The world’s biggest brands are gung-ho on Instagram. TrackMaven analyzed a year’s worth of Instagram content, amounting to 41,000 posts and found that more than 50 percent of the Fortune 500 now have Instagram presences. In 2013, only 24.6 percent of Fortune 500 brands had Instagram accounts — 123 brands in all. A Dartmouth study found that the biggest brands in the world now use Instagram more than both Google+ or Pinterest.

Instagram remains top of mind, despite changes to the platform including an algorithm that may dampen organic success, as well as the introduction of new formats like longer video. It is also where the people are: A third of the Earth’s internet population is expected to be on it by 2018.

But how do these brands really use Instagram?

Likes still rule: Per TrackMaven, 98.9 percent of interactions come in the form of likes, while comments account for only 1.1 percent. Weekdays also rule: Thursday and Friday account for most of the posting activity on Instagram.

And posting more and more regularly might not be a bad thing. A report from L2 found that frequency of posting is key to higher engagement: Fashion brands, which tend to be the most active brands on Instagram, posted an average of 10 times a week in 2015, up from eight times a week in 2014.

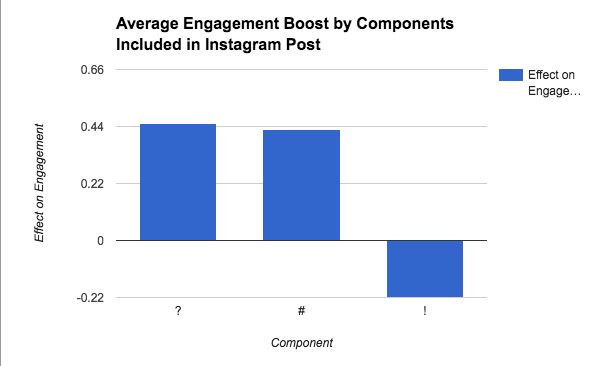

According to TrackMaven, brands that ask questions in their posts see a 0.45 percent boost in engagement compared with those that ask no questions. And those with hashtags see a 0.43 percent boost. But whatever you do, don’t include an exclamation point: It actually lowers engagement by 0.22 percent.

TrackMaven also looked at what types of content Fortune 500 brands tend to upload. The company found that 89 percent of posts from those companies are #nofilter — brands either don’t retouch photos or pre-design them. Here are the filters brands do use, followed by the filters that actually get the most engagement.

More in Marketing

Agencies create specialist units to help marketers’ solve for AI search gatekeepers

Wpromote, Kepler and Jellyfish practices aim to illuminate impact of black box LLMs’ understanding of brands search and social efforts.

What AI startup Cluely gets — and ad tech forgets — about attention

Cluely launched a narrative before it launched a tool. And somehow, it’s working.

Ad Tech Briefing: Start-ups are now table stakes for the future of ad tech

Scaled ad tech companies need to maintain relationships with startups, when the sector is experiencing ongoing disruption due to AI.