Last chance to save on Digiday Publishing Summit passes is February 9

Programmatic ad buying continues to soar — and with it, marketers’ worries about fraud and transparency in the inventory they’re buying.

A new Association of National Advertisers and Forrester survey found that 79 percent of respondents made programmatic buys in the past year — up from 35 percent in their last survey two years ago.

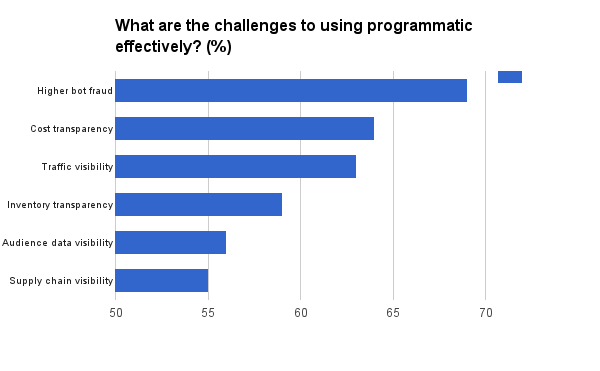

At the same time, respondents considered ad fraud and a lack of transparency in the process to be serious obstacles to the effective use of programmatic. Fully 69 percent said they were concerned about higher bot fraud.

In the area of transparency, concerns have spiked since the 2014 survey. For example, 64 percent say they’re concerned about a lack of transparency around costs in the programmatic supply chain — up from 37 percent two years ago. There were also big jumps in concerns over a lack of visibility into inventory, firms involved and data used to define audiences.

Marketers see big benefits in programmatic, with its ability to do better targeting, manage buys across media and optimize them in real time. As a result, its use is widespread and growing, with 93 percent saying they plan to use it in online display in the coming year. Respondents also plan to expand its use in online video, search and audio. Beyond digital media, marketers also said they expect to expand programmatic buying in TV, print and outdoor.

The survey also asked respondents what steps they’re taking in response to transparency concerns. Their top three were requesting detailed campaign guidelines and reporting from agency partners (62 percent); updating “blacklists” (51 percent); and targeting “whitelists” (45 percent).

Now again for the bad news: Marketers are lagging in taking other steps to address transparency issues, according to the survey, with only 24 percent creating restrictions for sourced traffic and 15 percent creating a private marketplace, for example.

The survey was conducted in February and is based on responses from 128 ANA members.

More in Marketing

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.