Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

This article is part of an ongoing series for Digiday+ members to gain access to how platforms and brands are pitching advertisers. More from the series →

Amazon has joined the likes of Google and Meta by launching its own black box-style ad campaign called Performance+.

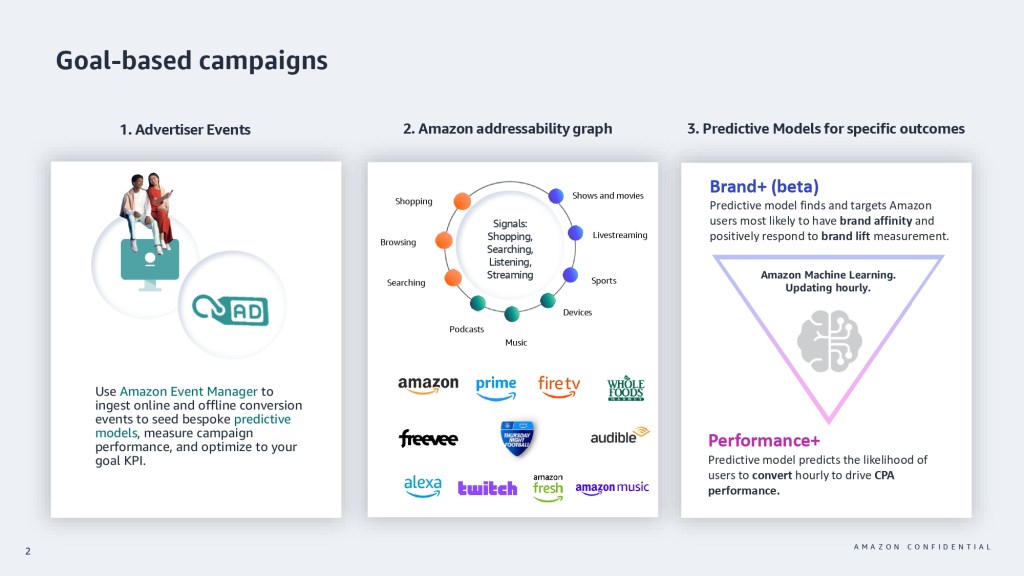

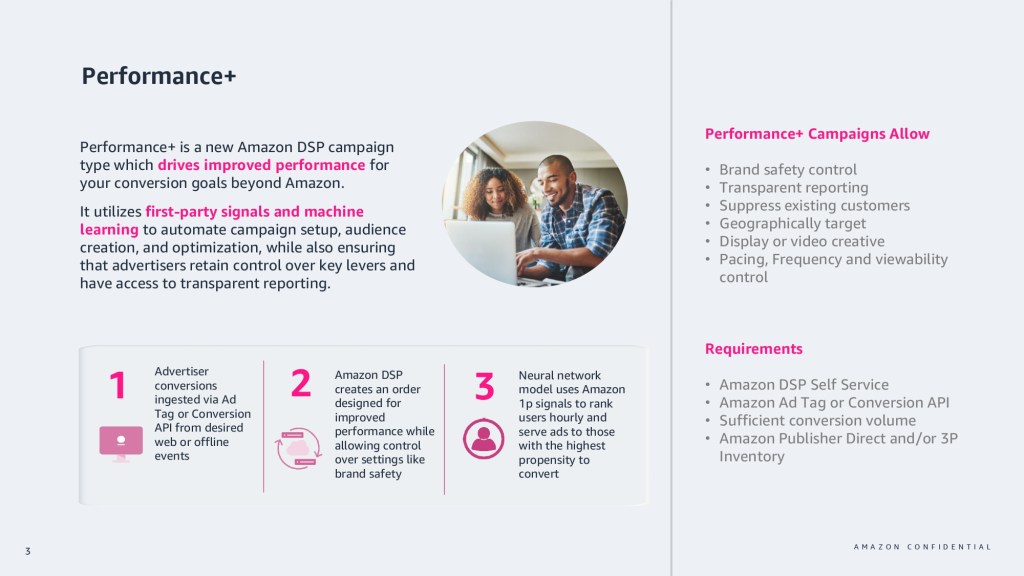

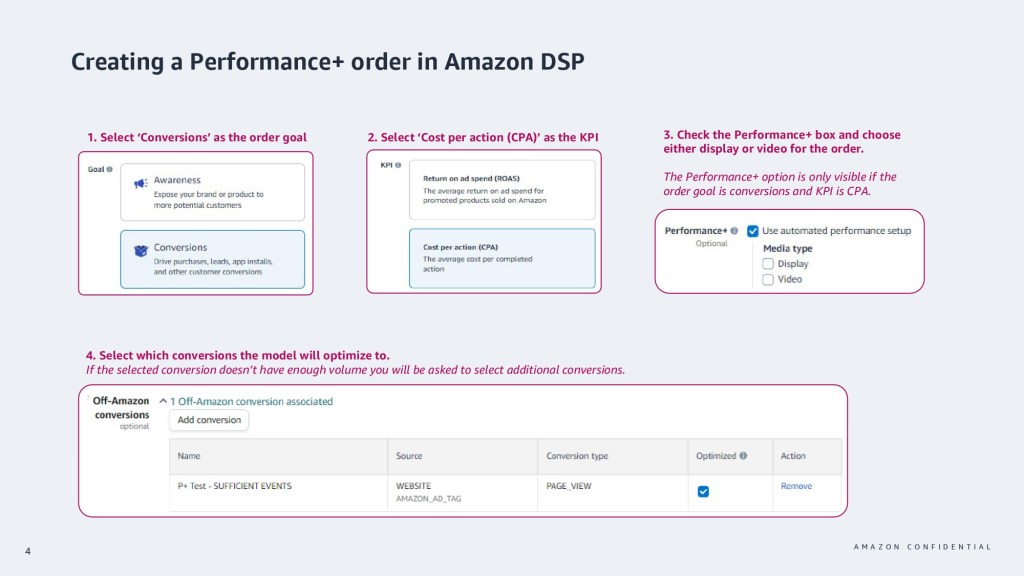

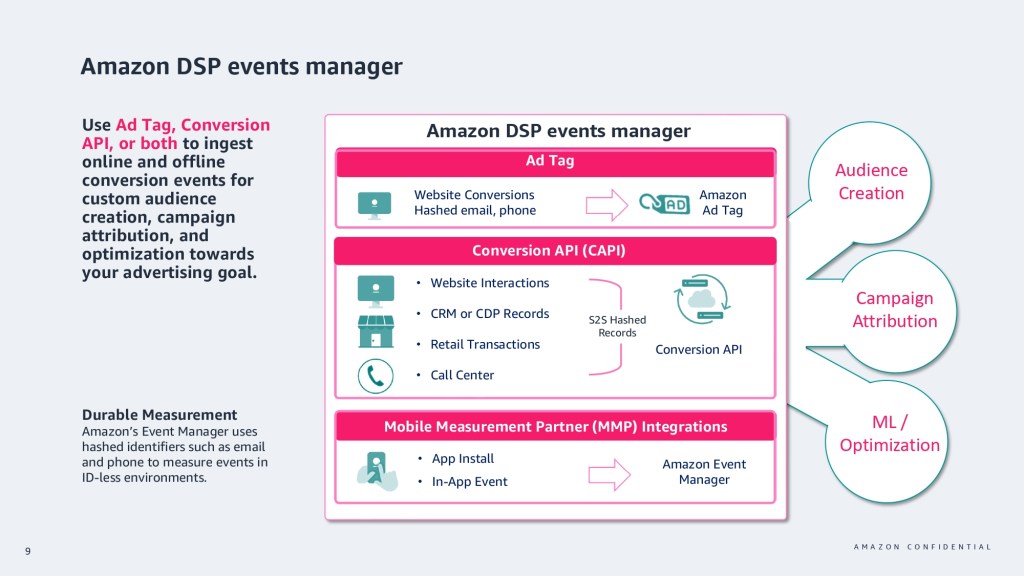

Designed to make campaign creation and management as easy as possible, Performance+, which sits within Amazon’s demand-side platform uses a predictive model to predict the likelihood of users who will convert hourly, in order to drive cost per acquisition performance.

The tool works by using “first-party signals and machine learning to automate campaign setup, audience creation and optimization,” as Amazon itself put it in its pitch deck, which was shared with Digiday. In other words, Amazon is saying, “Hey marketers, get set up, or we can help with that if you need support, plug in the CPAs you need to hit for this campaign to be a success and we’ll sort the rest.” Simple.

Based on how Performance+ works, Jason Weilenmann, vp of marketplace performance at Front Row, said he believes Performance+ functions similarly to how the old Facebook algorithm and tracking used to work, because it’s built off tracking conversion events.

Where it could slightly differ from its black box peers (think Google’s Performance Max and Meta’s Advantage+) is the fact that Performance+ targets brands that are not currently selling on Amazon. The platform itself said as much during its launch messaging in March, stating that Performance+ is “designed for businesses that sell beyond the Amazon store.”

“Amazon’s biggest pain point is non-endemic clients (brands that don’t sell on Amazon), but Performance+ will pull in ad dollars because it targets those clients,” said Manuel Do Valle, managing director (Europe) at Macarta, a division of Mindgruve.

And he’s not wrong. Weilenmann said he’s already seen brands across the cruise industry, some across insurance, as well as other traditional industries you might not expect to see on Amazon, moving their dollars over into this. His team found the pitch interesting because it has opened up opportunities for them to run Performance+ campaigns for brands and different industries they wouldn’t reach otherwise.

“I’d say the goal-based predictive ability is probably what long-term might set this apart [from others on the market], because it’s going to be very easy for brands to say, ‘We know what we want to acquire a customer for, based on their lifetime value,’ or whatever it may be,” he said. “And as long as you can achieve that, keep spending.”

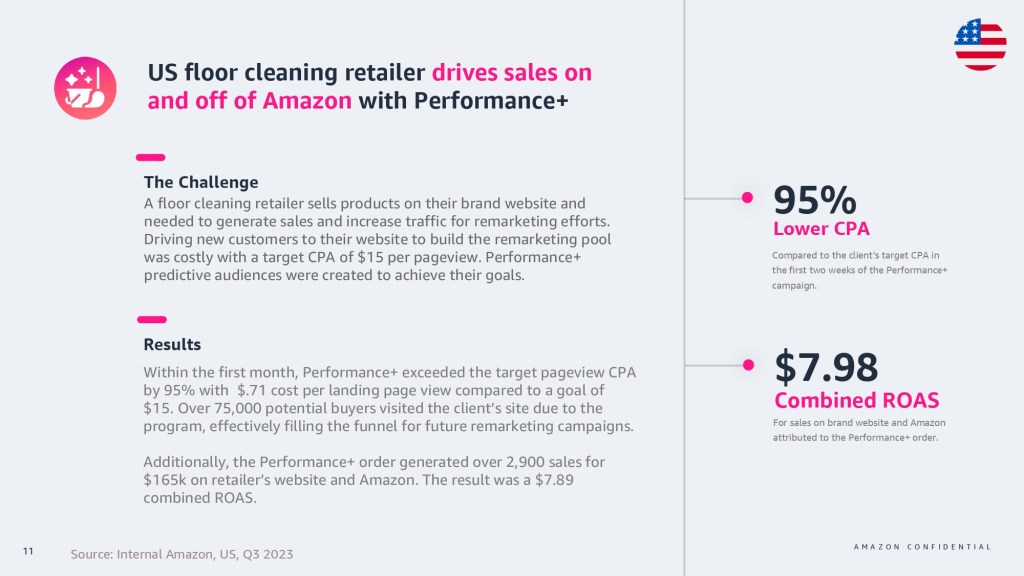

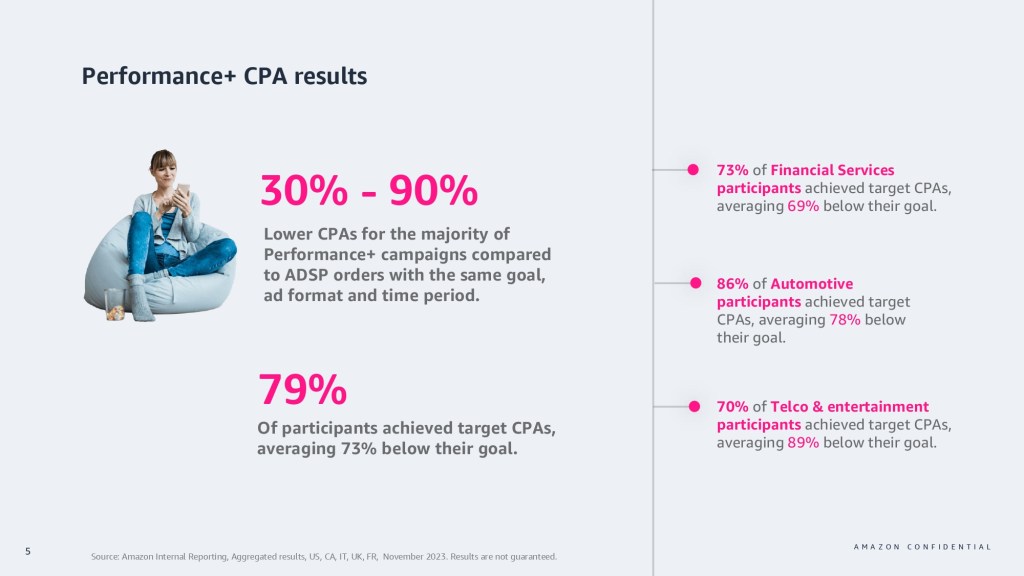

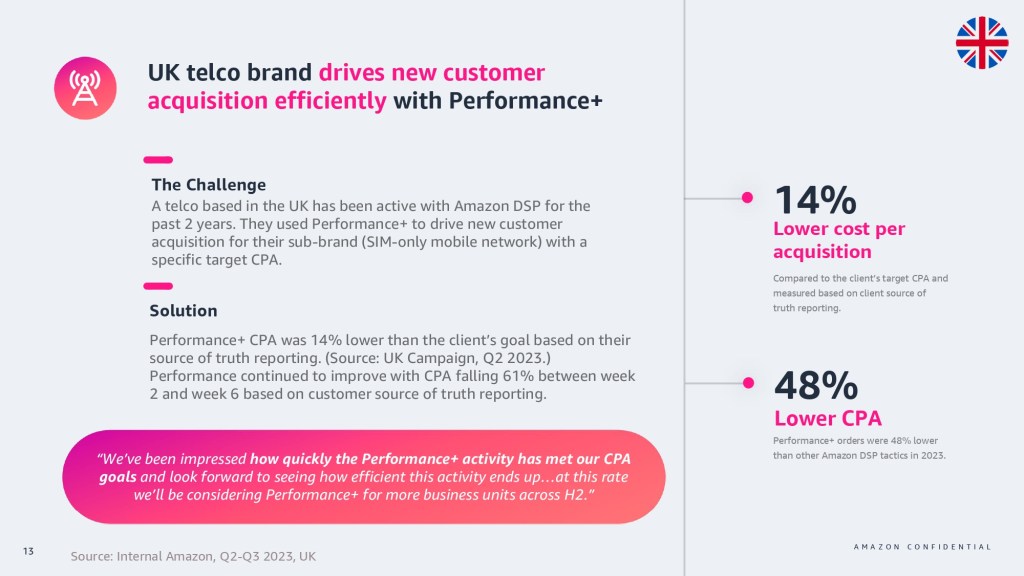

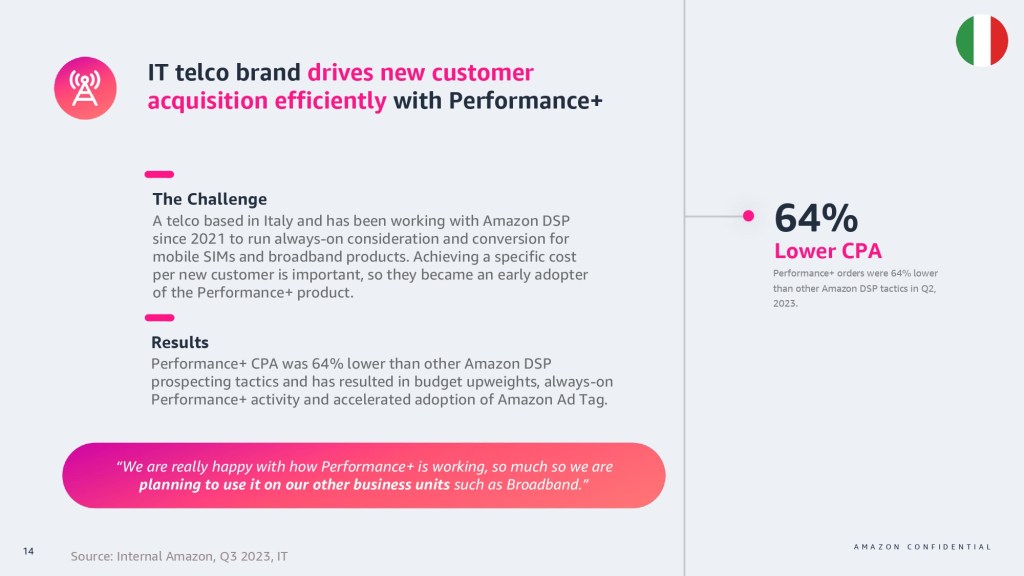

To encourage usage, the Amazon’s pitch deck highlights that the majority of Performance+ campaigns have achieved 30% to 90% lower CPAs compared to Amazon DSP orders with the same goal, ad format and time period.

For example, one U.S. floor cleaning retailer found driving new customers to their website to build their remarketing audience pool was costly with a target CPA of $15 per page view, the deck highlighted without naming the brand. But by using Performance+, the same retailer exceeded the target page view CPA by 95% with a $0.71 cost per landing page view within the first month.

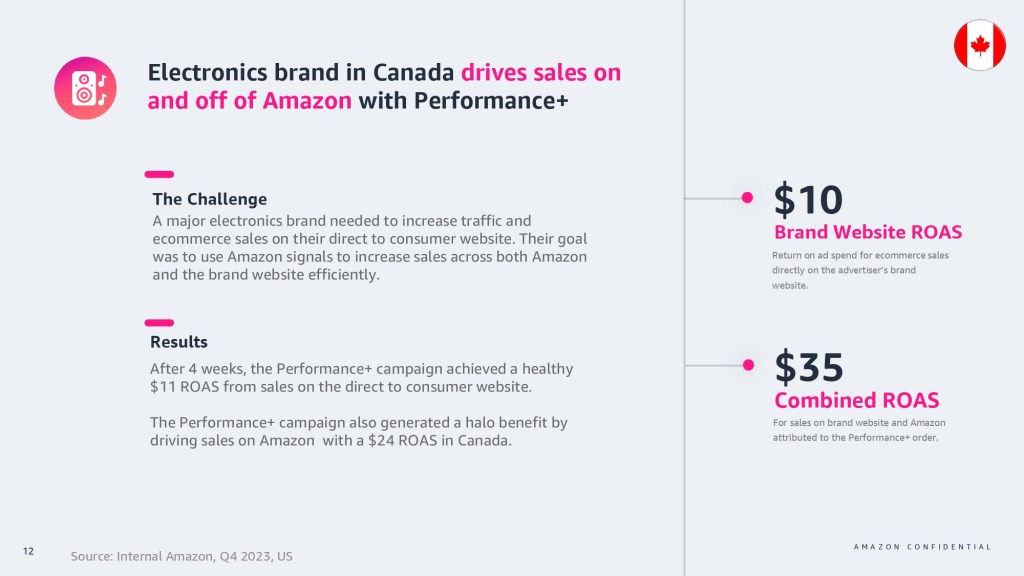

Another case study included in the pitch deck was a Canadian electronics brand, which wanted to use Amazon data signals to increase sales across both Amazon and their own website. According to the deck, the brand achieved an $11 return on ad spend from sales on the direct-to-consumer website after a month.

So what’s not to love?

Well, for the most part, efficiencies are great, and anything that can reduce costs with better performance is going to be a winner for any marketer. But black boxes have a track record for being problematic due to their lack of transparency. So while it’s still early days, Amazon’s Performance+ still has question marks.

“Marketers should still have visibility into performance metrics and control over targeting choices,” said Robert Kurtz, group vp of search media solutions at Basis Technologies. “If platforms, like Amazon’s Performance+, prioritize transparency and allow marketers to adjust settings, it can mitigate concerns about unwarranted influence.”

It seems as though Amazon has tried to address this, at least initially for this campaign type. According to the pitch deck, marketers who use Performance+ can control their brand safety settings, pacing, frequency and viewability controls, as well as the ability to suppress existing customers.

“I would say Amazon opening it up, so that it is self-service and advertisers and companies have the ability to control that themselves, learn the marketplace and understand it, is probably some of the better visibility compared to what I’ve seen across either other retailers or similar other marketplaces,” said Weilenmann.

Another concern is around the custom attribution settings and reporting. Effectively, marketers can tinker with different attribution settings and/or reporting in Performance+ and make their campaign performance look far better than it would have been otherwise.

But this level of manipulation isn’t a problem strictly for Performance+, it’s something Weilenmann has noticed generally with Amazon’s DSP, because Amazon charges based on viewability. And according to the platform, a view counts if at least 50% of the ad is in view for at least one second for display ads and two seconds for video ads.

“With view-based ads, I’m always skeptical if the campaign is going to assign attributed revenue or conversion event, when it didn’t actually have the conversion event that it’s saying that it did,” Weilenmann added. “My one level of trust is just tough there, because there’s so many different things, whether or not you [the consumer] saw that ad — the viewability metric on Amazon, historically, is very low.”

But this isn’t a new issue. In fact, there was a period where marketers weren’t that impressed with Amazon’s DSP, having noted its lack of measurement capabilities and limited range of inventory. With that said, the mood is shifting, thanks to the number of changes that Amazon has made to its ad tech over the last 18 months. And Performance+ is another step forward. Adding this campaign type to the mix should, in theory, enable the platform to build its addressable identity graph to extend outside of its walled garden, without tapping into alternative ID solutions.

“The concept isn’t far off from what other buying platforms can do in terms of ingesting data,” said Laura Taylor, retail investment lead at Goodway Group. “But the combination with the largest producer of purchase data is where it then becomes scalable.”

Amazon’s push to automate more of its advertising operations reflects a broader trend across the industry. Whether it’s Amazon, Meta or Google, automating advertising through AI has become the new norm in digital marketing. While there are valid concerns about giving these platforms even more control over ad dollars, marketers appear to be on board as long as the performance is genuine and they have tools to assess it. Nowadays, media buying is increasingly about strategically allocating budgets across channels and measuring the incremental impact of each dollar spent. Services like Performance+ are designed to help marketers achieve just that, offering a glimpse into this ideal strategy.

Take a look below to view the full pitch deck.

Update: After this article was published, an Amazon spokesperson said in an email: “For several years, we’ve been refining our AI-based solutions and are excited to have launched Performance+. Our goal is to offer advertisers and agencies AI-powered efficiency with clear oversight, enhancing their marketing tactics and achieving their business objectives. Performance+ simplifies programmatic buying while providing visibility into effective creatives, placements, and audiences reached, along with a range of controls to ensure ads reach the advertiser’s desired audience. We are committed to further investments in this area, and excited about the future opportunities this technology offers both advertisers and shoppers.”

More in Marketing

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.