Last chance to save on Digiday Publishing Summit passes is February 9

Yahoo’s upcoming live stream of a regular-season NFL game may not be a big deal for the future distribution of live sports, but it is a big deal for Yahoo and the NFL.

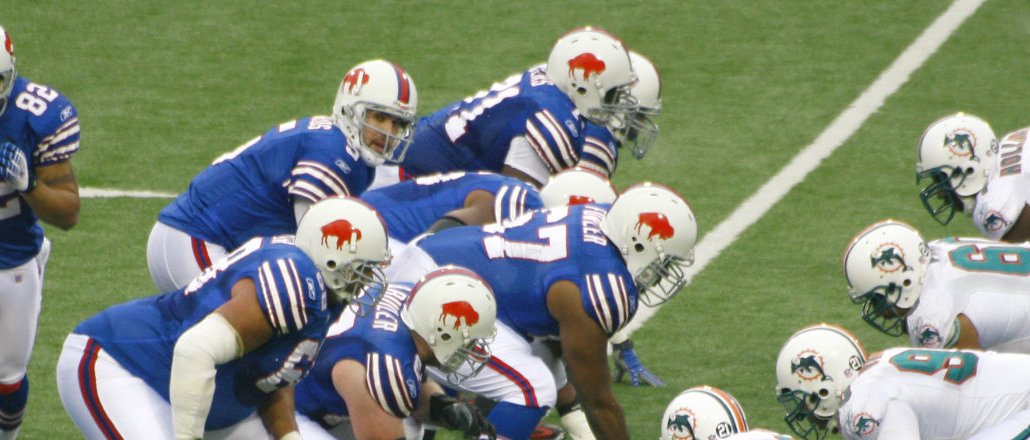

This Sunday, Yahoo will air a low-profile tilt in London between the Jacksonville Jaguars and Buffalo Bills, with the stream beginning at 9:30 a.m. on the U.S. East Coast. The international game is reportedly a $17 million investment for Yahoo, according to Bloomberg, with distribution across its homepage, Yahoo Sports, Tumblr and Yahoo Screen. CEO Marissa Mayer clearly hopes it will showcase the power of Yahoo, since experts say there’s no chance Yahoo can recoup its $17 million investment through ad sales.

“A lot of people’s natural habits are going to bring them to us, whether it’s coming to Yahoo Mail to check their email or Yahoo Fantasy to set their lineups,” said Ken Fuchs, vp of publisher products at Yahoo. “We have the ability to make the game available to them regardless of their access point.”

Live video is certainly not new to Yahoo or other digital publishers like AOL, both of which have been streaming concerts and festivals for years. Like hosting the Olympics, however, there are questions about the long-term benefits of such splashy events. AOL’s early streaming effort around the 2005 Live 8 benefit concerts, which reportedly had 5 million people viewers, is a textbook example. It was hard for AOL to translate those spikes into sustainable traffic.

What makes it doubly tough for Yahoo is that its video business is struggling. Its Katie Couric deal, for which the journalist gets paid $10 million per year, is still a work in progress. And during its third-quarter earnings call, Yahoo said it lost $42 million on “Community” and its two other original, TV-sized series “Other Space” and “Sin City Saints.”

Yahoo said it has sold out all of its inventory for the game, which will feature 32 advertisers including big names such as Toyota (halftime show sponsor), Dairy Queen (pregame show sponsor) and American Express. But even here, Yahoo reportedly had trouble. According to Reuters, the company had to slash its asking price for the game by half — from $200,000 to less than $100,000 per advertiser — in order to sell-out all of the inventory. To compare, the price for 30-second spots on the Sunday NBC, CBS and Fox broadcasts are easily north of $600,000. (That said, Yahoo had less ad time to play with than the broadcast networks as the NFL is using this game to also test shorter telecasts, according to The New York Times.)

“It’s kind of a novelty, not a must-watch game,” said Bernard Gershon, president of GershonMedia. “I give props to everybody for trying, but I think the issue is should Yahoo be in a position at the moment to throw money away while its core business falls off a cliff?”

Yahoo is clearly interested in live programming. It has a partnership with concert producer Live Nation to stream concerts, which Yahoo said generated more than 135 million streams in its first year.

“[This game] is something we have been building toward for a long time,” said Fuchs. “We look at this as if we can execute on an NFL game at the scale that it’s going to occur, it will open the door for us to do more in this space.”

Image via Olga Bogatyrenko / Shutterstock.com

More in Media

Brands invest in creators for reach as celebs fill the Big Game spots

The Super Bowl is no longer just about day-of posts or prime-time commercials, but the expanding creator ecosystem surrounding it.

WTF is the IAB’s AI Accountability for Publishers Act (and what happens next)?

The IAB introduced a draft bill to make AI companies pay for scraping publishers’ content. Here’s how it’ll differ from copyright law, and what comes next.

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

Q4 gave publishers a win — but as ad dollars return, AI-driven discovery shifts mean growth in 2026 will hinge on relevance, not reach.