After a terrible 2014, Target is on the rebound, with FactSet analysts predicting a rise of 22 percent in net income from last year’s $2.45 billion. And it’s a focus on digital initiatives that’s paying off.

Target CEO Brian Cornell on a third-quarter earnings call in November called digital “a critical enabler of the shopping experience in all of our channels,” visible in the company’s 30 percent digital-sales growth in the second quarter of 2015 and 20 percent in third quarter, respectively.

“Target has evolved from a digital laggard to a leader at parity with most of its rivals,” said Jason Goldberg, svp of commerce and content at Razorfish. “Along with focusing on the fundamentals, Target has continued to experiment and innovate.”

Here’s what Target did to regain its digital mojo:

Acting more Amazonian

Amazon has reset consumer expectations. Retailers like Target have been left in the dust. Target’s trying to fix that. It began testing out the “available-to-promise” functionality in fall 2015, which sped up shipping of digital orders and offered guests a more precise shipping window of two to three business days. The retailer also expanded its ship-from-store capability to more than 300 additional stores, to enable about 40 percent of digital transactions to be shipped from its stores in the fourth quarter.

Using digital to create in-store experiences

Retailers are increasingly moving to embed digital experiences inside their physical stores. In 2015, Target unveiled a new fitting-room service where Target employees provide style advice, as well as tech-savvy “Digital Service Ambassadors” who help customers engage with Target’s offerings on mobile devices. It also deployed beacons across 50 stores to personalize offers to customers.

“A continued effort toward anything that removes friction in the customer’s digital experience is good,” said Jennifer Polk, digital marketing analyst at Gartner. “It’s not just about offering tools but also making them efficient. Target is investing in that.”

Making the mobile leap

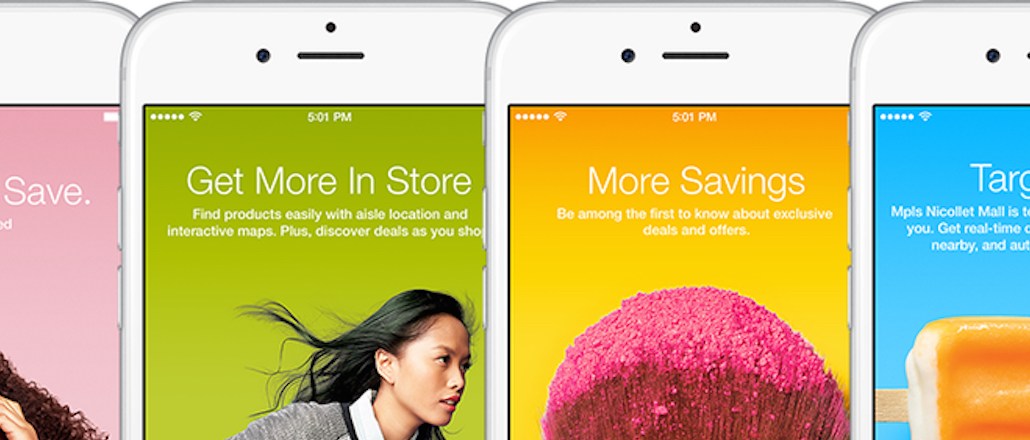

The retailer has dramatically improved its mobile experience as well, with a focus on capturing customers’ attention outside of the store as well as making in-store navigation easier. During the holiday season last year, for example, it optimized its mobile website with a feature that enabled customers to “like” products by tapping a little heart. This function saved products for future reference by the customer, while also giving Target insights on what the customer is interested in. Target also added in-store mode to its mobile app, allowing in-store mapping of products and making it easier for shoppers to find products.

“Shoppers today shop like bumblebees, flying from erratically from one spot to another — Target is trying to catch them regardless of their path to purchase,” said Erich Joachimsthaler, founder and CEO at Vivaldi Partners Group. “The mobile app allows customers to prepare a shopping list, and then the in-store beacons help personalize their path through the store based on the items they’ve selected.”

Providing utility through an app ecosystem

Target shoppers have access to a variety of its apps, including the Target app, In a Snap and Target Wish List among others. But its most successful app is CartWheel, a digital savings app that has over 13 million active users and which, according to Goldberg, is the most powerful weapon in Target’s digital arsenal. “CartWheel is Target’s mobile advantage over most other retailers,” he said. “It gives Target a much larger and more frequent mobile application user base than almost any other retailer.”

Target may have made considerable strides in the digital space, but experts say that there is still room for improvement. It did, after all, struggle to serve all its guests during peak demand this holiday season. Further, while it has caught up with its omni-channel rivals, it is still no match for, and is losing ground to, Amazon, which continues to disproportionately dominate e-commerce.

“Target’s turnaround is still a work in progress,” said Joachimsthaler. “Target needs to put their digital efforts in overdrive. This should be the highest priority.”

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.