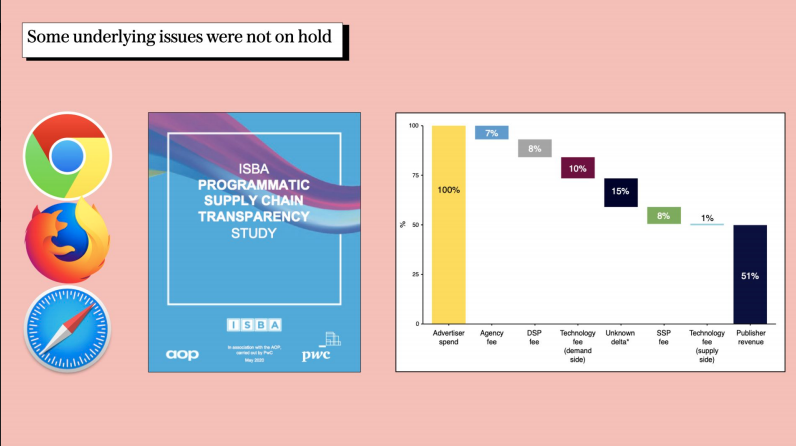

Crisis is nothing new to the media business. Even before the pandemic, the industry was dealing with declining ad revenue, Google’s cookie timebomb, and the longtail of other big existential questions about its future.

The virus, however, is a particularly dangerous kind of crisis for the industry. Despite companies becoming increasingly diversified, COVID-19 is hitting all of those businesses equally. Not only have brands scaled back their revenue, but many have also scaled back their affiliate commissions, hurting publishers’ commerce businesses. Then there’s social distancing, which has forced publishers to cancel their in-person events in favor of digital equivalents.

State of the industry

It’s, as they say, a perfect storm.

Fortunately, with that storm comes some green shoots. While COVID-19 has challenged all parts of the media business, it’s also acted as a forcing function for the industry. Many have been forced to get creative. They’re moving faster, thinking longer-term, and coming up with creative, new ways to serve client needs. The virus may be bad for the industry in the short-term, but it may make publishers far stronger and more resilient in the long run.

Digiday’s Deep Dive: European Publishing is a collection of videos, presenter slides and a guide of key takeaways produced by our editors from the Digiday Publishing Summit Europe Live that provides valuable tips and key insights so you’re prepared for what’s to come in publishing.

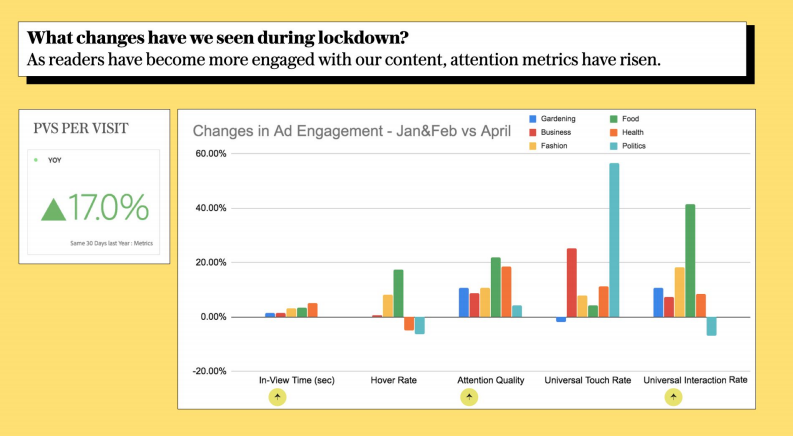

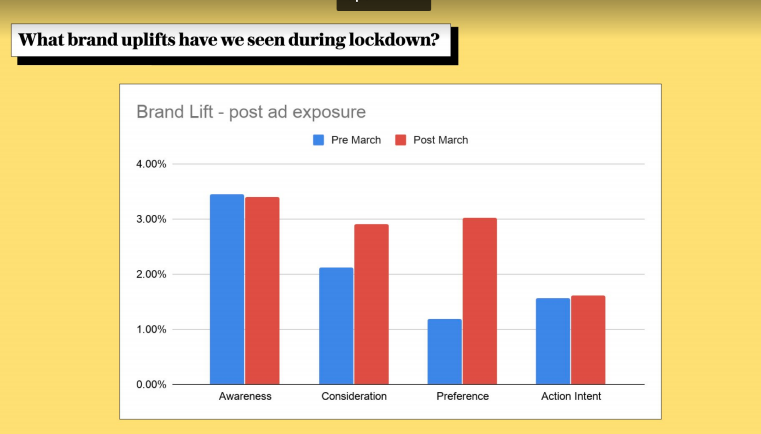

The last few months have been marked by contrasts. With the world in lockdown, publishers are seeing more interest from readers, but more mixed interest from advertisers.

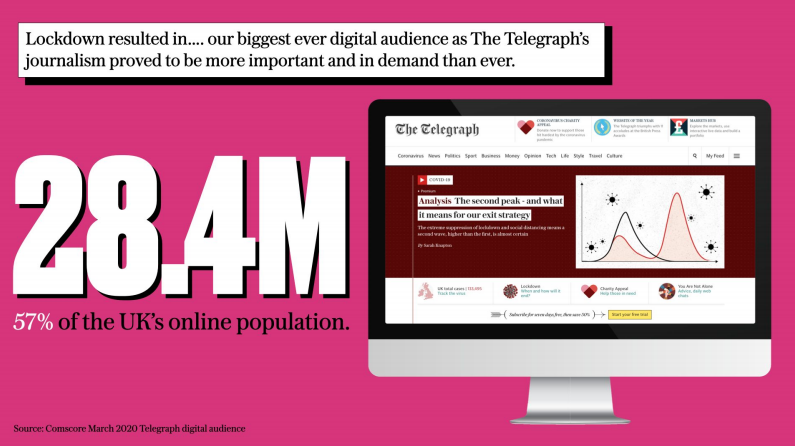

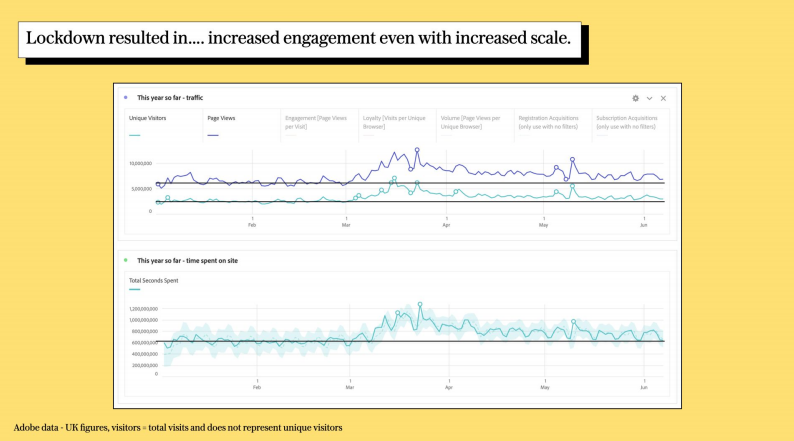

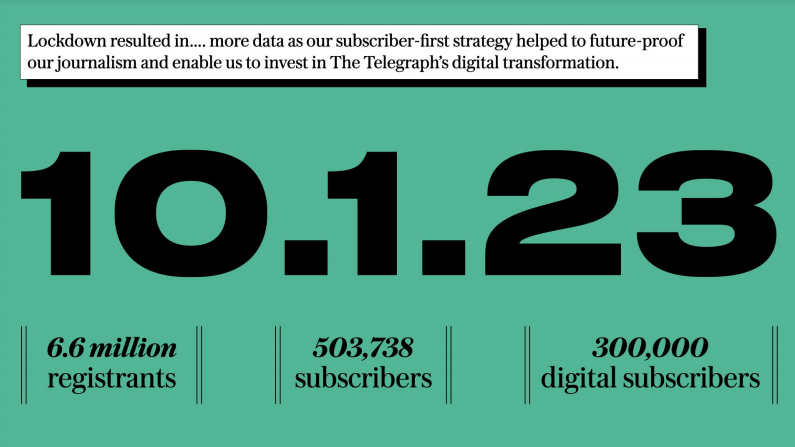

- Readership is up. The Telegraph, for example, drew 28.4 million visitors in March, its biggest ever digital audience, thanks to increased interest in news about the pandemic. Surprisingly, that increased traffic was joined with increased engagement and time spent. (Publishers typically see a “see saw” effect during times of increased traffic. Higher viewership typically means lower engagement.) More readers meant more subscribers. From April to June of this year, The Telegraph grew its number of registrants to 6.6 million, and its subscription revenue surpassed its advertising revenue for the first time in its history.

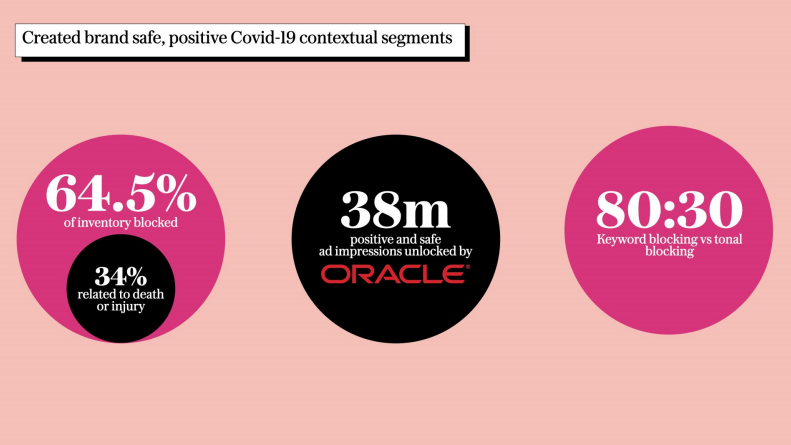

- So is COVID keyword blocking. With the pandemic touching nearly every part of daily life, from sports to politics to shopping, every story is ultimately a coronavirus story. That means an ever-increasing number of stories have been caught up in brands’ block lists. In March, The Telegraph found that keyword blocking had reached 64% of its inventory, according to Karen Eccles, senior director of commercial innovation.

- But advertising is down. The New York Times saw its advertising revenue drop 50% in the second quarter of this year. Those declines don’t extend to all sectors. There have been a handful of industries that have “had spend transcend the pandemic,” said Robins. Tech technology has been strong, and so have healthcare and pharmaceuticals, and even some CPG brands.

Further Reading:

‘Still dreadful, but trending in the right direction’: Digital ad spend began recovering in May

Digiday Research: Coronavirus-related keyword blocking is a problem for 43% of all publishers

Just as COVID-19 is giving people the time to cook and garden, it’s also given publishers the opportunity to experiment, plan, and serve clients in new ways.

- Future Publishing, which runs enthusiast sites such as Tom’s Guide and TechRadar, created an 8-person team of senior-level decision-makers to ideate and experiment with new product ideas specifically during the pandemic. One of the unique products to emerge from the team during lockdown is the Future Games Show, a digital event that took place the week of the Electronic Entertainment Expo, the biggest gaming event of the year. Asadi said that millions of people turned into the coverage and that the company plans to bring the event back again later this year and in 2021.

- With Amazon’s Prime Day postponed to later in the year, Vox Media has created its own version of the consumer holiday for The Strategist, which plans to host two days of 30 hand-picked deals in late July. “It’s something we’ve wanted to do for a long time,” said Camilla Cho, Vox Media’s e-commerce SVP.

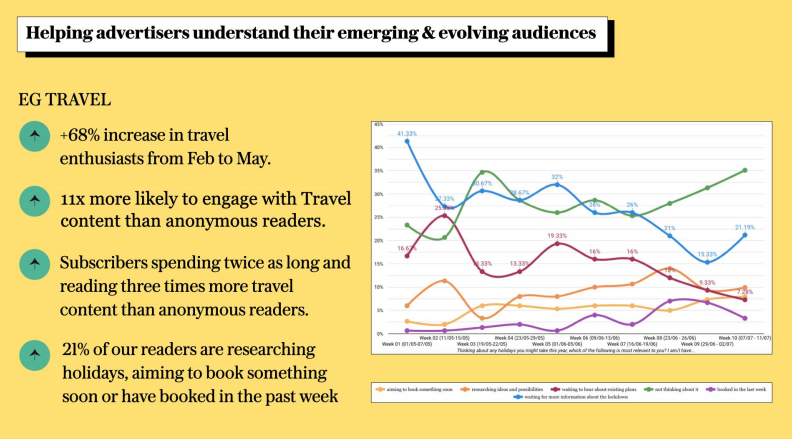

- In an effort to help brands understand emerging and evolving trends, The Telegraph has started collecting and sharing audience insights with advertisers. For travel brands, for example, the site has shared intel about how long subscribers spend on travel content and how likely they are to book a trip in the near future. “For brands, what’s important about this is that it lifts the lid on what’s going on, which helps them communicate with their potential customers in the right way,” said Karen Eccles, The Telegraph’s senior director of commercial innovation.

- The Washington Post has run a series of marketer-focused “master classes” since April, bringing in members of its product, data, research, and editorial teams to answer important questions about shifts in consumer interest and spending.

- Being agile also means adjusting creative to suit the times. The Washington Post, for example, realized that highly produced branded content is increasingly at odds with how people today are living. “We’ve seen those campaigns be a little less attainable in this new reality,” said Washington Post CRO Joy Robins. “If we’re just working with a dropcam and interviewing an executive, that feels more relevant at the moment because those highly produced campaigns feel out of place in so many ways.”

The Bottom Line: There’s a premium on agility in 2020, and that’s unlikely to change anytime soon. “We need to recognize we will not have a clear picture of things for some time, but setting your teams up and making people comfortable with flexibility and some degree of uncertainty is going to make you that much stronger on the other side,” Robins said.

Revenue diversification has always been important, and crises like COVID-19 prove why. According to Digiday Research from May, 85% of publishers expected to see declines in ad revenue, which is bad news for any company that relies heavily on it. Put another way: Publishers looking for a way out of this crisis aren’t going to find it through advertising. Where will they find it? For many, through commerce.

- Meredith, for example, has explored ways to leverage data from its affiliate business into helping brands design and develop new products. Knowing both what readers are interested in (via content) and what they buy (via affiliate links) opens up opportunities to help partners identify niches for new products. One example is the company’s partnership with Scotts Miracle Grow on a plant subscription product called Knock Knock.

- Likewise, for Vox Media, users’ COVID-19 has been a boon to its commerce business, as more consumers turn to online shopping for staples, comforts, and luxuries. From March to June, The Strategist saw a 70% increase in net revenue compared to the same time last year. (May was one of the strongest months in the site’s three-year history.)

- On the other hand: Commerce, too, comes with challenges. Early in the crisis, skittish brands quickly began cutting their affiliate commission rates, or in many cases, shut off their affiliate programs entirely.

The Bottom Line: As publishers continue to see payoffs from their investment in commerce, their efforts are evolving beyond just affiliate programs.

Further Reading:

How Meredith is investing in tech to connect ads to sales

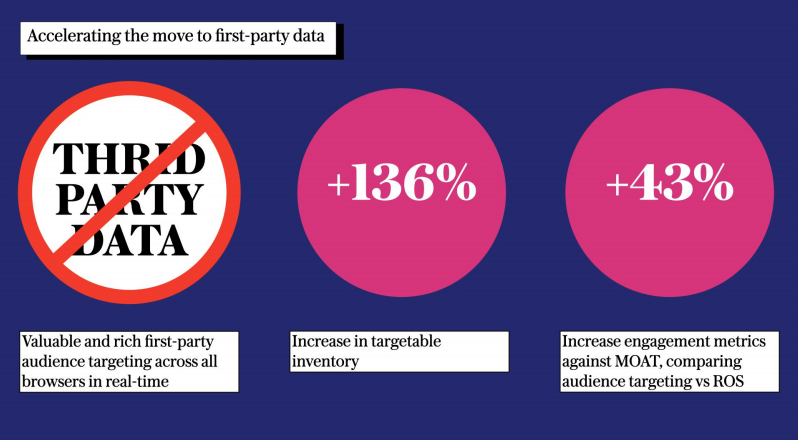

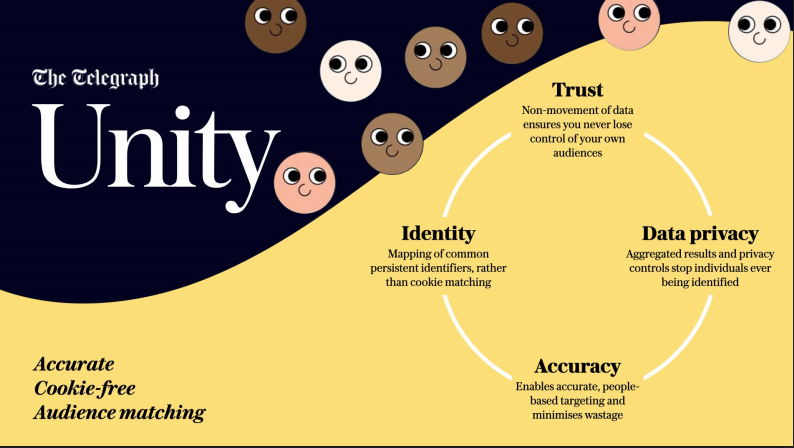

As the third-party cookie heads for the exit, publishers and brands are desperate to develop its replacement. Fortunately, there are signs that the first-party data movement is picking up steam. The Telegraph, for instance, announced during the Digiday Publishing Summit Europe that it’s ceased using third-party data for targeting, and will instead rely on its first-party data.

- For most publishers, the first-party data switch can’t be flipped overnight. At The New York Times, the process for reducing its reliance on third-party data began a year ago, and there’s still some work ahead of it before it can fully cease using third-party data entirely in 2021, as it announced it would earlier this year.

- While brands tend to be six months behind publishers on these issues, there are clear signs they’re feeling the pressure to move faster. Sasha Heroy, senior director of ad platforms at The New York Times, said that the Times now gets RFPs that include requests for information about first-party data capabilities.

- While Heroy said that the Times has received “a great deal of excitement” from some advertisers in response to the offering, the switch to first-party data also involves educating advertisers on its data capabilities.

- Embracing first-party data also makes testing and data validation more important than ever. For this reason, The Times has tested campaigns using its own first-party segments against those using third-party data.

- The Times plans to refresh its data sets on a regular basis. This includes soliciting at least 10,000 new survey responses each quarter to make sure its audience data is up to date. The Times is in the process of building out best practices for always-on data collection to make sure it has the proper feedback loop to keep its models accurate.

The Bottom Line: While the first-party data shift seems to be going well at the Telegraph and The New York Times, buy-side challenges remain. With many advertisers still making sense of the shift away from third-party data, elsewhere “struggle is all there is,” according to one event attendee. “Unless you have a tried and true dataset that’s large and well-known advertisers won’t take a risk on it.”

Further Reading

Inside The New York Times’ first-party data play

Reducing cookie reliance, The Telegraph rolls out ways to share data directly with advertisers

These are challenging times for leadership at media companies. With employees being tested both professionally and personally, leaders increasingly need to help their teams make sense of the crisis and lead them through it.

Here’s Future’s Aaron Asadi’s advice for leaders dealing with the crisis today:

- Accept change. The most effective way to respond to change is to embrace it. For Future, which announced the acquisition of TI Media last fall, change and reorganization have been a constant in recent years. Asadi said this gives the company an advantage in the current crisis. “In a crisis there isn’t once change, there are multiple, so you have to embrace that. Get used to the changing, not the change, because the change won’t last very long before the next one comes along.”

- Be cool. If accepting change is one constant of managing out of a crisis, accepting ambiguity is another. This doesn’t always come easy to leaders, who assume that they always need to have all the answers. But for employees, who are paying close attention to the news, that’s not what’s important right now. “Your teams aren’t expecting you to have everything planned out, but what they do need to see is that you’re unshaken and ready and collective enough to make logical decisions as you need to,” Asadi said.

- Communicate early and often. When it comes to crisis, more change demands more communication. When Future closed its offices earlier this year, one of the first things it did was schedule weekly calls with management to brief the team on how the business was performing. Leadership also listened closely to common themes in the team’s concerns, which would suggest areas where communication could improve. “We upped our internal comms enormously, making sure that everyone had a digest of what was unfolding,” Asadi said.

- Love your customer. When times get tough, empathy tends to be the first thing to go. Not so at Future. As the crisis unfolded, the company started to think about how the crisis had changed life for its customers. What new problems were they facing that Future could help with? The result: The company adapted its content to be more about what its customers needed, and less about what they wanted. This meant more guides, online talks, and virtual events.

- Be clever. In the end, one of the surest ways a company can escape a crisis is by engineering that escape itself. Future took this to heart, challenging its team to be clever and creative to solve customer problems. “Some of the ideas didn’t work out, some were good, and some are probably going to be here for a long time to come,” Asadi said.

The Bottom Line: A smooth sea never made a skilled sailor. Leaders should take Franklin D. Roosevelt’s quote to heart as they navigate the 2020’s choppy seas.

Further Reading

How Future adapted commerce content to drive 1m transactions in March

“There is definitely some apprehension on our side and we’re very much not counting on there being long-lasting change. We’d loved to be proven wrong, but at the same time having looked at people’s pattern of behavior over time, we wouldn’t be surprised if things don’t really change in the long run.

Bola Awoniyi, Black Ballad Co-founder and COO

Black Ballad, a subscription-first site for black women, has seen its numbers grow in the wake of the surging Black Lives Matter movement following the police killing of George Floyd. In April, it’s subscribers climbed 100% year-over-year, and it’s fielded interest from brands looking to align themselves with its message. But there’s also some trepidation over how long the interest will last.

“Clients today are less likely to want to chit chat. Even though we seemingly have more time than ever because we’re not commuting and many of us are staying home, it still feels as if our days are full. When you book time with a client, it really has to mean something.”

Joy Robins, Washington Post Chief Revenue Officer

COVID-19 has changed all parts of how sales teams work, including how they relate to clients. With clients strapped for time and resources, time is scarce, and publishers need to justify every second of the day they take up.

We’re turning flexibly from a fear word into an opportunity word. When our clients come to us saying they want to be flexible, they’re reacting to the need for flexibility from consumers as consumers dodge and weave and try to figure everything out. We’re trying to be the best possible partners in that context.

Corbin de Rubertis, head of innovation at Meredith

With brands increasingly seeking out more flexible relationships with publishers, and with even direct media buys becoming increasingly easy for them to get out of, Meredith has sought out ways to build stronger relationships with their partners. This means embracing their role as consultants, not just sales people.

“When you’ve got virtual space, you don’t have physical limitations, there’s no end to what you can do provided you have the customer interest.”

Aaron Asadi, CCO of Future

COVID-19 has made life very challenging for publishers who run events businesses, but it’s opened up new opportunities as well. With virtual events comes the potential for a wide variety of “long tail events” that publishers wouldn’t have the time or resources to run physically.