Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Who’s paying whom? Surprise triggers? Black box or not? What to ask when you buy tech

By Daniel Bornstein and Scott Messer, D360 by Demand Media

Not all is perfect in the programmatic kingdom.

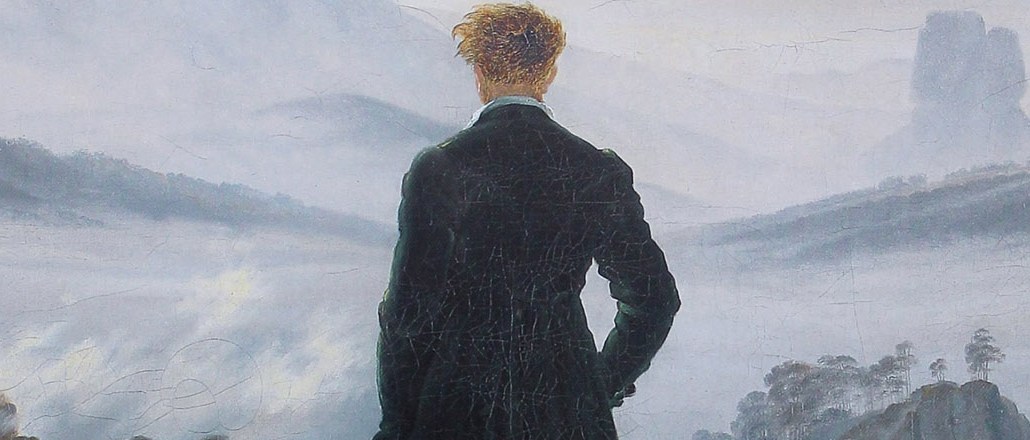

According to a recent Digiday survey, less than half of publishers and just a bit more than half of people on the buy side consider themselves either “satisfied” or “very satisfied” with their tech solution partners. Brands want results for their ad spend and publishers want ads that make sense for their audiences. But each is staring at the other across foggy third-party terrain where fraud is rife and too little sunlight penetrates. There are, of course, valuable tech partners out there. The question is: How to identify them?

Nurturing generalist or high-flying specialist?

Selecting the right vendor/partner is like choosing a doctor: Do you need a general practitioner to treat everyday ailments? Or an expert in obscure maladies who’s going to fly in, work her magic and disappear again?

A company’s misunderstanding of how many services it needs is one of the most common mistakes in the industry. Over-ordering products is a waste not only of money, but also of time; if you’re worried about scaling, you can structure the order form to add services only when you require them.

Once you know what you want, make sure that you’re getting the right type of service. Again: generalist or specialist? For example, DFP is a widely used platform because it has a vast range of products and services including Active View, their viewability product. Although the Active View is well integrated into DFP and AdX, we also choose to consult the measurement of MOAT, an analytics company specializing in viewability which is widely accepted throughout the industry.

Even with the right selection, you have to ensure your needs will be met. The most basic way to get enough attention from a partner is to work a service-level agreement (SLA) into the contract. Trouble is, even an SLA can be misleading.

An SLA might, for instance, indicate how many people a tech partner is dedicating to your account and how long it will take them to turn around certain tasks. But that won’t guarantee that the assigned people will be useful or that their quick work will be well done. “There is zero chance [a tech partner] will assign good people to a low-priority account, no matter what the SLA says,” said Adam Heimlich, head of programmatic at Horizon.

So ask questions, particularly of third parties. Ask about support coverage, about implementation details and about how the partner plans to handle the hand-off between sales, implementation and full operation.

Trust, but verify – and do the pipes connect?

Whether you’re licensing technology or selecting an agent, make sure you penetrate the black box. How is the potential partner going to make money, how much are you getting and how much are you paying to them? Before signing a contract, rig up some test scenarios in which you go over or under the ordered amount and then go through them line by line to figure out your fictional bill. You will find fat to cut and can avoid any surprise “triggers.” And if the numbers are too clever, you’ll likely face transparency issues.

Any new crew that you bring on board, meanwhile, had better lock right in with your existing tech. Some tech providers will be happy to play with others while others will insist that they sound better solo.

When testing header bidding partners, we have been very careful to get each partner to outline fully how its technology works and, more importantly, how it works with other exchanges. We’ve found two instances of companies over-promising about their integrations, thus saving us hours of wasted setup time. Be specific and get it in writing.

The internal process

Finally, while thorough A/B testing of vendors might be time consuming, having an internal company decision process in place can help you make a selection. Give each prospect the same set of questions, for objectivity’s sake. When Demand Media transitioned DMP’s we identified three main criteria—segmentation and optimization, mobile strategy and pro-active business products or practices—and then compared each by their merits. Having the disciplined process in place allowed us to focus on the core areas and clear the clutter from our decision.

Ad tech industry consolidation is coming, but until it thins the herd, about 2,000 ad tech companies will continue to work the market. It’s hard enough to distinguish between many of their solutions, much less to figure out which are must-haves and which are nice-to-haves. So a thoughtful analysis now can save you a lot of grief down the line.

More from Digiday

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.