Secure your place at the Digiday Publishing Summit in Vail, March 23-25

A picture may say a thousand words, but apparently a Vine can be worth $40,000.

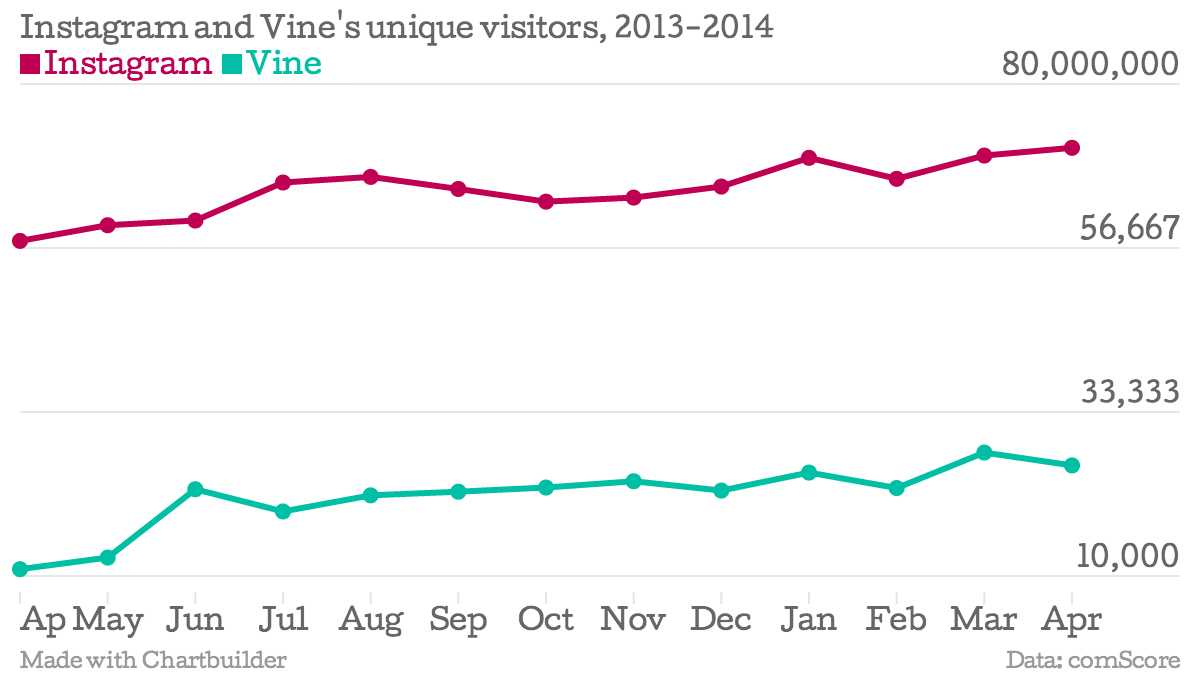

Both Vine, Twitter’s six-second video platform, and Facebook’s Instagram are growing fast. Vine boasts more than 25 million U.S. users, according to ComScore, and Instagram over three times that. Like YouTube before it, the platforms now boast their share of micro-celebrities, who have amassed tens of thousands of followers to their budding micro-media empires.

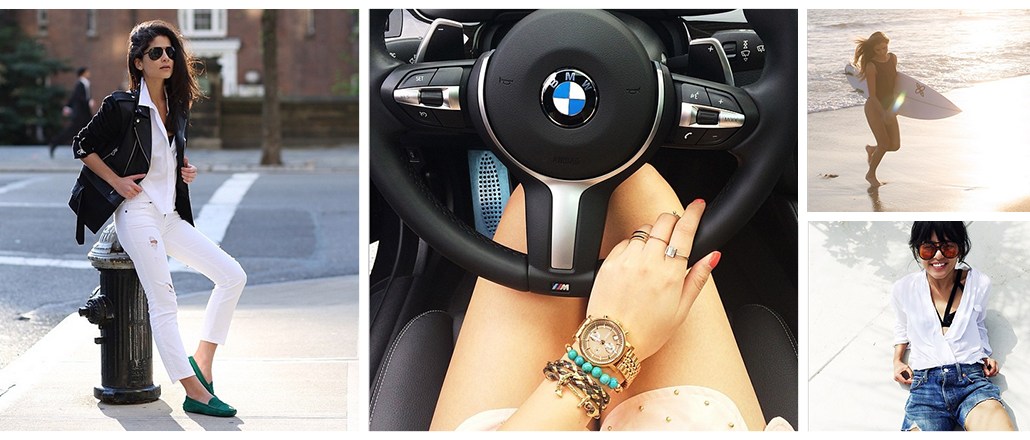

Enter the brands. InstaBrand CEO Eric Dahan facilitates deals between fashion and retail brands such as American Apparel, Levi’s and Unilever, and a network of approximately 1,500 Vine and Instagram influencers. On Vine, brands are willing to pay influencers as little $500 or up to $40,000 if they have several million followers, Dahan said. Top Instagrammers — like surfer Anastasia Ashley, who posted the below photo on behalf of high-end fashion brand Ferragamo — themselves typically receive up to $10,000 for an image.

InstaBrand, which takes 10 percent of each transaction and is currently making several hundreds of thousands of dollars a month, has also been able to convince app publishers to tap into its talent pool. App downloads drive the mobile advertising industry, partially because they deliver easily measured results. But posting about them on Vine or Instagram allows no such conversion.

Still, the app UberFacts has been willing to try it with popular Viner Jessica Lesaca, who has more than 250,000 followers.

But the influential Viner may not have been much help: the app has slipped from No. 7 in the iTunes App Store on April 25, the day the below Vine ran, to No. 571 as of this Monday, according to app analytics firm App Annie.

Nonetheless, Vine influencers tend to command higher prices from brands than their Instagram counterparts despite having only a third of the audience — Instagram had nearly 71 million unique visitors in April to Vine’s 25.7 million. Dahan attributed this to Vine being inherently more viral than Instagram. Vine’s “revine” capability allows for more organic reach, while Instagram has no such feature.

“Vine prices are a lot higher on a per activation basis,” he said. “There’s a creative aspect to it, and it can go viral if it’s good.”

That can make it hard out there for a social media star. Christine Hsu, who has more than 170,000 followers on Instagram as @kkarmalove, receives only $75 per branded image through her contract with InstaBrand, she told Digiday. She has posted photos on behalf of watch brand Fossil and Unilever’s Q-tips, but the number of requests slowed after the holiday season, she said.

Still, agencies see potential in pairing these platform-specific celebrities with their clients. Social agency Laundry Service has created an entire division, Cycle, devoted to identifying Instagram’s biggest stars. Fittingly, the division is being run by Laundry Service executive director Liz Eswein, the woman behind @newyorkcity on Instagram (1.2 million followers).

Cycle, which oversees a network of 1,000 Instagram users, recently launched an activation in Shanghai for Michael Kors, and it represents popular Instagrammers Swopes (213,000 followers) and Kyle Kuiper (775,000 followers), Laundry Service president Jason Stein said. Kuiper has done work for Disney and Swopes for tequila brand Casamigos.

According to Stein, being an Instagram star can actually be quite lucrative and on par with what a platform itself may receive from a brand.

“Kuiper averages 13,000 engagements per post, and he’s also creating the content,” Stein said. “That ain’t cheap.”

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.