Secure your place at the Digiday Publishing Summit in Vail, March 23-25

‘Everybody is in a similar situation’: Sports publishers try teaming up on ad deals

With no live sports on television and athletes sheltering in their homes, sports publishers are hoping that teamwork will help them keep their advertisers’ attention.

Over the past six weeks, a number of sports publishers, including CBS Sports, USA Today Sports and Minute Media, have either pitched or discussed pitching advertisers different ad programs that combine either those publishers’ audiences, media, production capabilities and content, sources said. A few sports publishers have had discussions about similar collaborations with non-endemic partners in the news and lifestyle space, though none have progressed all the way into pitches, two CROs said.

During that same period, sports publications owned by corporate conglomerates, such as Disney-owned ESPN or WarnerMedia-owned Bleacher Report, have begun pitching packages to advertisers that involve their sister brands’ audiences. WarnerMedia, for example, is pitching agencies the idea that it can target the same viewers it might have attracted with March Madness coverage on other WarnerMedia properties using Xandr, two agency sources said.

Though different combinations of these publishers have worked together in the past on programs, the discussions around possible collaborations have stepped up in recent weeks, as economic uncertainty and public health concerns have turned sports media upside down.

With no clear timeline for when major sports league seasons will resume, and advertisers grappling with major changes to consumer demand and their supply chains, there are fewer opportunities to win big, seven-figure deals from clients.

“There was a time when there were 50 of these [RFPs] coming through the door,” said Rich Routman, the chief revenue officer of Minute Media. “Now, it’s seven or eight.

“Everybody is in a very similar situation,” Routman added. “You’re just trying to find ways to capitalize on the macro state of the industry.”

Over the past six weeks, digital ad spending has fallen by almost 50%, according to the investment bank UBS, putting enormous pressure on every corner of the media world.

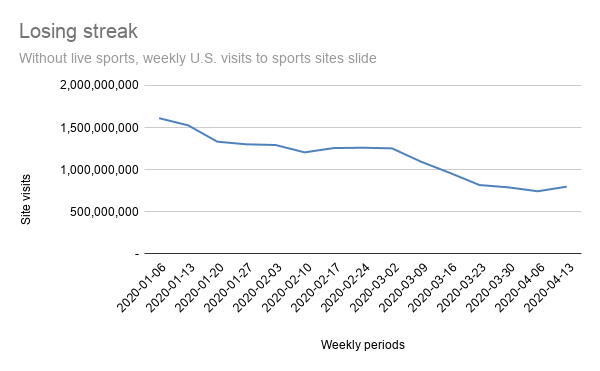

But while certain categories of media have enjoyed spikes in traffic recently, sports publishers have struggled over the past six weeks, during a time of year when their audiences normally surge, thanks to events including the NCAA men’s basketball tournament, the NFL Draft and the NBA playoffs.

In the first week of March, sports publishers’ sites attracted more than 1.2 billion visits, according to Comscore data; in the first week of April, total visits to those sites had slid 34%, to more than 790 million visits, the data showed. Through the first three weeks of April, no single week has improved on that total.

Collectively, sports sites’ total views in March 2020 were down more than 25% year over year, Comscore data showed.

Yet the lack of live games has hurt linear TV too. Broadcasters have tried everything from rebroadcasting past games to live-streams of esports, programs that some advertisers responded to coolly.

That has many sports publishers hoping to fill that gap. “Brands, advertisers, agencies, are looking to get the biggest footprint they can outside of linear right now,” a revenue leader at one sports publisher said.

In theory, teaming up offers publishers a chance to shore up some of their weaknesses. In addition to more scale, combining forces gives publishers more resources to work on branded content at a moment when publishers, agencies and production companies are all limited in what they can make.

“The production side is the bigger limiting factor for a lot of these guys,” said Jason Haddad, svp of media at the sports marketing agency Revolution World.

But collaboration can also require trade-offs. Combining audiences can mean settling for lower CPMs than an individual publisher might charge on their own. It can also slow the process down at a time when more publishers are trying to act quickly.

“You don’t want to invest your time into 90 different partnerships,” Routman said. “If it’s a huge process, it’s not going to make us win anything.”

More in Media

The case for and against publisher content marketplaces

The debate isn’t whether publishers want marketplaces. It’s whether the economics support them.

Urban Outfitters shifts its influencer strategy from reach to participation

Me@UO is Urban Outfitters’ new creator program leverage micro-creators with smaller, engaged communities that are passionate about the brand.

Media Briefing: Without transparency, publishers can’t tell if Google’s Preferred Sources feature benefits them

Six months in, Google’s Preferred Sources promises loyalty-driven visibility, but leaves publishers guessing at the traffic impact.