Forever 21 is associated with trend-driven millennial women willing to cycle through affordable party dresses and accessories each season. Now that the retailer has built a fast-fashion empire with 700 global stores, it’s flexing its muscle in menswear.

The company has been designing quick and cheap men’s clothing since 2006, but only recently has that piece of the brand surfaced in its content strategy. Forever 21, which has one of the most popular accounts on Instagram with 7.6 million followers, launched a new Instagram account, Forever 21 Men, in June. In two months, @Forever21Men gained 38,000 followers and generated 8,000 posts tagged #Forever21men.

The new account is one part of the retailer’s push to recreate, for menswear, the success it has seen with womenswear. While the retailer doesn’t break out what percentage of its shoppers are male, a Forever 21 representative said that the consumer base remains largely female but added that the men’s business has been experiencing “double-digit growth.” (The company would not disclose the base, which makes it hard to evaluate whether this is truly impressive.)

“We’re establishing ourselves as a serious player in the men’s market, and with that, we wanted our customers to know that we’re creating product and content specifically for them,” said a Forever 21 rep.

The brand is pushing to build out its offerings for men as well as kids and is using the same growth strategy as it did to build its women’s brand: offer fast, fashion-forward clothing accompanied by inspirational brand content.

“Since Forever 21 has had such success with its main Instagram account, a menswear account is a natural extension,” said Donna Delshad, a strategist for United Talent Agency’s brand studio. “The consumer starts to associate that brand or that account almost as if it were a lifestyle, and that’s what Forever 21 needs to be for men.”

The strategy of creating one gendered account to complement a main gender-neutral account on Instagram has proven successful for Nike, which launched a second Instagram account, @NikeWomen, without cutting women’s products from the main @Nike Instagram page. Nike Women now has 2 million followers on Instagram.

Just as trendy fitness gear — or “athleisure,” as it’s called — has become an undeniable force in the fashion industry, more fast-fashion retailers are paying attention to their male consumers.

“Over the past few years, the men’s market has seen a dramatic shift in how men shop for clothing – it’s faster, more fashion-forward and diverse,” said Forever 21.

“For Forever 21 has a huge opportunity for menswear because they’re only growing,” said Jessica Navas, chief planning officer at Erwin Penland. “Fast-fashion is universally appealing.”

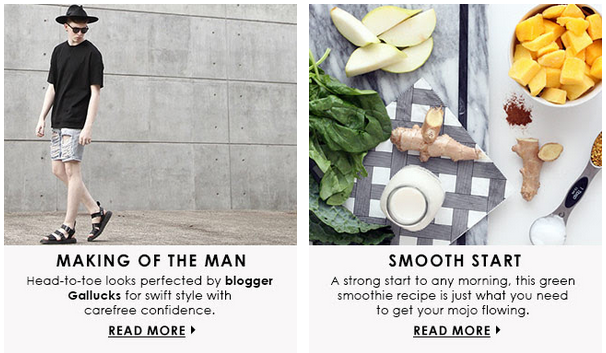

On its menswear Instagram, Forever 21 puts together outfits and recruits style bloggers to contribute to the feed, similar to its main account. According to Navas, drumming up outfit inspiration and making it look easy and approachable is what “any smart brand will do.”

More men-driven content has begun to surface in other facets of Forever 21’s branded content strategy. The daily newsletter features more men’s products, and 21st Street Blog, Forever 21’s native content blog, has slowly begun working in content centered around menswear and featuring male style bloggers.

“We like to highlight all the accomplishments we’ve made and all the hard work the team has put in to building this brand,” Forever 21 said about the menswear content.

“They’re smart to figure out how to get men involved. The promise of Forever 21 is that it’s of-the-moment style within reach, and now, they’re elevating that promise to reach both of these audiences equally,” said Navas. “It’s a great brand play.”

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.