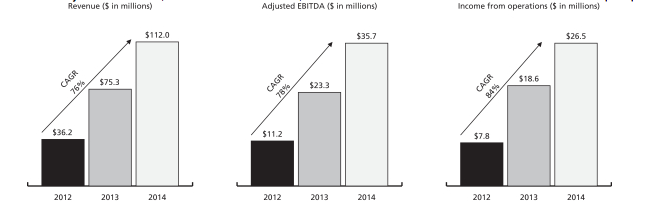

The company has seen really good growth over the last three years.

Soulcycle earned $112 million in revenue in 2014, up from $75 million in 2013. It added 235,000 riders in 2014.

Each Soul studio — there are 38 in all — generated an average of $4 million in revenue in 2014. Revenue from studio fees represents 84 percent of all revenue. “Other revenue,” from retail and equipment sales is on the increase — it went from $12 million in 2013 to $18 million.

SoulCycle may turn into an exercise video company.

The filings indicate that the company sees a clear opportunity to expand its platform to create online video. “We believe there is also an oppotunity to expand SoulCycle class content to an at-home audience.” The brand also plans to explore line extensions in digital publishing and media going forward.

SoulCycle’s biggest brand problem may be an over-reliance on urban areas.

The following table shows where Soul studios are open as of March 31. There are 23 in the New York area alone — which might explain the $9.1 million it paid in rent and occupancy expenses in 2014, an increase of almost 50 percent from the year before.

IPO watchers are worried that this may be a risk factor, since as investors will demand scale that the company might not be able to deliver on. SoulCycle classes cost $34 each, and while the company’s filing says there is no target demographic it appeals to, only those of a certain level of affluence can afford it.

One of SoulCycle’s risk factors is geographic concentration and the ability to expand to new markets #soulcycleIPO pic.twitter.com/8s7wdHjPcE

— Leslie Picker (@LesliePicker) July 30, 2015

Another risk factor is an overreliance on celebrities: Karlie Kloss and Victoria Beckham are two of their most high-profile clients. The brand said it does benefit “from favorable publicity related to celebrities riding in our studios. If in the future we lose such celebrity ridership, this could have a negative effect on our business.”

The brand recognizes that its instructors are the “soul” of the company.

In the filing, SoulCycle writes that the core identity of the brand is “fueled by the personalities of our instructors.” Soul instructors are active on Twitter, Instagram and other social media channels. They befriend regular customers and create a powerful army of loyal evangelists. As Digiday reported earlier, SoulCycle instructors are “mini-celebrities,” and customers often follow them from studio to studio. Avid New York cyclist Jenna Garofolo, for example, said she considers her instructor, Akin Akman, to have his “own brand separate from SoulCycle.”

“Our riders arrive early and stay after class,” said the filing. “Riders voraciously consume, comment on and share content from our blog and social media channels.” Compensation and related expenses cost the company $42.2 million last year.

The brand is more than the classes.

The prospectus paid special attention to the company as a “lifestyle brand,” pointing out that SoulCycle apparel has become the uniform of choice both inside and outside studios. “Our silver retail bags can be seen in airports, on street corners and in households across the country,” it said. The plan is to extend and monetize the brand with clothing lines beyond just what you can wear at the gym, the filing said.

More in Marketing

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.