Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

A tale of two ad products: YouTube’s shoppable ads vs. Google’s click-to-buy button

As the number of Google’s desktop searches declines, the engine has turned its sights on mobile. This month, Google rolled out two new mobile ad products to facilitate faster m-commerce sales: click-to-buy buttons in search and shoppable ads on YouTube videos.

The differences between the two products are subtle but significant: The click-to-buy buttons are designed to drive sales seamlessly, but YouTube’s shoppable ads appear to be more about driving a brand’s mobile influence.

As such, while both ad models minimize the number of clicks mobile shoppers need to get to the checkout page, the buy button has the edge over shoppable YouTube ads. Placed next to product search results, the click-to-buy button brings shoppers directly to a Google checkout page, enabling one-click purchases, a major improvement for seamless mobile shopping.

With the click-to-shop ads, YouTube sends users to the retailer’s product page, leaving the checkout process in the hands of the retailer and creating a fuzzier path to purchase than the direct-to-checkout buy buttons. The mobile sale is still at the whim of the retailer’s mobile website.

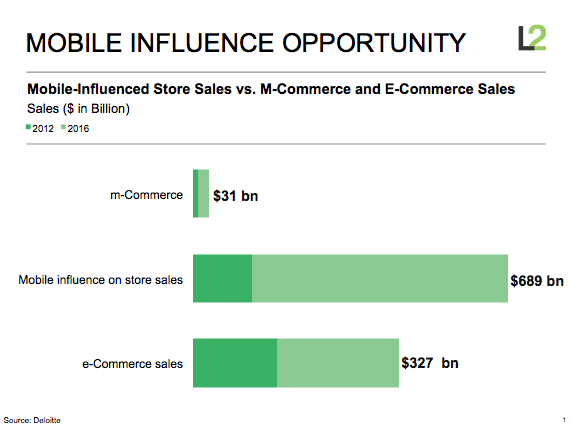

“When you’re searching videos on your phone, it’s relevant to what you’re doing at that time,” said Mabel McLean, research and advisory associate at L2. “It’s a huge influence driver: one click to find out exactly what a product is, how much it costs and where to find it. M-commerce, in that format, isn’t at the forefront.”

Still, when it comes to cracking mobile commerce, anything is an improvement for retailers, according to adMarketplace’s vp of business development Vince Meyer.

“Generating leads through mobile influence makes a lot of sense for retailers,” said Meyer. “To be frank, anything new is going to be better than what they have now on mobile.”

Before, consumers watching product-heavy videos like reviews and tutorials would have to migrate from YouTube to Google in order to search for something they saw and wanted to buy. Now, when the clickable product ads pop up (in an overlay format, similar to the text ads that appear in videos), the viewer can go from video to product page with one click.

Wayfair and Sephora, which both tested the ads in beta, have seen positive results. At first, Wayfair was wary of how much YouTube could drive impressions for its demographic of 35- to -64-year-old women, said Ben Young, the company’s media manager of TV and online video. But after incorporating the shoppable ads, it plans to generate more original video content.

“People want specific products seen in the videos, and this gives them a direct avenue,” said Young. Going forward, he said, the content team will incorporate the shoppable ads into their video strategy, like having the on-screen actor point to where the ad will be and remind customers they can buy using that button.

Google boasted in a blog post that Wayfair reported a 300 percent revenue increase per impression with the shoppable ads. Sephora, which specializes in beauty tutorials, saw an 80-percent lift in consideration and a 54-percent lift in ad recall. Google also pointed out that 50 percent of YouTube views happen on mobile.

“The scale of mobile influence doesn’t even compare to the scale of purchases, so that’s where we’re seeing mobile optimization,” said L2’s McLean. “Rather than for pure commerce, people are using their phones for research.”

Meyer added that while we’ll have to see how the shoppable ads roll out on YouTube in the long term, we can count on Google to continue down the path as an e-commerce player.

“Ten years ago, Google wanted to be at the start of the user’s journey on the Web. Now they want to be as close as possible to e-commerce conversions. It’s an interesting situation, where Google is blurring the lines.”

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.