Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Reality check: Distributed media strategies won’t work if they can’t be measured

The rush of publishers to embrace distributing media across platforms rather than relying mostly on people coming to their owned properties rests on a basic assumption: The business model will follow.

But that’s easier said than done. As the travails of BuzzFeed and Mashable have shown, excelling at audience development on platforms does not necessarily (and immediately) mean the ad revenue comes with it. One of the big, thorny issues that’s holding up the migration of ads is the simple fact that it’s hard to measure publishers across platforms. BuzzFeed claims to reach 400 million people across platforms; good luck getting Nielsen or any unbiased third party to validate that.

It’s fair to say that after years of buying based on a Web-based measurement, agencies have their work cut out for them, with data, measurement methods and audience experience on multiple new platforms. “It’s a complicated issue for agencies, to merge the ways we assign to value to audiences and content,” said Bruce Kiernan, head of performance marketing at MEC. Here are some of their biggest challenges:

Mo’ data, mo’ problems

Overall, agencies just have more audience data to decipher, and they can’t ignore an emerging platform like Snapchat because there’s no common metric for all of them. Not to mention publishers pitching newfangled metrics like “time spent” and “engagement” scores.

“We’ve got to sift through them and look for, what problem are we trying to solve, and what we’re selling how does it dovetail with what we’re trying to do,” said Tom Talbert, head of media at Campbell Ewald. “We have to ask more questions.” The buyers’ impression that the sellers are short-staffed and don’t get what marketers want doesn’t help.

Video:

Video has its own complications. Each platform has a different way of measuring how long a video has to be viewed before it counts as a view that the advertiser is charged for. Whether autoplay ads are as valuable as those a viewer opted to watch is another question.

Publishers are motivated to count a view as soon as possible; naturally, agencies don’t always agree. But Ben Winkler, chief investment officer at OMD, said that increasingly, publishers are bending to agencies and talking about their completed views rather than charging for views lasting two or four seconds. “Clients want people to consume as much of their content as possible and see it to the end,” Winkler said.

Viewability:

Another challenge is figuring out how to apply timeworn TV measurement practices to digital video, where it’s hard to prove if the ad was seen, said Kiernan of MEC, whose parent GroupM has demanded that its ads exceed the industry standard for viewability. Viewability makes it hard to put a value on mobile audiences, too. Youth-aimed advertisers like mobile’s ability to reach young consumers, but the small screen size and fast-scrolling behavior means it might not be the ideal place to get your ad seen.

Platforms:

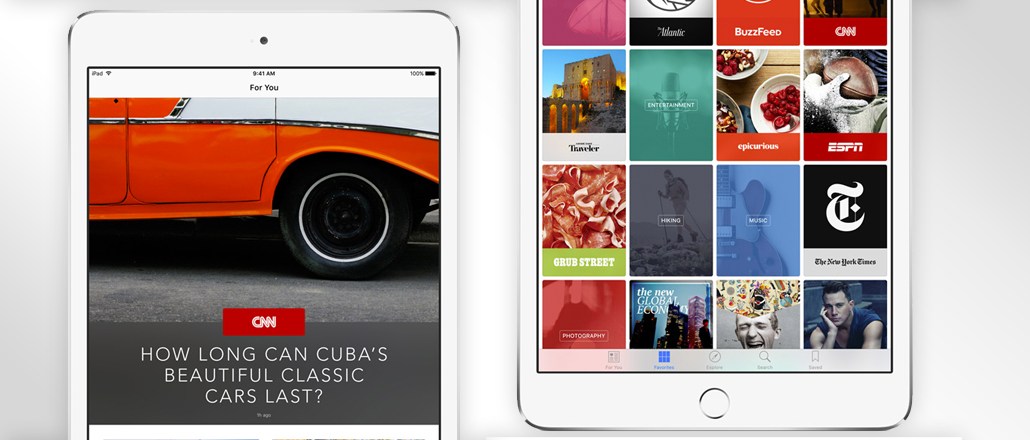

Figuring out how to value a reader depending on where they are is another issue. Publishers that are getting more of their content seen on social platforms versus their own sites naturally would argue that their content is just as valuable to an advertiser, regardless of where it’s being seen. For advertisers trying to reach an audience at scale, that may be true, but for a premium brand trying to reach a specific audience, a publisher’s direct audience is more valuable, though.

The type of ad matters, too. If the ad is good branded content, it doesn’t matter where the ad runs; good content is good content. For a 15-second preroll that wants to be in the best environment, though, the location matters, Winkler said.

Data gaps:

Buyers also share the publisher frustration that the platforms such as Facebook, with its fast-loading mobile Instant Articles, is that they’re stingy about giving them data on who’s reading their articles on those platforms, how much they’re sharing it and what else they’re doing there. “Facebook is a pretty tight walled garden, and publishers are operating in these same walled gardens,” Kiernan said.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.