Secure your place at the Digiday Publishing Summit in Vail, March 23-25

For Kit and Ace, Snapchat doubles as a TV channel and customer service assistant

Kit and Ace believes that young people are using Snapchat the way the rest of us do television. So the luxury retailer has been building its following organically on the platform through original TV-style episodes.

Like many brands, Kit and Ace started experimenting with Snapchat by posting behind-the-scenes content around a year ago, but the company soon realized that was not enough to get people coming back. The revelation: The platform ought to be treated more like TV, with reliable showtimes. “Snapchat is replacing TV in some segments,” said Braden Hoeppner, head of e-commerce for Kit and Ace. “The platform is moving towards episode-based content, where people want to come back and watch snaps periodically.”

While Kit and Ace still posts behind-the-scenes fare on Snapchat, it’s taking a more “informational and episodic approach” with a video series created by its in-house content, social media and creative teams. Some of the content is exclusive to Snapchat while some are taken from Instagram, The Brief (its online magazine) or other channels, and then contextualized on Snapchat, explained Hoeppner.

For example, its Snapchat video series “Talking Points” features editors from The Brief talking about their print column of the same name. Topics have included the Rio Olympics, the rent regulations in Shanghai, China and the X-Men movies.

“Talking Points” alternates with another video series called “What the Well(ness)?” on Fridays, where team members act as guinea pigs to try out the latest and weirdest inventions in the world of wellness, from “brain octane” oil to a recent Pokémon Go parade in Chicago. (It’s a type of exercise and thus falls into the wellness category.) Kit and Ace hopes that this series can help humanize the brand and is in line with the company’s mission to address health, fitness, nutrition across channels, explained Hoeppner.

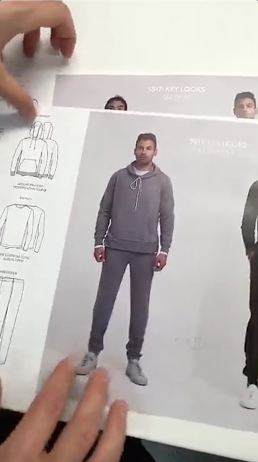

Meanwhile, Kit and Ace snaps an interactive series called “Truth or Dare” on Tuesdays where a company executive — most recently Evan Fox, director of men’s design — fields the demands of Snapchat followers. Questions range from “Show us the weirdest thing on your desk” to “Give us a sneak preview of an upcoming line.”

And on Wednesdays, Kit and Ace broadcasts “WTF Wednesday” to showcase spontaneous and fun things taking place at its Vancouver headquarters.

While Hoeppner declined to disclose any audience numbers for Kit and Ace on Snapchat, he said that views, engagement and followership have been “regularly increasing.”

Video series aside, Kit and Ace integrated Snapchat’s revamped video and phone chat into customer service back in March of this year, a use of the platform that few brands have tapped into so far.

“This is a combined effort by our marketing team and customer service team, because we want to make sure that we have enough staff to handle a big call influx,” said Hoeppner. “Right now, Snapchat is a customer service component but it’s not large.”

But the bottom line for Hoeppner is that Snapchat works because Kit and Ace’s customers are already there — and the company can produce the right kind of content for the platform.

“If money comes to play, I always make sure that we have a small amount of marketing budget for experimentation without expecting ROI, while keep the core budget to scale,” he said. “We are considering some paid products on Snapchat right now.”

More in Marketing

‘An ethics issue’: Why some creators are re-auditing their brand deals after Hootsuite-ICE controversy

Hootsuite’s partnership with ICE sparked controversy earlier this year, prompting creators to re-examine their brand deals and ethics standards.

Gary Vaynerchuk built his name telling CMOs they were wrong. Now he’s telling their CFOs instead

Gary Vaynerchuk has a new favorite meeting.

As it ramps up push to fund AI bets, Meta makes a new play for agencies

Even in the age of Advantage+, Meta needs agencies.