Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Why Overtime is banking on third-party metrics to grow its roster of advertisers

Overtime, a digital sports brand was born on social media in 2016, and set its sights on growing online video to achieve scale. Execs at the media brand for Gen Z and millennials identified from its beginnings that social media was the platform to find younger audiences and they focused on social posts and platform distribution.

The brand now boasts an audience of 35 million unique monthly viewers.

As the Gen Z and millennial cohort of 18- to 34-year-old internet users continues to grow, the reach that social video can get has started exceeding linear TV, according to Tubular Lab’s research study with The Global Video Measurement Alliance.

“When you start to do the research into it, online social video, which people are still trying to understand, it’s as large of a platform as any other major media,” said Stephen DiMarco, chief strategy officer at Tubular Labs. The only category where linear TV is still king is in sports, he said, due mainly to live game broadcasts.

But to try and win more media dollars away from television, Overtime and other publishers have to prove to marketers who are going after a younger audience that they have successfully captured those audiences on YouTube and Facebook. And with the number of publishers all vying to do just that, it will take a lot more than internal metrics to close a sale, especially when working with new partners, said Overtime’s CRO Rich Calacci.

Some media buyers, however, are at odds with needing to trust and verify a secondary partner in addition to the publisher, though they see the benefit of having another perspective on what audiences are interested in on the internet.

During a recent campaign that Yuting Zhang, the digital engineering director at Media Kitchen, was working on, she said her ad tech partners wanted to use third-party data to “reverse engineer” what the target audience might be more likely to watch, listen to, or read so they could place ads directly on that content.

“Having some general insights into what a broad audience’s behavior is would be beneficial for a new campaign. [But] after a campaign is live for a while, I would want to heavy up the use on [first-party] data and eventually fade out the use of [third-party] data,” Zhang said.

The following conversation has been lightly edited and condensed for clarity.

Why do you feel third-party measurement and verification of your distributed video views is important as a publisher from a revenue standpoint?

Rich Calacci: If you think about the business we’re in, which is the business of sports, all of that is made better when there [are] officials on the court creating third-party validation of what was a foul and what was not a foul. The same is true in the media business. If you succumb to the temptation of grading your own homework, as that has happened in the past, and you don’t offer third-party validation to your brand, you miss a huge growth opportunity. In the end, marketers are quantitatively based. Qualitative factors certainly play a role, but they’re quantitatively based. And they need to see the data that says this dollar is going to get this audience. You need third-party validation to be able to attract and retain new brands.

Beyond the actual scale of views, do you work with Tubular to get into the nitty gritty of who this audience is, and if so, what are you looking for from that data about how they spend time with your brand online? What do your brand partners really want to know from this data?

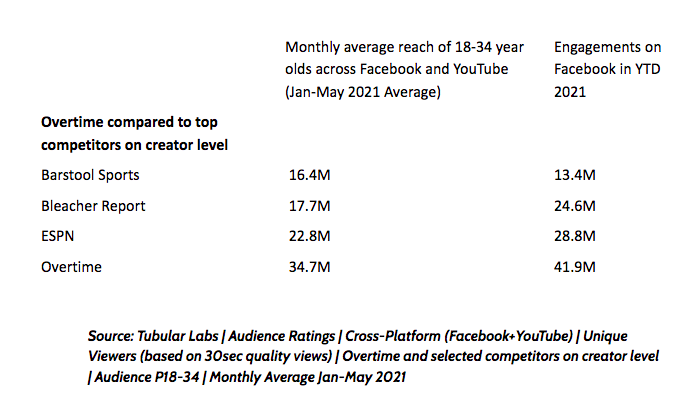

Calacci: The reach story is part of it, which is really important in the planning process, but the engagement story is equally important because we want to be able to index our performance, by video view, relative to our competitive set. Being able to do those two things simultaneously becomes really compelling for brands, as money is flowing from television into social video and you cannot reach 18- of 34-year-olds outside of the world of sports on television.

If somebody is trying to reach adults 50-plus, Overtime is probably not the best utilization of your marketing dollars. But at the same time, if you’re buying television trying to reach an 18- to 34-year-old audience, you’re making the same mistake.

So how does Tubular Labs actually get these insights from viewers on Facebook and YouTube? Is there any individual level tracking or do you use first-party data from the platforms to get access to user profiles?

Stephen DiMarco: There’s no personal information. There’s no [third-party] cookies. It’s all direct data integrations, privacy compliant with GDPR and CCPA. We don’t interact with Overtime’s first-party data.

Everything [comes from] a hybrid methodology. We have a permission-based panel of consumers that we can see their demographics and if we don’t have a complete [picture], we can attribute demographics. And then we augment that with a lot of the information that we get from the platforms, some of that is from the platform, the platform’s the metadata that they add into the video, themselves, like the title of the video, or the format of the video. And some of that is actually from the users themselves. It attributes the person watching the video with the content of the video and it makes the connection. So you can say “yes, this is a woman 18 to 34 who’s watching a video about the WNBA.”

[To date], we probably ingest upwards of at least 5 billion videos across every content category. We’ve got 1,500 categories that map to 24 genres, one of those, of course, would be sports. And within that we’re processing videos every day, creating a taxonomy that allows companies like Overtime to very quickly identify trending sports content that could be appealing to one demographic or one geographic. Overtime can then decide, “Do we want to create some content?” Or, “Do we want to partner with an influencer here?”

What are some examples of how Overtime was able to use this data to close deals with brands?

Calacci: Whether it’s our show “League Ready,” which was sponsored by State Farm, or “Drafthouse,” sponsored by Rocket Mortgage, in both those cases, with third-party validation coming from Tubular, we’re able to show a higher engagement rate versus our competitive set for those two series, which is really important because we’re a video lead business. Tubular is exclusively a video-led data set and being able to figure out what the sweet spots are for telling that story is really important. We’re able to show the clients — not necessarily in real-time but very expeditiously — that their relationship with Overtime and their relationship with that content yielded a higher level of engagement as evidenced by the data that Tubular provides.

How does this information help with non-endemic brands who aren’t in the sports space, or might not be directly interested in a sports audience? Basically, how are you appealing to new brands to keep adding to your roster of clients?

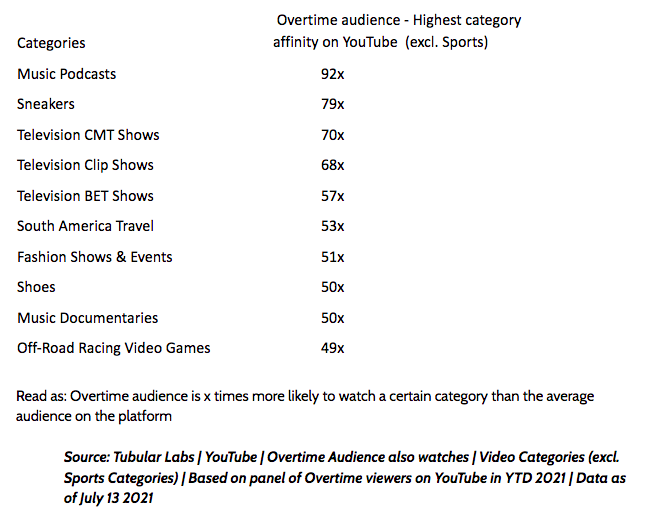

DiMarco: We have an “audience also watches” metric [that monitors] if you watch this type of content, you’ll also watch this type of content. It’s exactly that information that Rich’s team would then take to those categories. So you know, people who watch online social video content on overtime sports, also consume a lot of DIY Home Improvement content as an example, so that tees up a perfect opportunity for Rich and the team to go talk to Home Depot and Lowe’s and Benjamin Moore. It opens up categories upon categories because people don’t watch just one type of content. People watch all types of content, you just need to figure out what is the content graph for the rest of your audience’s viewer habits.

Calacci: If you talk about Overtime, generally, we’ve never been in the NASCAR business. That’s not really who we are, it’s not what our community is coming to Overtime to see. But in the last few months, we’ve done a whole content series about a young college sophomore from The University of Georgia, Hayden Swank, who’s trying to break into NASCAR. And the whole series is sponsored by Old Spice. To Stephen’s point, you have to show the community something different than just what they’ve come to you for. And some of the insights we’re able to derive around why they want that variety and how that sustains their viewership is then reinforced when we see longer watch times against these different types of content series.

It’s a combination of variety and creativity, as well as content quality, and you bring all those things back to your community, and are rewarded with larger audiences. Every single month for the past year, we’ve probably added a million-plus followers.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.