‘It’s a land grab’: Amazon is now testing ads in Amazon Business

Amazon has begun testing ads within the Amazon Business marketplace in an effort to get more B2B clients.

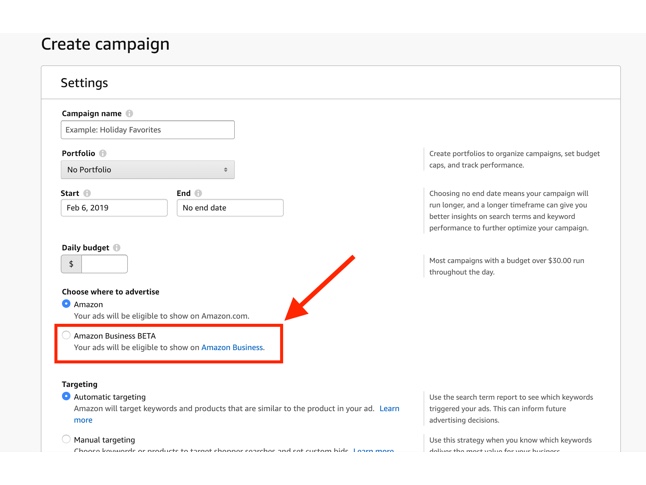

Three agency executives that have received access to the beta program told Digiday that the company is now letting companies advertise within its Amazon Business marketplace, where companies can buy and sell office supplies and other business products.

Entering the B-to-B advertising market could help Amazon to reaccelerate advertising revenue growth. In the fourth quarter of 2018, Amazon’s “other” revenue, which primarily consists of ad revenue, hit $3.4 billion, a 95 percent increase year over year. By comparison, in Q3 2018 the revenue segment grew year over year by 123 percent, and in Q2 2018 it had increased by 129 percent year over year. B2B advertisers are expected to spend $6.08 billion on digital advertising in the U.S. in 2019, up from $5.12 billion in 2018, according to eMarketer.

As of September 2018, Amazon Business had “millions of business customers and hundreds of thousands of business sellers around the world with more than $10 billion in annualized sales,” according to a company blog post published at the time.

Amazon declined to comment.

Amazon’s entry into B2B advertising introduces new competition for LinkedIn — the business-centric social network is considered the primary digital ad platform for B2B advertisers — as well as Facebook and Google, whose ad products can be used for B2B campaigns.

The advertising options for Amazon Business — formats, targeting, placements, etc. — are identical to what’s available for ads running on Amazon’s consumer marketplace, according to Trevor George, CEO of Blue Wheel Media, an agency that specializes in Amazon advertising. However, advertisers cannot set a single campaign to run across both Amazon’s consumer marketplace and Amazon Business. Instead, they have to create separate campaigns for each marketplace.

Wunderman Commerce’s Marketplace Ignition has had multiple clients test ads on Amazon Business and seen that the prices per click are lower than they are for ads running on Amazon’s consumer marketplace, according to Marketplace Ignition CEO Eric Heller. “It’s a land grab,” he said. Heller cautioned that the testing is still early; as more advertisers gain access to Amazon Business, it’s likely that prices would increase with the additional demand.

Amazon is likely to see the most demand from B2B marketers, naturally. “Previous to this advertising capability, B2B products in the Amazon Business marketplace could only grow organically,” said George.

But opening up Amazon Business to ads could raise an opportunity for brands that may not consider themselves B2B marketers. “Just think of how many SMBs there are out there and think, ‘How do these folks replenish their toilet paper, office fridge, K-cups, etc?’” said Heller.

Non-B2B marketers may already be selling products on Amazon Business without knowing it. In that case, they can log into Amazon’s Seller Central or Vendor Central selling platforms to see how many sales they had in the past month on Amazon Business. “If the brand has any volume from the business marketplace, B2B advertising could be big. It might make sense to literally duplicate all your campaigns and run them in both the consumer marketplace and the business marketplace,” George said.

More in Marketing

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.

Digiday ranks the best and worst Super Bowl 2026 ads

Now that the dust has settled, it’s time to reflect on the best and worst commercials from Super Bowl 2026.

In the age of AI content, The Super Bowl felt old-fashioned

The Super Bowl is one of the last places where brands are reminded that cultural likeness is easy but shared experience is earned.