Last chance to save on Digiday Publishing Summit passes is February 9

Mediabank, fashioning itself as a leading candidate to be the anti-Google, has added another piece to its emerging media agency operating system with a demand-side platform offering that will let agencies develop their own trading desks.

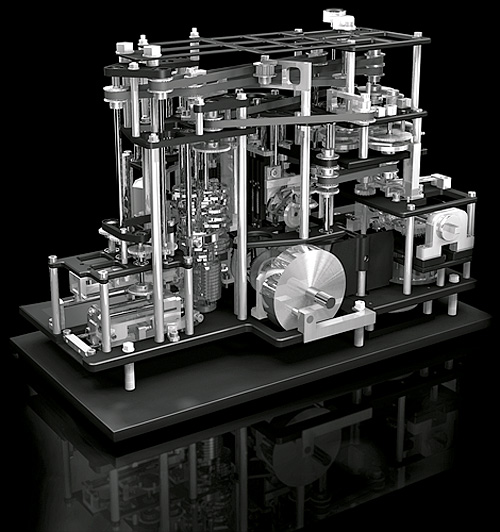

“This is really a technology stack,” said John Bauschard, president of marketplaces at Mediabank. “The algorithm should be owned by the agency. It shouldn’t be a vendor type relationship.”

The key there is “owned by the agency.” Mediabank is providing the DSP infrastructure as a white-label tech, meaning agencies can customize it and in many ways make it their own. In the early days of programmatic buying, many DSPs have gone beyond their remit as tech providers and instead become outsourced agency services. That’s not a long-term solution for agencies as electronic buying of ad inventory becomes the norm, according to Tim Ogilvie, svp of product and the founder of AdBuyer. Many DSP act quite a bit like ad networks, after all, taking orders from agencies and executing buys on their behalf.

“It’s a giant opportunity [for agencies] from a cost and margin-creation standpoint,” he said. “They invest more in learning how to do this internally. They want to be a trader.”

Agencies large and small use Mediabank, but it is likely small to mid-sized and regional shops that will use this product, Mediabank execs said. They would not name agencies using the DSP now, but they said those owned by the major holding companies, which have all built their own trading desks, are not among them.

More in Media

Brands invest in creators for reach as celebs fill the Big Game spots

The Super Bowl is no longer just about day-of posts or prime-time commercials, but the expanding creator ecosystem surrounding it.

WTF is the IAB’s AI Accountability for Publishers Act (and what happens next)?

The IAB introduced a draft bill to make AI companies pay for scraping publishers’ content. Here’s how it’ll differ from copyright law, and what comes next.

Media Briefing: A solid Q4 gives publishers breathing room as they build revenue beyond search

Q4 gave publishers a win — but as ad dollars return, AI-driven discovery shifts mean growth in 2026 will hinge on relevance, not reach.