Secure your place at the Digiday Publishing Summit in Vail, March 23-25

At a time when publishers like BuzzFeed and Mashable are pushing to publish directly on platforms, Condé Nast is working in the opposite direction with its 8-month-old video hub, The Scene.

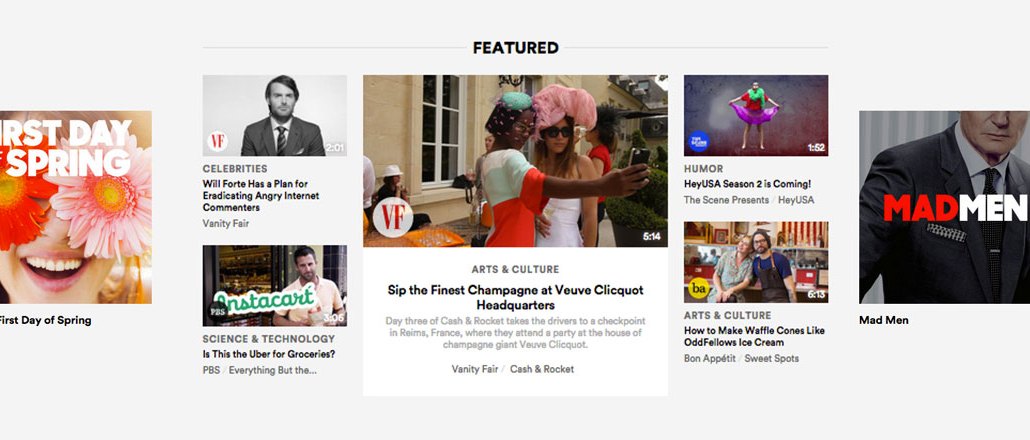

Condé Nast Entertainment, the media company’s video production arm, launched The Scene last July to create a destination for Condé’s video content. TheScene.com is home to everything produced by Condé Nast Entertainment, as well as video from eight content partners, including BuzzFeed, Forbes, AOL and The Weather Channel. The pitch: a “digital platform that attracts more affluent, upscale millennials than any other digital platform,” said Whitney Howard, svp of business development and strategy at Condé Nast Entertainment.

The strategy is unorthodox. YouTube is the dominant force in video, home to just about every video imaginable. Now Facebook is emerging as a twin force. But some publishers, particularly traditional media companies, are hesitant to rely too greatly on platforms they don’t control, preferring to build up their owned and operated properties.

The Scene’s audience has been in a free fall since October, according to comScore data. In October, The Scene attracted 11.5 million unique viewers on U.S. desktops. Following five months of consecutive drops, that desktop audience had shrunk to 2.8 million viewers by Feb. 2015. Some of that traffic is directly purchased: The Scene’s two top traffic referrers are content-recommendation engines Taboola and Outbrain, which collectively drive 35 percent of the site’s unique visits, according to Amazon-owned analytics site Alexa. Condé Nast declined to discuss the traffic decline.

“We believe in the premium video experience, and we need more dogs in the hunt, so from that perspective, we love [The Scene],” said John Tuchtenhagen, svp of media at Digitas. “Where they have some work to do is in increasing the size of the actual viewership. Most new video ventures hit the scale right away, but they don’t have advertiser relationships or premium nature of the product. Condé is the opposite.”

Condé Nast has been aggressive about marketing the site and its content. For every dollar Condé spends on original video programming, it spends another on marketing, Condé Nast Entertainment programming evp Michael Klein said on a panel last year. Still, Condé has an uphill battle on its hands to achieve the reach advertisers expect — and command premium CPMs.

“Chanel’s own video channel [on YouTube] is more popular than the Condé Nast brands,” said Fahad Khan, CEO of Tube Centrex, which builds video apps for publishers, brands and YouTubers. “So why would they pay Condé Nast a $50 CPM or more when they can buy that audience on Twitter or YouTube or Facebook for much less?”

Condé’s Howard declined to discuss specifics of the company’s monetization strategy for The Scene, but suggested the “premium viewer experience” commands premium prices from advertisers. Across its various content channels, The Scene is currently running unskippable 15- to -30-second pre-roll video ads from Toyota, Allstate, Bank of America, Goldman Sachs and Edward Jones Investments. But the luxury brands that regularly appear in the pages of Condé’s glossy magazines — Chanel, Dior, Cartier, Prada and so on — are noticeably absent.

“When it’s as easy to get big, luxury audiences on digital properties as it is in print, you’ll see those dollars flow,” said Tuchtenhagen. “Condé needs to work on being a lot bigger — by a factor of ten, probably.

“It really isn’t price [holding back luxury advertisers], because of all the advertising categories, [the luxury brands’] personal business model is pay more for better. So when they find better, they’ll pay more.”

Time Inc. has adopted a similar video strategy, bundling its publications’ video together in The Daily Cut hub. But both destinations suffer from an identity crisis: Stuffing People video next to Time video is as confusing as placing Teen Vogue next to The New Yorker, said Khan. The benefit is lumping all that traffic together to catch marketers’ attention with one large viewership figure.

“From an advertiser buyer perspective, there is nothing wrong with having the content all mashed together,” said Tuchtenhagen. “Time will tell if users like that or not.”

In addition to The Scene, Condé Nast has a major presence on YouTube, even hiring YouTube stars to create video content for its magazine brands on the platform. Condé Nast Entertainment also has syndication deals with AOL, MSN, Samsung Milk and others, according to Howard. But The Scene remains a core focus for Condé Nast Entertainment, which intends to squeeze high ad rates out of the property by offering only high-quality content and custom ad experiences, such as interactive video ads. On Wednesday, Condé Nast announced a partnership with Rapt Media, which will enable Condé to add clickable elements to its editorial and advertising content.

Condé Nast has built “The Scene” apps for Apple TV, Roku and Xbox. Viewership in the living room is “as critical as having our content on a mobile device or on a desktop,” said Howard. But Condé Nast has yet to offer The Scene apps on iOS or Android, relying on the mobile Web to service the smartphone and tablet crowd.

“Millennials are mostly consuming on video devices, so for any media company not to have a mobile-first strategy is problematic,” said Peter Csathy, CEO of Manatt Digital Media, a venture capital and media advisory firm.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.