Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In Graphic Detail: The rise of micro dramas that are attracting big ad dollars

Following the ubiquitous nature of short-form video, it’s no surprise that short stories, otherwise known as micro dramas, are now attracting attention.

These mobile-first shows run just two to three minutes per episode and are shot vertically, but unlike typical short-form clips they trade quick dopamine hits for narrative tension. Each installment feels like a miniature TV episode complete with characters, arcs and cliffhangers that pull views into the next. Instead of doomscrolling, they bridge — one micro drama at a time.

Small as they are, micro dramas are already generating a hefty amount of revenue and viewership. How much? Read on to find out.

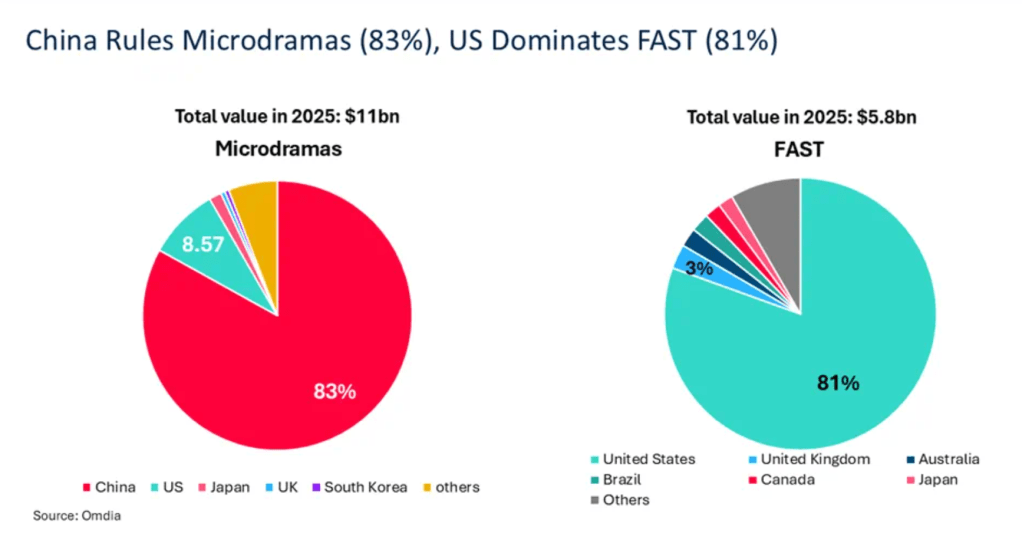

Micro dramas are expected to record $11 billion in global revenue

Micro dramas are set to achieve $11 billion in global revenues this year, with most (83%) of that revenue coming from China, according to Omdia. The U.S. records the biggest revenues internationally, accounting for around 8.6%, with the likes of the U.K, Japan, South Korea and Thailand accounting for smaller portions, as adoption of mini dramas continues to grow.

With how quick micro dramas are growing, Omdia also expects the format to generate nearly twice the amount of revenues of free ad-supported streaming television (FAST) channels, which are forecast to reach $5.8 billion by the end of 2025.

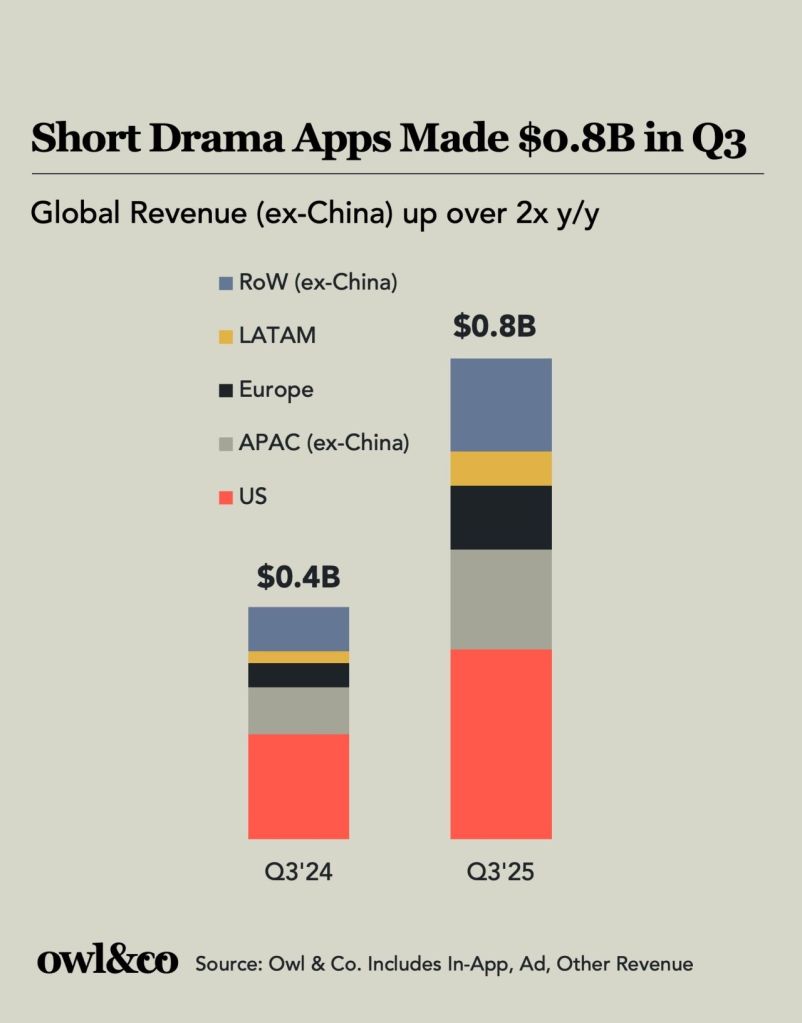

The format generated $800 million in just Q3 2025

In the third quarter, micro dramas raked in $800 million in global revenues (not including China), having doubled from $400 million, year-over-year from Q3 2024, according to boutique media and entertainment consulting firm Owl & Co.

The U.S. is the biggest revenue generator, while the rest of world and APAC (not including China), Europe, followed by LATAM contributed smaller revenues as those regions continue to increase adoption.

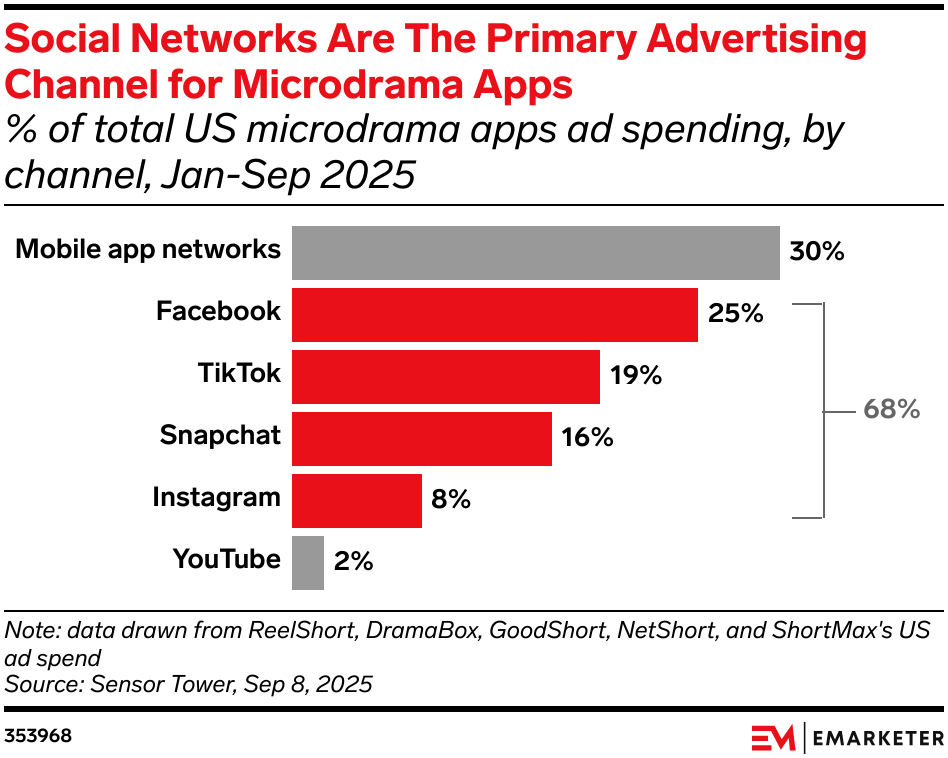

Most ad spending around micro dramas in 2025 came from social media

Overall, 68% of total U.S. micro drama apps ad spending came from social media between January and September 2025, according to eMarketer, citing Sensor Tower.

Broken down, Facebook took the biggest chunk (25%), followed by TikTok (19%), Snapchat (16%) and Instagram (8%). Despite YouTube going all in on YouTube Shorts, it still only accounted for 2% of U.S. microdrama ad spend, per eMarketer. However, that could be down to the fact it’s taken a minute for Shorts to really get some traction, compared to other platforms.

“Micro dramas are catching on in the U.S. because their stories’ outsized emotions, sharp plot twists and short run times are structurally optimized for sharing on social networks,” said Max Willens, principal analyst, social media and the creator economy at eMarketer. “Scripted content already constitutes a substantial share of time spent on some of these platforms — film and TV clips are the fourth most viewed type of content on TikTok, for example — and so it’s not surprising that micro dramas travel well on them, both organically and inorganically.”

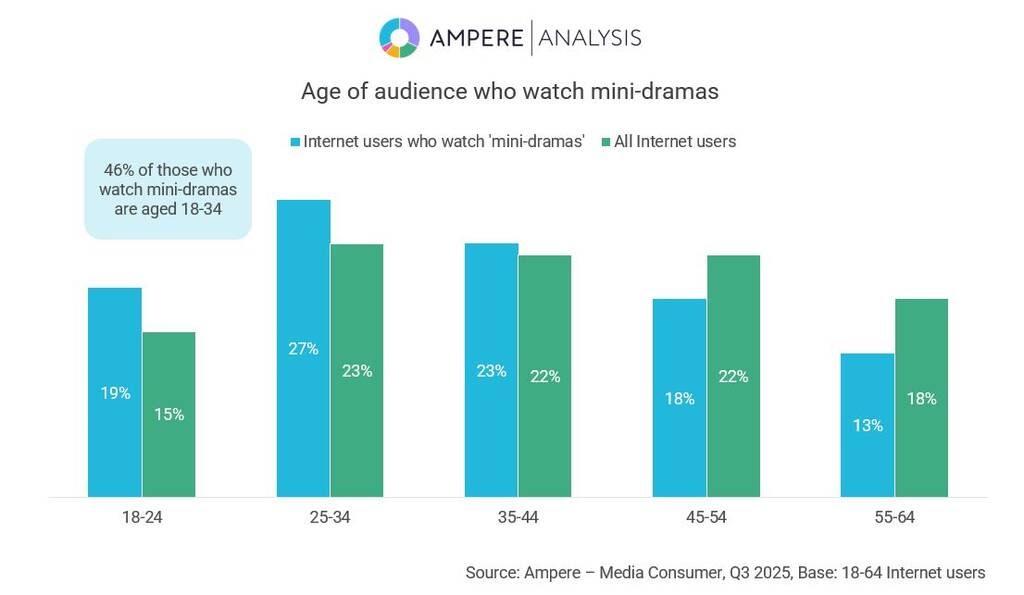

Micro dramas aren’t just appealing to younger audiences

Unsurprisingly, nearly half (46%) of internet users who watch mini dramas are aged between 18 and 34 — or mostly Gen Z and some millennials.

Of that group, over a quarter (27%) of 25 to 34 year olds along with a fifth (19%) of 18 to 24 year olds watch mini-dramas.

Interestingly, more 35 to 44 year olds watch mini dramas than 18 to 24 year olds, with Ampere recording 23% of the age group.

Where there’s more available apps, there’s more viewers

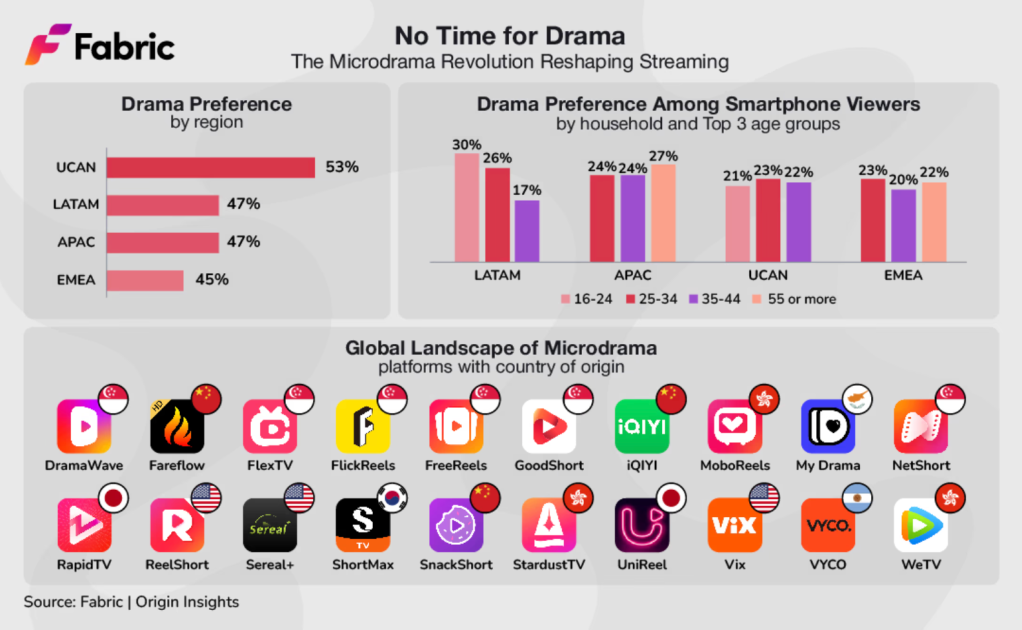

As you’d expect, there’s a correlation between regional adoption, and where micro drama apps originate.

Of the 20 apps that software and data solutions company Fabric analyzed:

- Six originated in Singapore (DramaWave, FlexTV, FlickReels, FreeReels, GoodShort and NetShort.

- Three originated in China (Fareflow, iQIYI and SnackShort)

- Three originated in Hong Kong (MoboReels, StardustTV and WeTV)

- Three apps came from the U.S. (ReelShort, Sereal+ and Vix)

- Two apps came from Japan (RapidTV and UniReel)

- One app came from South Korea (ShortMax)

- One app originated from Argentina (VYCO)

- One app originated from Cyprus (MyDrama)

Moreover, when considering age groups in each region (LATAM, APAC, UCAN, EMEA), APAC leads the way with over a quarter (27%) of smartphone viewers aged 55 or more watching micro dramas, while no 16 to 24 year olds watch them in the region, according to Fabric.

EMEA mirrors APAC in that no 16 to 24 year olds watch micro dramas, instead it’s quite a similar split across the younger age groups.

In comparison, no over 55s watch micro dramas in the U.S. and Canada (UCAN), while viewership is pretty even across 16 to 24-year-olds (21%), 25 to 34 (24%) and 35 to 44 (22%).

It’s a similar set up in LATAM, albeit micro dramas’ biggest audience there are aged 16 to 24 (30%), followed by 25 to 34 (26%) and the lowest age group is 35 to 44 (17%).

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.