Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This is the capstone to a series looking at how today’s retailers are fighting back against the Amazons of the world. It is brought to you by Sociomantic, a market leader in providing dynamic display ad campaigns powered by CRM data for e-commerce advertisers. JB Brokaw is president, North America for Sociomantic.

Retailers have long applied customer information and insights to craft engaging brick-and-mortar shopping experiences. As omnichannel marketing has gained steam, they have also sought to create new types of digital engagements. Saks Fifth Avenue, for example, has armed sales associates with iPads for quick inventory checks, while Nordstrom allows in-store pickup of online orders, a tactic that earned the retailer an 8 percent lift in sales.

Unfortunately, customer insights have not always been applied online as retailers underuse their own valuable customer data. This is one of the reasons for dismal shopping cart abandonment rates, which hover at about 68 percent, according to the Baymard Institute. Without this data, retargeting remains a blunt instrument instead a honed blade used to combat cart abandonment.

Retargeting today is used to bludgeon consumers into submission rather than entice them with well-tailored offers. Why? Most retargeting technology is unable to ingest retailers’ valuable CRM data – which might be housed in multiple systems – let alone support customized creative through real-time bidding. And the business logic so finely tuned over decades of customer interactions? Forget about it.

This is unfortunate. Were retargeting done correctly – by taking advantage of a retailers’ data and business logic – it could improve commerce conversion dramatically. This was the case for BrandAlley, one of France’s largest online retailers. When it applied its own CRM data to retargeting conducted through RTB, it saw a twofold increase in the number of new customers and a fourfold increase in sales.

This success demonstrates the value of retargeting that is focused on “a” customer rather than “the” customer. Retargeting – like so much online engagement – is usually aimed at a faceless amalgam of information that is assembled on the fly to categorize individuals into convenient, but overly broad, buckets. Retailers like Macy’s or Nordstrom or Saks know their customers. They know them by name and, in many cases, have known them for years.

When these retailers reach out to their customers – whether through email or direct mail or social media – they use their CRM data to treat them as individuals with names and addresses and preferences and a past. Retargeting shouldn’t be any less informed. Retailers’ own first-party data provides what they need to transform retargeting into a highly personalized and valuable sales tool.

The benefit of effective retargeting doesn’t end with improved conversion. By allowing operational intelligence – such as real-time inventory, supply chain status or past buying behavior – to be applied to digital display, retailers can tune offers not only based on the customer they are trying to reach but also to help achieve specific business goals. Special offers and promotions can be crafted that will satisfy the customer and make room for new product.

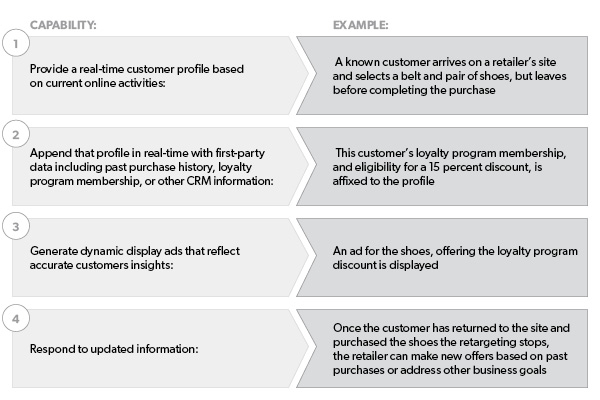

Effective retargeting should be able to:

There is no special magic or secret to successful retargeting. It simply requires appropriate technology that is able to maintain a real-time customer profile and append it with data from a retailer’s own CRM systems, can ingest and apply a retailer’s established business rules that have been developed and proven over time, can react and respond to market dynamics at lightning speed, and bring all these elements together to deliver personalized offers through digital display. Maybe it is magic?

More from Digiday

In graphic detail: How Anthropic’s Pentagon refusal is paying off in downloads, brand trust and enterprise deals

OpenAI’s Pentagon deal seemed to spark uproar among its users, many of whom were against it. Anthropic’s refusal to agree to the terms was seen by users as the more trustworthy alternative.

How AI could disrupt retail media’s $38 billion search ad market

ChatGPT and other AI chatbots could divert shoppers from retailer sites, putting the $38B retail search market at risk.

‘Brand safety is moving from fear to curiosity’: Zefr’s Raddon on content-level accreditation – and what it exposes about the industry

The threat is no longer a discrete piece of bad content that a keyword list or a domain block can catch. Its volume.