Last chance to save on Digiday Publishing Summit passes is February 9

For Petco’s new YouTube series, “Pet Code,” the pet store recruited a well-known duo: professional vlogger Toby Turner (who goes by Tobuscus on YouTube) and his popular dog Gryphon. Turner and his dog’s back-and-forth — the dog has a vaguely Scottish voice dubbed over him — about how to become a better pet owner is entertaining, even if you don’t own a pet. As Turner introduces the new series, the dog’s voice interrupts with “It sounds like a stupid marketing thing that some lame executive came up with.” How self-aware of them.

The video, which has been viewed 560,000 times since it was uploaded, is the first episode of the 10-part video talk show that premiered last Thursday, which Petco produced in partnership with Edelman. The collaboration with Turner, who boasts 15 million subscribers across his three YouTube channels, is part of the store’s strategy to go beyond the hard sell of its products, and tap into the world of its consumers — pet owners or “parents” if you insist — who are passionate about their animals.

“It validates going down that path [of getting a YouTube star],” said Dave Hallisey, Petco’s vp of communications. “The overarching goal for our digital properties is to support our pet owners, so we want to be the go-to source for information as well as fun.”

On YouTube, the channel posts some commercials (which get around 1,000 views a pop), but focuses on buzzy content like Petco Friday 5 (shameless cute-animal clips that also live on Vine — the latest got 30,000 views in six days) and tutorials and tips, like video guides to different dog breeds. “Pet Code” is the first series involving a YouTube star.

Petco’s niche market is both a blessing and a curse for the store. People love pet videos on the Internet, but it’s also a very crowded space, a fact that is not lost on Petco.

“We needed to differentiate, so we put our stake in the ground with the latest series that’s both funny and can teach you something,” said Hallisey.

The tutorial side of Petco’s YouTube account gives the channel an edge, at least when looking at what people want out of YouTube.

“Search terms on YouTube, by volume, revolve most around process-oriented queries. You see it most in beauty, but it carries into other departments,” said Mabel McLean, research and advisory associate at L2. “People don’t search ‘Mercedes’; they search ‘how to change oil.’”

Other than optimizing YouTube content for how-to terms, the smartest play a brand can pull is recruiting a high-profile vlogger. These YouTubers “have incredible reach that brands can never hope to achieve,” said McLean; according to L2 research, they receive 15 times more channel views and have 108 times more subscribers than brands, on average. Petco, for its part, has 24,000 YouTube subscribers (competitor PetSmart has 17,000).

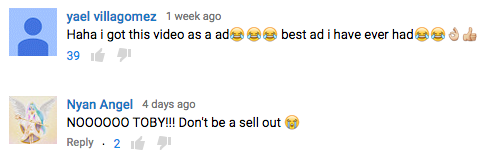

Video content steers shoppers toward an easy decision: which products to buy. After watching a tutorial on YouTube, buyers are likely to replicate the process by purchasing the items used. In the first “Pet Code” video, Turner talks about how to keep your pets entertained while you’re not home, offering up colorful toys by Leaps & Bounds as a solution. The YouTube star’s product peddling, albeit cloaked in his own brand, had mixed reactions in the comments.

“In terms of conversion and engagement, video content has a much greater impact than static content,” said McLean.

Petco has two content blogs: a community board called Pet Talk Place and a native blog called Unleashed. Pet Talk Place’s purpose is open conversation around petcare topics, while Unleashed features articles about living with pets. Engagement on those channels is harder to measure than, say, the number of views on Petco’s YouTube — Pet Talk Place is largely populated by Petco representatives, but according to Hallisey, that site is getting a makeover.

“Our social marketing ecosystem and branded community is becoming increasingly important,” said Hallisey. “I think we’ve struck a chord.”

More in Marketing

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?

How food and beverage giants like Ritz and Diageo are showing up for the Super Bowl this year

Food and beverage executives say a Super Bowl campaign sets the tone for the year.

Programmatic is drawing more brands to this year’s Winter Olympics

Widening programmatic access to streaming coverage of the Milan-Cortina Games is enabling smaller advertisers to get their feet in the door.