Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

How Grupo Bimbo used social listening to boost sales of its Gansito cakes to $580,000

In today’s always-on social media world, several brands including Marriott and Nestlé are battling to make sense of real-time data on a daily basis. And sometimes that data can even lead to sales results.

Case in point is Mexico’s baked goods company Grupo Bimbo, with over 100 brands including Thomas’ and Arnold’s in its portfolio. The company was able to turn negative sentiment online about its Marinela’s Gansito brand snack cake into a $580,000 sales opportunity.

“Social listening and trends are an important guide for the marketing and communications for our brands,” said Elizabeth Juárez, creative director at Vector B, Grupo Bimbo’s agency. “We’re constantly tracking the conversations, trends and ranks over time.”

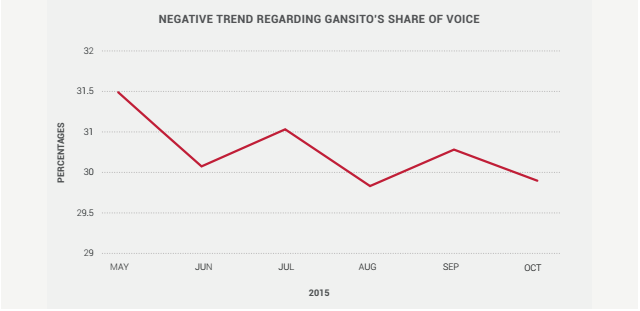

The company knew that Gansito was in trouble. The share of positive social mentions around the Twinkie-like snack cake decreased throughout 2015 (as shown in the chart below). And a decline in its sales would have a big effect on Marinela’s overall business.

But the brand was able to avert that loss, using Brandwatch Analytics. Marinela had launched a special edition in the U.S., Gansito Red Velvet, without considering doing the same in the Mexican market. The brand thought the Mexican market wouldn’t be receptive to a new version, given it had been unchanged for over 50 years.

But when Mexican consumers heard of the Gansito Red Velvet, they took to social media to demand that the new flavor be sold in their country. Gansito Red Velvet became a viral trending topic in Mexico, prompting the brand to bring the red velvet version to Mexico.

Launching a new product in a market where it hadn’t anticipated demand was a task in itself for Bimbo. It had a small budget for the launch, and months of negative sentiment to overcome. So Bimbo took a three-pronged approach. It used influencers to tease the product from October 2015 to January 2016, followed by geo-targeting on social media. Lastly, through April 2016, it shared user-generated content from the launch to fuel conversations on Facebook and Twitter.

“We had little time and a limited budget to turn it all around,” said Juárez. “The best part was beating our metrics ahead of time.”

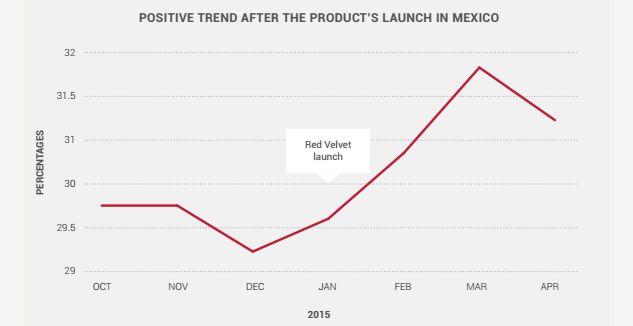

Despite the limited marketing spend and only two markets selling the product, Mexico City and Guadalajara, Gansito sales in Mexico increased 12 percent to $580,000 over two months. Moreover, the red velvet product sold out in just eight weeks, four weeks earlier than expected, and positive social mentions soared (see chart below).

“The biggest lesson for us is that war rooms aren’t just for special occasions — they can really help drive business results,” said Juárez.

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.