Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘The momentum is there’: In 2021, marketers are starting to see TikTok as a staple of the social budget

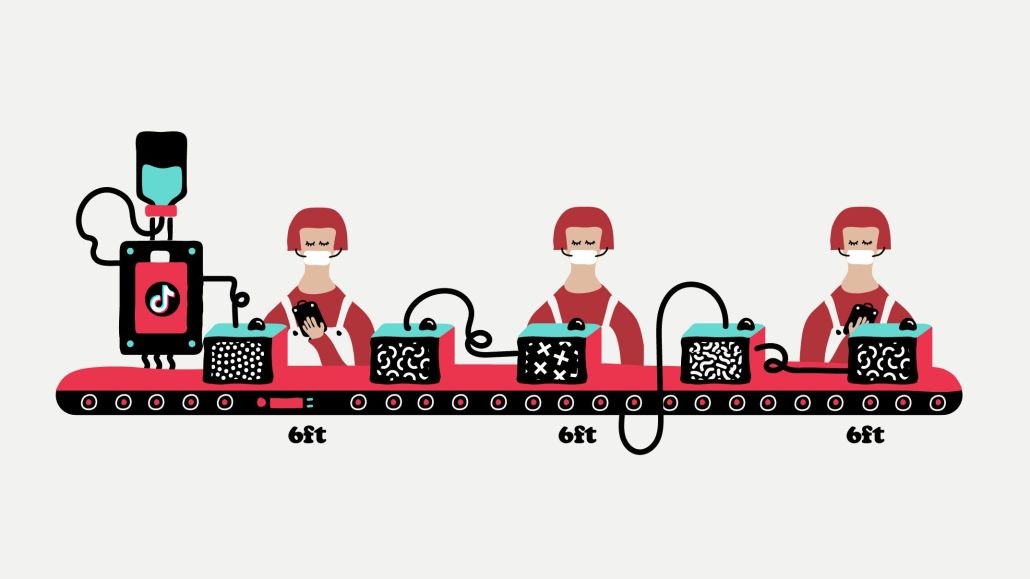

This year, TikTok has quickly started to move out of the “experimental” bucket and is now becoming a staple of the social spending pie, according to media buyers, who say that they expect more ad dollars to flow to the app this year.

With the future of the app in the United States no longer a question and the sale to Oracle shelved, that stability has marketers more comfortable committing additional ad dollars to the short-form video app. Buyers said improvements to its e-commerce capabilities — like its partnership with Shopify as well as new e-commerce-focused ad units like a dynamic catalog ad unit that’s currently in beta — are swaying marketers to spend more on the app.

“In 2020, marketers were wary of the stability of TikTok,” said Madelyn Lydon, associate director, public relations and social media at OH Partners. “It seemed like a big risk to invest dollars without knowing the future of the app. However, we’ve seen users are spending more time on TikTok than Facebook, and it is crucial for marketers to provide those users with content. Otherwise, they risk getting left behind.”

Without the perceived risk, the overall perception of TikTok has shifted dramatically over the last 12 months, and in doing so shaped marketers’ sentiments, according to marketers and media buyers. This year, TikTok seems to be a “social partner that clients ask for, versus us having to push to get ‘test budgets’ in 2019 and 2020,” explained Carrie Dino, head of media for Mekanism.

“Brands have shifted from viewing them as that fun/experimental platform to one of the big players,” said Brendan Gahan, partner and chief social officer at Mekanism. “As a result, we’ve been doing a lot of planning around ongoing content strategies. Clients are investing (or considering investing) in creating a community versus just doing one off activations like branded hashtag challenges or influencer partnerships.”

However, TikTok has yet to become a “staple like Instagram and Facebook, but the momentum is there,” added Gahan. “You can see how it could happen soon.”

While media spend on TikTok varies by brands, buyers say its still a minimal portion of the budget allocated to social platforms. Katya Constantine, CEO of performance marketing agency Digishop Girl, said that direct-to-consumer brands she works with now allocate roughly 5% of the social budget toward the app versus roughly 75% toward Facebook and Instagram.

TikTok’s investment to make ads more shoppable and push further into e-commerce has the potential to help the app become more of a priority in ad budgets, according to buyers. Constantine said that new e-commerce-focus ad units have clients eyeing the platform more and more.

“If they continue enhancing advertising platform at the same rate as last 12 months then TikTok has a strong place at the table to be 20% of the mix,” said Constantine, adding that currently it represents roughly 5% of the media mix. “That’s especially true for brands that are going after younger consumers.”

Buyers expect marketers to continue to spend more on the platform this year, particularly as advertisers look to diversify their media mix due to an overreliance on Facebook and Instagram when it comes to social channels.

That said, as the platform continues to gain ground, buyers say advertisers will have to invest in creating content specific for TikTok’s highly engaged audience, who is not as apt to interact with material that’s not native to the app experience. Even so, buyers expect brands to continue to lean into TikTok as the burgeoning app, which AppAnnie expects to hit 1.2 billion monthly active users this year, is where consumers are spending more time.

“TikTok is the new beauty haul, a more dynamic unboxing opportunity, the virtual makeup counter or live runway, and it puts the tools in the hands of its users,” said Jess Richards, evp managing director, commerce at Havas Media. “Brands can gain a lot by finding ways to enable this experience in a meaningful, authentic way.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.