Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This article is part of the Digiday Partner Program and is brought to you by Dstillery. This article was written by Brian Dalessandro, VP of data science, Dstillery.

When I was a kid, I was fascinated by maps. I had an atlas of the world that served as a gateway to countless explorations, none of which required leaving my bedroom. Now I find myself indulging old habits, only this time it’s for marketing science.

Recently, I’ve been analyzing a lot of mobile data to create what I call a branded landscape, or “Brandscape.”

Brandscapes combine mobile data with location data, and they’re a new and effective tool for creating a mobile targeting strategy for brands. Here’s how it works.

The beauty of mobile data is that it paints a fascinating picture of not just digital activity but also of how people move, travel and engage with the world geographically. Some of the results are obvious (e.g., the data shows that people commute to work), but some of the data leads to amazing discoveries.

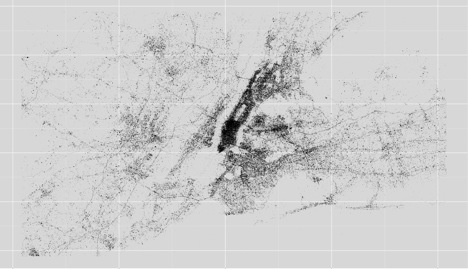

For instance, when we get a request to serve an ad, I look at the coordinates of the mobile devices where the request originated. Then I put those requests on a map.

If you are a New Yorker (or just really love maps), you’ll recognize this. The map shows that people are consuming ads everywhere there are people. As a marketer, this means your potential reach just got a lot bigger. Many of the lines formed by this plot are highways. The billboards of tomorrow might be sitting in your cell phone!

It gets better.

The above map indicates that mobile devices represent a robust platform for advertising. But this is 2013, and simply being able to reach people isn’t good enough. Which of these mobile users should you actually target? Fortunately, we have some insight to help with that decision.

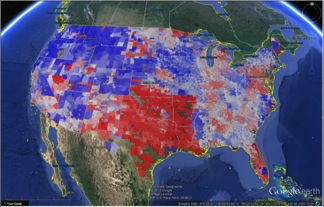

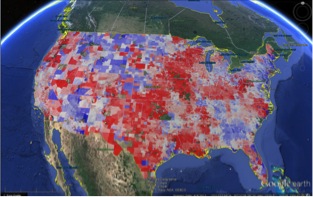

By combining various data points of purchase intent from desktop and mobile users (such as visiting a store on or offline, with or without a purchase) with location data, we can paint a picture of how product interest and intent varies geographically. The next two maps are examples of this mash-up of data sets (the first for a hotel brand and the second for a travel brand):

In both of these maps, blue-colored regions represent areas where the population has a higher likelihood of brand awareness and purchase intent. This heat map can be produced for any brand, and no two brands will be alike (we all know brands are like snowflakes, and it’s nice to see this come to visual life).

Brandscapes are actionable just as any targeting strategy is actionable — target people with high brand awareness, affinity and intent and get a better ROI on ad spend. Further, the Brandscape can be used for strategic brand-building. We could overlay physical store locations or national TV and radio campaign data on these maps. The brand managers can quickly see inconsistencies between where they have been investing in building recognition (with both advertising and physical presences) and where people have a high likelihood to engage with the brand. Combining both might show us where a brand should invest to improve brand awareness and brand affinity.

More from Digiday

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?

From Boll & Branch to Bogg, brands battle a surge of AI-driven return fraud

Retailers say fraudsters are increasingly using AI tools to generate fake damage photos, receipts and documentation to claim refunds.