Innovation comes at a price, it turns out. The New York Times’ investment in new digital products ate into its first-quarter earnings.

The company has been busy developing new digital products to capture readers who fall on either the low or high ends of the engagement spectrum. The NYT Now free mobile app on one end and, at the other, Times Premier, a premium service aimed at diehard fans, rolled out after the end of the first quarter, and more vertical apps are on the way.

In the company’s first-quarter earnings call, it disclosed that operating costs rose 3.8 percent to $365.8 million, mainly due to expenses associated with new products. Operating profit was $22.1 million in the quarter, down from $28.1 million in the same period of 2013.

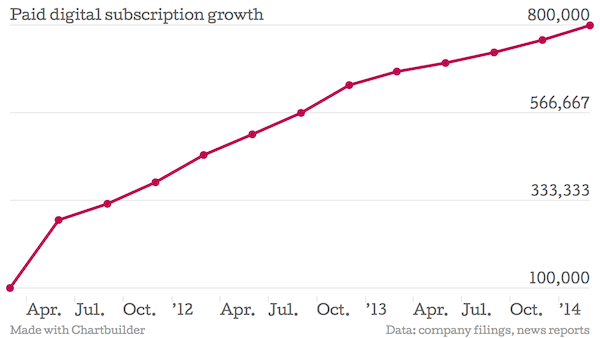

On the bright side, the Times’ print and digital revenue is up for the first time in several years. The paper also continues to add digital subscribers, contributing to a 13.6 percent increase in overall digital circulation revenue over the year-ago quarter.

More in Media

Digiday+ Research: Dow Jones, Business Insider and other publishers on AI-driven search

This report explores how publishers are navigating search as AI reshapes how people access information and how publishers monetize content.

In Graphic Detail: AI licensing deals, protection measures aren’t slowing web scraping

AI bots are increasingly mining publisher content, with new data showing publishers are losing the traffic battle even as demand grows.

In Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google’s adland dominance

Last year was a blowout ad revenue year for Google, despite challenges from several quarters.