Secure your place at the Digiday Publishing Summit in Vail, March 23-25

Unlike HBO, AMC is taking a cautious approach into creating a standalone streaming service.

In July, AMC’s parent company, AMC Networks, launched Shudder, a subscription video service dedicated to fans of horror films and TV shows. Available for $4.99 per month, it’s the company’s second OTT product after the documentary-focused SundanceNow Doc Club, which charges $6.99 per month. (Both services also offer year-long membership options that shave the monthly price off by a dollar or two.)

“The fact is when we think about our new [streaming] services, we have to consider them as their own businesses and we are investing in those businesses as standalone services,” said Linda Pan, svp of new digital business at AMC Networks. This includes producing original series as well as licensing content from other networks and studios for each streaming service.

What it doesn’t include — at least for now — is programming that currently airs on AMC’s flagship TV channel.

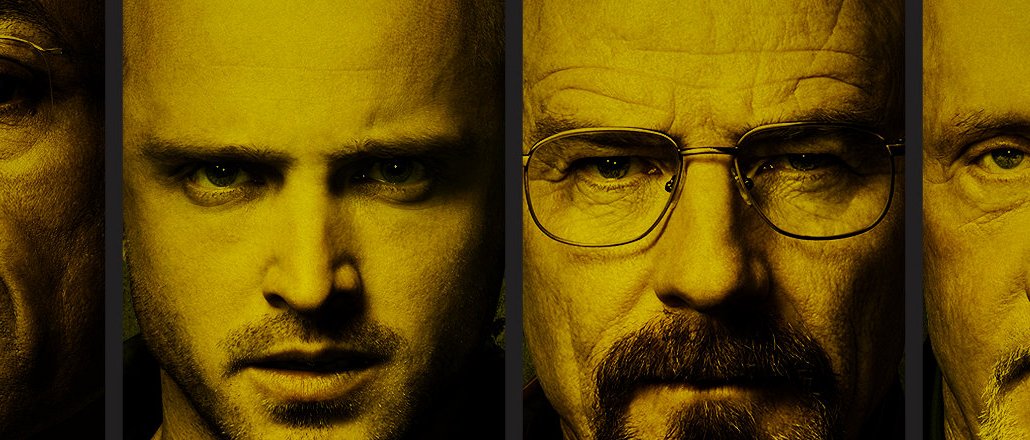

The move is in the opposite direction of how AMC’s counterparts HBO and Showtime are approaching streaming services that go directly to subscribers — and make an end-run around cable distributors. HBO made a big leap in April with the launch of HBO Now, which provides full access to the network’s entire catalog of films and TV shows. A couple of months later, Showtime followed suit with its own subscription-based service, which it also calls Showtime. AMC, on the other hand, is not offering any of its critically acclaimed TV series — “Breaking Bad,” “Mad Men” and even the zombie hit “The Walking Dead” — on its streaming services.

The easiest explanation for AMC’s strategy is pure entertainment economics. All three seasons are exclusively available on Netflix due to prior deals cut between the studios that own the distribution rights and the streaming service. (“Breaking Bad” and “Mad Men” are distributed by Sony Pictures Television and Lionsgate, while AMC owns distribution rights to “The Walking Dead.”)

But that’s not the only reason AMC’s going the niche route. There is also an opportunity n building new TV brands that service specific communities via digital platforms.

“This is not about becoming a poor man’s Netflix,” said Seung Bak, CEO of DramaFever, the online video company which developed both services for AMC Networks. “The level of capital and commitment you need to go against Netflix is just not rational. Instead, Bak said AMC and DramaFever are taking a “building-block” approach to building these services, with an eye toward establishing a “sustainable” competitive advantage in horror and documentary content online.

Of course, while there are only a small number of big names in streaming, the overall market is incredibly saturated. Roku offers more than a 1,000 apps, many of which most of you haven’t heard of — the list includes FrightPix and ScreamBox in horror and Docurama in documentary.

AMC Networks’ pitch is that — across its TV and film businesses — it has been producing and distributing horror and documentary content for years now. It already knows how to cater to these audiences; it’s only a matter of doing it correctly online, which it believes is focusing on building community elements on top of each service’s video library. Doc Club members, for instance, get access to events, festivals and screenings, while Shudder currently get exclusive and limited-edition merchandise and other perks.

“If you look at media in general, there are basically broadcast brands that appeal to a mainstream audience,” said Bak. “Netflix is like shopping at a department store. Yeah, sure, you can go there for horror and documentary, but if you’re really passionate about [the genres], it will never provide the depth of content and experience.”

In terms of performance, it’s too early to tell for Shudder, which launched in July. Doc Club, meanwhile, has tripled its number of subscribers since the beginning of the year, according to Pan.

Looking ahead, there is a possibility that AMC’s approach to streaming will create something that the TV industry already specializes in — the digital bundle. Pan declined to name which other genres the company hopes to pursue down the road. “For a long time it was about cord-cutting and cord-shaving and now it’s about the skinny bundle,” she said Pan, adding that as those opportunities emerge AMC will participate.

What it won’t do, at least for now, is untether its flagship TV channel. “We exist in and thrive in and support the MVPD system and today have no intention of going over-the-top,” said Pan.

More in Media

Media Briefing: As AI search grows, a cottage industry of GEO vendors is booming

A wave of new GEO vendors promises improving visibility in AI-generated search, though some question how effective the services really are.

‘Not a big part of the work’: Meta’s LLM bet has yet to touch its core ads business

Meta knows LLMs could transform its ads business. Getting there is another matter.

How creator talent agencies are evolving into multi-platform operators

The legacy agency model is being re-built from the ground up to better serve the maturing creator economy – here’s what that looks like.