Last chance to save on Digiday Publishing Summit passes is February 9

Instagram is growing like a weed. The question now is whether it can ring up sales.

On Instagram itself, there are limited options for driving people to e-commerce destinations. So for most retailers, Instagram is a branding play. But on retail sites, it is a different story. Retailers like West Elm, BaubleBar, and Alex and Ani are using widgets to drive conversions from user photos. The widgets will pull in Instagram photos that are tagged with a specific hashtag to the retailer’s site, where it can be associated with a product for sale.

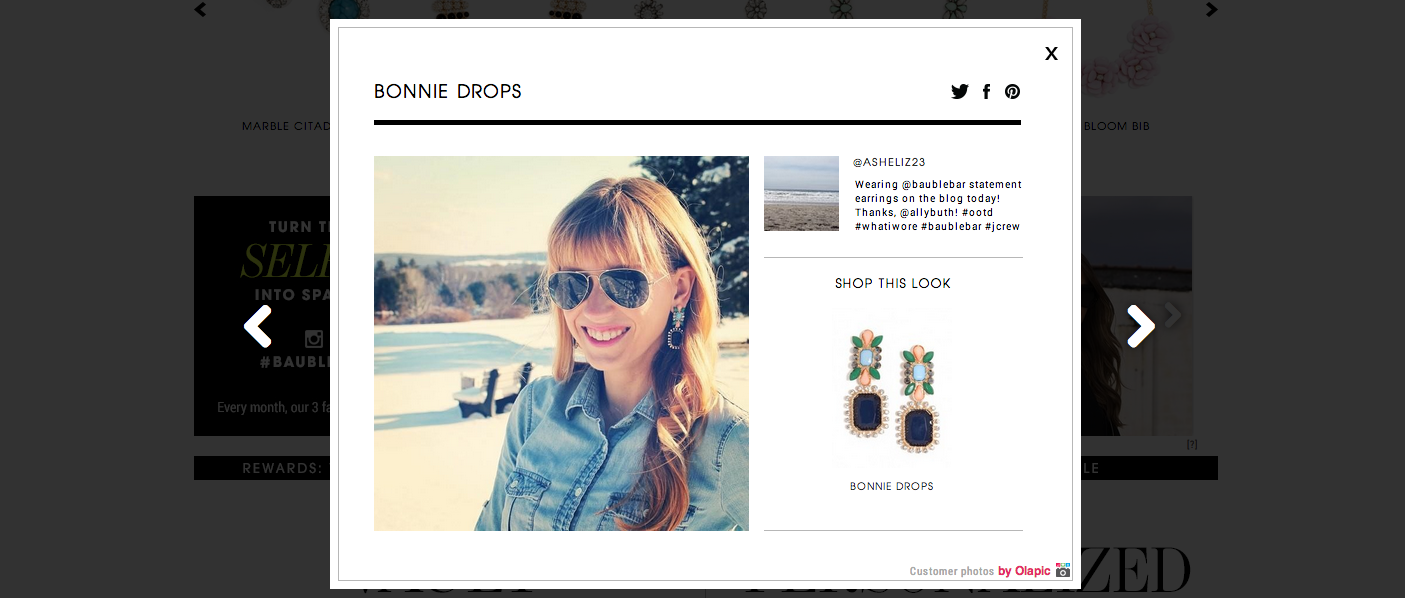

For instance, online jewelry retailer BaubleBar uses the widget on its front page to show customers Instagram selfies displaying their merchandise. As you click on the photo, a pop-up window shows the jewelry within the photo and links to a page where online shoppers can buy.

“Thirty to 35 percent of our online traffic engages with that widget on the homepage or on the product page,” said Daniella Yacobovsky, co-founder of BaubleBar. “We see conversion about four to four-and-a-half times higher with these people than from people who don’t engage.”

Another retailer, West Elm, uses the widget to organize photos on a subpage called, #MYWESTELM. Users can filter by room to see how other West Elm customers arrange their homes (and pets) with West Elm products.

“There’s definitely a correlation between the ones that sell the best and the ones that are on Instagram,” said Abigail Jacobs, vp of brand marketing for West Elm. Still, Pinterest currently drives more direct conversions for the retailer than Instagram, Jacobs added. But perhaps not for long as Facebook figures out what it wants to do with its little photo-sharing app.

Pau Sabria, the co-founder of Olapic, which provides Instagram widgets, recently told the New York Times that brands using the widget on average see visitors that turned into buyers increased by 5 to 7 percent and the average order value rose by 2 percent.

“On Facebook, there are a lot more fans and you can target paid audiences,” said Ryan Bonifacino, vp of digital strategy for Alex and Ani, a retailer that also uses the Olapic Instagram widget for its e-commerce store. “Because they own Instagram — you also have paid targeting there. If you assume Facebook is there, then you can assume that Instagram will be there on its coattails. Pinterest has to compete. “

More in Marketing

Star power, AI jabs and Free Bird: Digiday’s guide to what was in and out at the Super Bowl

This year’s Big Game saw established brands lean heavily on star power, patriotic iconography and the occasional needle drop.

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?