Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Media Briefing: Ad spend rebounds in Q2, but publishers brace for a murky second half

This Media Briefing covers the latest in media trends for Digiday+ members and is distributed over email every Thursday at 10 a.m. ET. More from the series →

This week’s Media Briefing looks at advertising spend going to publishers, and which categories are faring well and not so well.

- Q2 ad revenue is pacing well, but publishers are dealing with some delays and jitters from advertisers.

- Politico’s newsroom in legal fight with management over AI use, Washington Post tech workers unionize, and more.

Market check

With President Donald Trump’s tariffs looming, publishers are dealing with some jitters from their advertisers. Fortunately, that hasn’t resulted in a bad second quarter for publishers. But it’s making planning for the rest of the year more difficult.

Publishing execs are seeing a delay in planning, with advertisers signing deals much closer to campaign launches. That means publishers have to be able to move fast — working with teams that can handle tight timelines and shortening production processes, in some cases by half.

Meanwhile, others are finding that advertisers are more hesitant to unlock spending that had been set for a certain quarter, delaying by three to four months in some cases. So although they’re not yanking spend, their hesitancy is messing with some publishers’ revenue targets for the second half.

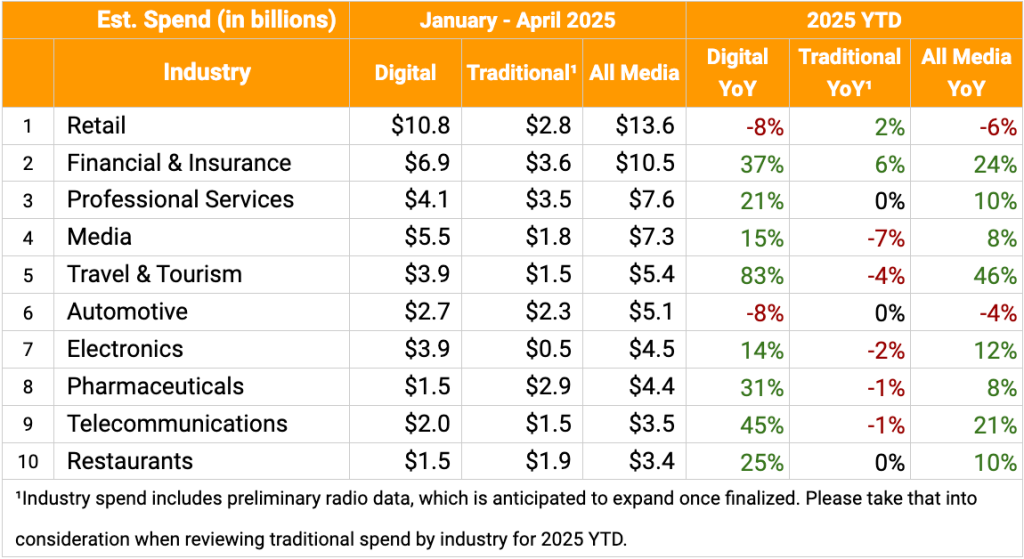

But the first half of 2025, hasn’t been too badly affected. A year ago, advertising categories like retail, pharma and travel were spending less with digital publishers than they were the previous year. But in the first half of this year, most of those categories are up year over year.

According to MediaRadar data shared with Digiday, retail is down 8% year over year, however. Auto — a strong growth category in the first half of 2024 — is down 8% year over year in 2025. One publisher CEO Digiday spoke to on condition of anonymity, said that auto manufacturers have been “particularly spooked” and halted spending.

Advertising spend from January through April 2025 was $90.7 billion, a 6% year-over-year increase from the same period in 2024, according to data from MediaRadar. Digital media, ranging from display to paid search ads, captured 64% of the ad investment, after a 11% year-over-year increase.

Publishers report growth in Q2

Despite a slow start to the year, Q2 is pacing well, according to six publishing execs.

Digital advertising revenues were mostly flat year-over-year in Q1 2025 for public digital media companies like BuzzFeed, Dotdash Meredith, Gannett and News Corp’s Dow Jones business, which includes The Wall Street Journal. The New York Times’ digital advertising business was an anomaly, growing 12% year-over-year in the quarter. (Times CEO Meredith Kopit Levien chalked that up to the news org’s “diverse” content offerings, new ad supply and large audience.)

Advertising revenue at Gallery Media Group is up about 10% year-to-date, according to CRO Chris Anthony. The average deal size at GMG increased by around 30% from this time last year.

Advertising revenues are up “double digits” compared to this time last year, according to Axios CRO Jacquelyn L. Cameron.

Direct sales is pacing to be up 60% year over year at Apartment Therapy, according to president Riva Syrop. Programmatic direct is also up, about 40% year over year, she said.

“Open market programmatic at this point is flat but we are seeing a significant RPM increase which we’ll take as an indicator that demand is holding up well,” she said. “We’re pacing to have our biggest Q2 ever, with an overall revenue increase of 26% year-over-year.”

Direct sold advertising at Slate is up in Q2 year over year, according to CRO Charlie Kammerer.

Categories that are up — and down

Publishing execs said they were seeing increases in ad spend in categories like retail, finance, telecom, beauty, CPG, tech and luxury.

Two publishing execs said they were seeing a softness in ad spend in auto.

One exec at a large digital publisher — who requested to speak anonymously — said ad spend from the music category was down, due to tariffs impacting pricing on musical instruments coming from China.

According to Syrop, ad spend in the travel category was down due to audiences “spending less on discretionary items and experiences while spending more on home goods [and] food.”

Seeing ‘delays’ in the second half

While Q3 is looking pretty good for publishers, execs are noticing some hesitancy among marketers later in the year.

The third quarter is pacing “even” said the digital publishing exec for the same large digital publisher, mentioned above.

“Looking ahead to the second half of the year, the picture remains fluid and more uncertain. We’re monitoring tariff developments closely, and clients are echoing that uncertainty. In response, we’re remaining nimble and responsive to clients. We also have a diversified business, and are also focusing on revenue streams like membership, which we have more direct control over,” Kammerer said.

Apartment Therapy has seen a “huge increase” in RFP volume for Q3 in the last few weeks, and bookings are pacing 18% ahead of Q3 last year at this time, Syrop said. The fourth quarter, on the other hand, “feels delayed,” she said. Syrop is seeing brands planning much closer to campaign launch.

“Many companies, brands — they’re waiting to see how the next few months play out, how consumers are reacting to the economy and any fears they have around the impact of tariffs and the policies of the new administration,” Syrop said. “I wouldn’t be surprised to see a lot of Q4 planning happen late Q2, early Q3 when everyone has a better handle on what’s to come.”

Anthony said GMG already has some deals in place for 2026, because brands are planning ahead or thinking next year will be “more stable.”

“It’s so hard to predict our business now,” he added.

How publishers are dealing with uncertainty this year

“Efficiency” was a word publishing execs kept repeating. That means moving fast.

Publishers have figured out how to do that, thanks to the playbook they developed during the bumpy pandemic years, execs said.

For example, Gallery Media Group had a campaign deal signed off a week after Christmas last year, timed to go live during the Super Bowl — that kind of quick turnaround is made possible by prioritizing working with vendors that move fast, and having creators on call for when timelines are short, according to Anthony.

Publishers also have to provide more “ammo” to protect marketers’ budgets, Anthony said. That could mean offering more content (such as social videos), or consultancy services, he added.

Since the pandemic, Apartment Therapy has cut most of its development cycles in half. Programs that typically took 12 weeks to execute can now happen in six, Syrop said. Processes that would get done step-by-step now happen in parallel — instead of waiting for a video to get shot and edited before a sponsored article came out about it, writers are given previews and stills to pen the article while the video is being edited, for example.

“Most clients these days don’t want laborious 12-week timelines with dozens of assets to review with multiple rounds. People just don’t have the time,” Syrop said. “I suspect the strong deal volume will continue, we’re all just going to have to be ready to move much, much faster to execute excellent campaigns quickly.”

What we’ve heard

“When you’re running ads against something, you really need to stop saying you don’t make money off it.”

– Danielle Coffey, president and CEO of the News/Media Alliance, on Google testing ads in AI Mode despite Google saying previous tests showed removing news content had no impact on its ad revenue.

Numbers to know

£500 million: The valuation of The Telegraph after its purchase by U.S. private investment firm Redbird Capital Partners.

1.3 million: The number of recurring paying digital members to the Guardian.

July 31: The deadline for Washington Post staffers to decide if they will take voluntary buyouts.

200,000 square feet: The size of the office space Condé Nast is in talks to sublease to Bank of New York Mellon Corp., four floors at 1 World Trade Center.

What we’ve covered

How publishers are navigating the latest Google core update

- Google’s March core update has brought manageable search traffic dips for some publishers.

- AI Overviews dragging down Search for publishers, and Discover is picking up some slack.

Read more here.

Google is adapting its traditional search ads for AI Mode and AI Overviews

- Last week’s roll-out of AI Mode in the U.S. means Google has to change how it incorporates ads into search results.

- Dan Taylor, vp of global ads at Google, shared with Digiday how those ads will be priced and integrated into these new generative AI search features.

Listen to the latest Digiday Podcast episode here.

ChatGPT referral traffic to publishers’ sites has nearly doubled this year

- ChatGPT is sending more of its traffic to publishers’ sites. Of the traffic OpenAI’s generative AI platforms send to external websites, 83% went to news and media sites in April, up from 64% in January, according to Similarweb data.

- Some of the sites that saw the biggest increase change in their share of referral traffic from ChatGPT in April 2025 included The BBC, Fox News and The Independent.

Read more here.

WTF is clipping?

- The low-lift creator strategy of sharing short clips from longer content is grabbing advertisers’ attention.

- Brands and advertisers are starting to pour more marketing dollars into clipping.

Read more here.

Generative AI content farms are stealing publishers’ ads.txt files to hijack ad revenue

- DoubleVerify has been tracking the activity since January, and found “AI slop sites and networks are using generative AI to mass-produce content and spoof ads.txt files.

- It’s siphoning revenue from legitimate publishers, and fueling the next wave of ad tech fraud.

Read more here.

What we’re reading

How TheSkimm grew its politics audience

TheSkimm founders Danielle Weisberg and Carly Zakin discuss how they’ve evolved their newsletter business (with 5 million active subscribers) to cover politics for women on both sides of the aisle, Vanity Fair reported.

Politico’s newsroom takes on management in legal fight over AI use

Politico’s union members claim recent AI initiatives at Politico violate their contract, and are taking the dispute to arbitration this July, Wired reported.

Washington Post tech workers unionize

The Washington Post’s tech workers have voted to unionize under the NewsGuild, marking the first successful organizing effort at the publication under Jeff Bezos’ ownership, per MediaPost.

Mozilla sunsets its Pocket app

Mozilla is closing down its read-it-later app Pocket, due to changing browsing habits, according to Nieman Lab.

Food52 co-founder Amanda Hesser is stepping down amid the food site’s business struggles to focus on Homeward, her Substack newsletter, Adweek reported.

More in Media

From feeds to streets: How mega influencer Haley Baylee is diversifying beyond platform algorithms

Kalil is partnering with LinkNYC to take her social media content into the real world and the streets of NYC.

‘A brand trip’: How the creator economy showed up at this year’s Super Bowl

Super Bowl 2026 had more on-the-ground brand activations and creator participation than ever, showcasing how it’s become a massive IRL moment for the creator economy.

Media Briefing: Turning scraped content into paid assets — Amazon and Microsoft build AI marketplaces

Amazon plans an AI content marketplace to join Microsoft’s efforts and pay publishers — but it relies on AI com stop scraping for free.