Secure your place at the Digiday Publishing Summit in Vail, March 23-25

People Inc. strikes Microsoft AI licensing deal as Google’s AI Overviews hit programmatic ad revenue

People Inc. has struck an AI licensing deal with Microsoft to be part of the tech giant’s pay-per-usage AI content marketplace.

The news was revealed to shareholders by People Inc. CEO Neil Vogel during parent company IAC’s 2025 third-quarter earnings call on Nov. 4.

Vogel described the Microsoft marketplace as an “a la carte” pay-per-use model, in contrast to the “all you can eat” lump sum deal it has with AI rival OpenAI. “We are very happy with either model — both can be viable as long as our content is respected and paid for,” said Vogel.

“Microsoft has committed to paying for content to support its AI efforts,” he said. “It’s a very strong endorsement of us to be in the room with them, and a very strong endorsement of the publishing marketplace and the value of content to make AI that is of high value.”

Microsoft is working with a select group of major publishers to plug into its two-sided content marketplace, created to compensate publishers for their use of content by AI companies and products. Microsoft’s Copilot assistant will be the first buyer. Gannett revealed it is also a Microsoft AI marketplace partner during its earnings calls last week.

Jon Roberts, chief innovation officer, People Inc. said it’s very early on in the partnership and is looking forward to helping Microsoft build its publisher content marketplace “from the ground floor”. He said this marks an important step in companies like Microsoft establishing fair compensation for publishers’ quality IP. “This is a critical step forward in creating and maintaining a vibrant ecosystem for publishers in the AI era,” he said in an email statement.

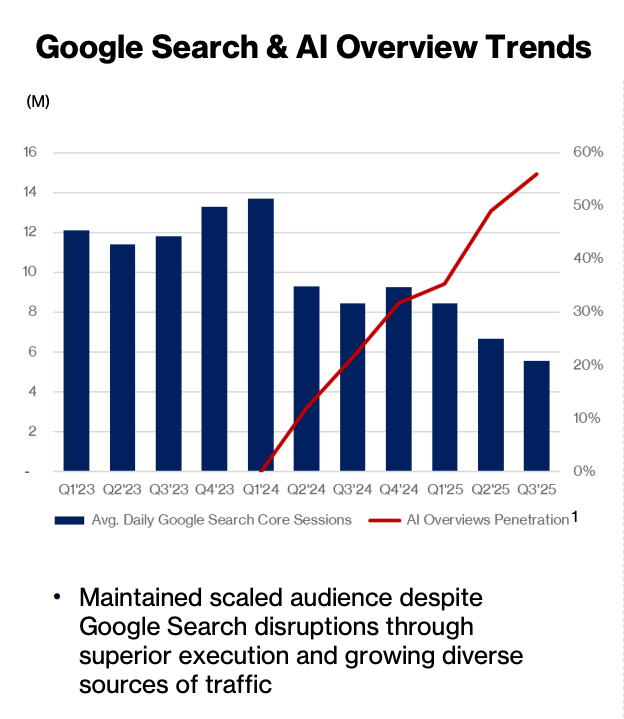

Maintained scaled audience despite Google AI Overviews’ impact

Digital revenue climbed 9 percent to $269 million, driven by performance marketing (38% growth) and licensing (24% growth) — partly attributed to improved performance from Apple News+ and other content syndication partners like YouTube. That marks its eighth consecutive quarter for digital revenue growth, per Vogel.

Advertising revenue dipped 3 percent to $161 million in the third quarter, down from $166 million the previous year. Vogel said this dip was “volume not rate-related.”

The erosion of referral traffic as a direct result of Google AI overviews has continued. Currently, a total 24 percent of traffic comes via Google search, down from 60 percent of its traffic at the time it announced its merger in 2021, while AI Overviews’ penetration has steadily increased.

Vogel stressed that the company has been well prepared for the erosion caused by Google AI Overviews for some time and that, due to the popularity of its household brands and its audience diversification strategy, it now reaches half of the U.S. population each month with its combined assets.

“The good news is we’ve maintained our scaled audiences despite this [Google AI Overviews penetration], because we were prepared for it,” said Vogel. “We were very early to recognize changes in Google, and were very early to recognize AI, and that is why every other meaningful source of traffic has increased for us over the past two years. We expect the Google Search challenges will continue, but believe our strategy and investments are going to enable us to maintain our overall growth.”

Premium advertising primarily in the travel, technology and finance categories as well as increasing contribution from D/Cipher+, which is its answer to monetizing the unaddressable portions of the open web, helped counter the impressions drop.

A dip in programmatic advertising revenue was attributed to revenue lost from lower impression volumes, which it said was largely due to Google AI Overviews affecting referrals. There was a 6 percent decline in core sessions, due primarily to the increasing prominence of Google AI Overviews on Google searches.

Barry Diller, chairman and senior executive of IAC was bullish on the media group’s strategy that is diversified enough to withstand and even thrive during the AI information era. “We’re not going to be on the back foot like almost every other publisher seems to be these days,” he said.

IAC invested in MGM Resorts International in August 2020, acquiring a 12 percent stake for approximately $1 billion. “MGM is a giant hedge against disintermediation,” said Diller. “AI will affect everything other than live entertainment and travel experiences as there is no simulation that’s going to get between MGM and its worldwide customers. These assets can never be disintermediated. Las Vegas can never be disintermediated.”

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.