Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Move over Kardashian, this mobile game is striking a chord with women and retailers

One of the most successful mobile games for women took five years to perfect. That’s because, according to Covet Fashion’s senior vp of marketing and brand Blair Ethington, its creators declined to take the easy way out. They designed the game from the ground up.

“We didn’t want to take the mechanics of successful mobile games and just paint them pink,” she said.

Many existing mobile games share Covet’s main goal: to create virtual outfits from a mini digital closet, show them off to other players, and build up an eye for style. But those similar games – titles like Fashion Star Boutique, Fashion Story and even the wildly lucrative Kim Kardashian: Hollywood – miss out on two of Covet’s main advantages. The mobile app targets a rare but wise demographic and incorporates real-life retail.

Unlike most mobile games, the app’s key demographic is specifically women aged 22 and older. (Usually, the goal is to keep the game simple and appeal to men, women and teens, according to Stephen Baer, managing partner at The Game Agency.) Covet has 600,000 active users who spend an average of 30 to 60 minutes playing the game each day. Of those, 70 percent are over 22; the average age of players is 29. When creating the app, Ethington asked herself what women (not teens) loved about fashion, and what they were looking for in entertainment.

So, she decided that all of the clothing swapped and styled in the app had to be real, as in, available in-store, right now from actual brands. According to Ethington, women are more likely to spend time playing a game on their phones if there’s a real-life purpose behind the surface-level fun.

“Knowing all the clothes are real makes it feel more valuable. It doesn’t feel like you’re wasting time,” she said.

According to Ethington, Kim Kardashian’s extremely popular mobile game was beneficial for Covet Fashion when it launched a year and a half ago, since it shifted the perception of who gamers can be.

Baer said the appeal for this type of player – both on Covet and Kim Kardashian: Hollywood – is the games’ relation to the real world.

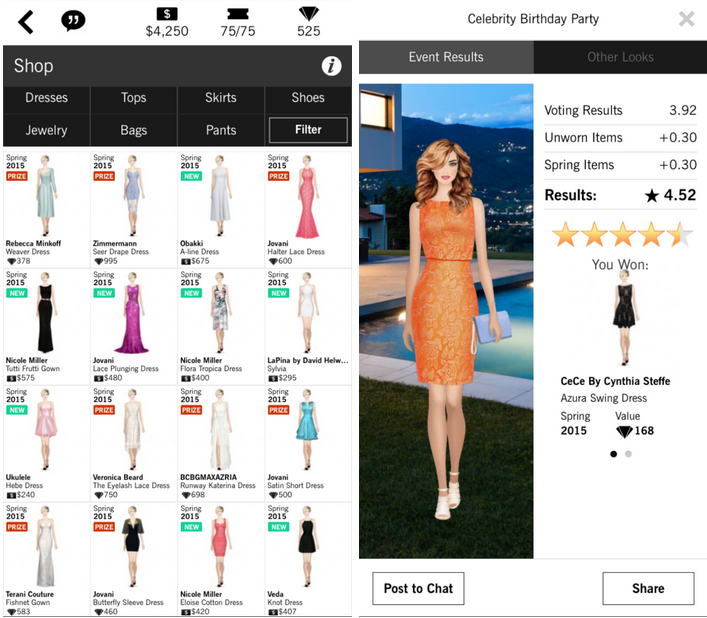

Covet Fashion can feel like online shopping but with a competitive edge: Users partake in different challenges – create a look using a certain statement piece, for instance – then other players will vote on the best outcome, and the top scores earn rankings, in-app cash or “diamonds,” the game’s version of loyalty rewards. If you like an item you’ve styled on the app, all you have to do is tap the picture to be taken to brand’s product page.

This gives Covet’s model a certain edge up on Pinterest and Instagram: On Pinterest, the outfits you pin may no longer be available for purchase; on Instagram, you can’t link to product pages directly from photos. So, targeting a demographic that’s active on Pinterest and Instagram makes sense, even when it comes to mobile gaming.

The game also resonates with millennial influencers: Instagramer and blogger Danielle Bernstein of WeWoreWhat (906K followers) posted last September wearing a denim jumpsuit by Cynthia Rowley, a find she attributed to Covet Fashion.

The app also doesn’t look or feel childish. Where other similar shop-and-style games choose cartoonish avatars and bold colors, Covet uses real images from brand campaigns, accurate product illustrations and sophisticated avatars and themes (“Style an outfit for a celebrity birthday party” is the game’s first challenge).

The game partners with a little over 150 brands, like J Brand, Cynthia Rowley, French Connection and Nicole Miller – the type of brands that shoppers will find wholesale, in major department stores. Their individual e-commerce stores oftentimes get less traffic, but Covet brings shoppers directly there.

The problem was that once the game’s users were on the brand’s site, a too-small percentage were actually making purchases, something that Mandi Meng, director of digital media and e-commerce at French Connection, attributes to the hesitation customers have on their mobile devices: “When they get to the checkout screen, they balk.”

So French Connection worked with Covet to come up with ways to get players to the point of purchase. Last year, the brand offered a new dress exclusively to Covet Fashion users, and the result was $12,000 in sales in 10 days, and over 110,000 click-throughs to French Connection’s e-commerce site. A Covet Fashion email campaign that let subscribers know when French Connection was having a sale yielded more positive results: Conversion rate was three times higher.

Overall, Covet says it increases brands’ mobile traffic by 50 percent and is responsible for 5 to 10 percent of e-commerce sales for large brands, and more – up to 40 percent – for smaller brands. New items are added every day to the app’s closet, and collections change by season.

The quickly changing database within the app, however, can cause user-experience problems. Many reviews of the app cited that the game crashed often, and loading individual items, hairstyles, colors and more can sometimes take too long.

According to Baer, an ever-growing app that continues to add content can run into user issues, which hinders the ability to recruit more users.

But the idea has legs: on a very basic level, Covet Fashion hints toward a virtual reality shopping experience. They weren’t the first, of course. In 2009, The Sims launched a PC game titled “H&M Fashion Stuff,” a world centered around H&M products that let players build their own boutiques and try on clothes. The Sims recreated this model with Diesel and IKEA, but the game lacked the ability to update its existing collection or link out to product pages.

“It’s a try-it-before-you-buy-it user experience,” said Baer. “That’s somewhat unique and appealing to a larger audience. The interesting thing is, I wouldn’t be surprised if the market went that way eventually – toward an interactive and creative shopping experience.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.