Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Google’s Search Partner network comes under fire in research underlining brand safety vulnerabilities

A study from Adalytics Research explores the intricacies of Google’s Search Partner (GSP) network and asks marketers, “Does a lack of transparency create brand safety concerns for search advertisers?”

The report suggests marketers booking ads via GSP — a network of thousands of sites that use its content-discovery and monetization tools — run the risk of their ads appearing alongside content few would deem brand-safe.

Researchers behind the report, which was published earlier today (Nov. 28), observed how these included websites containing pirated content, explicit adult content, and hundreds of putative Iranian websites, which may potentially be under U.S. Treasury Office of Foreign Assets (OFAC) sanctions.

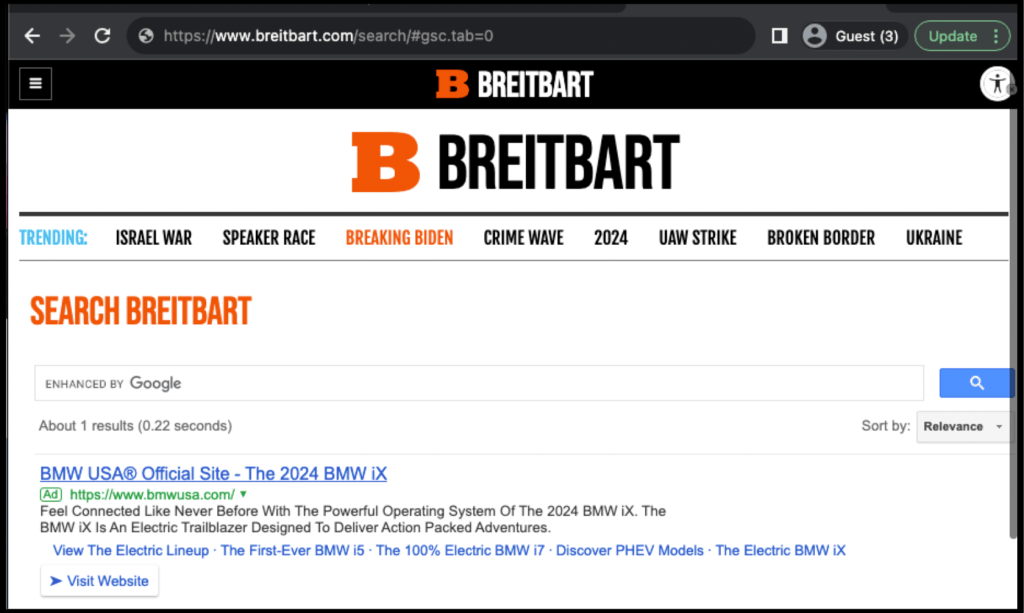

Meanwhile, Adalytics also observed how brands such as BMW that had earlier added Breitbart to their blocklists — some making such decisions to much fanfare — were running on the so-called “alt-right” website via the GSP network, see image below.

According to the study’s findings, hundreds of blue-chip brands (many of which were also members of the Association of National Advertisers) and institutions (such as the European Commission, U.S. Treasury, and multiple campaigns for U.S. politicians) were observed on sanctioned Iranian, and/or adult-themed websites.

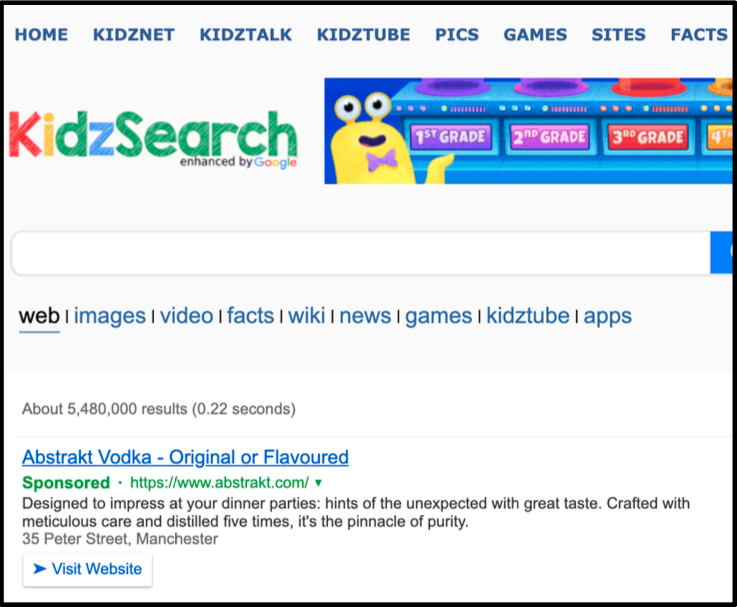

Separately, researchers also observed ads from alcohol and confectionary brands served via the GSP network on websites specifically targeted toward minors — ‘Kidzsearch‘ is just one example; see image below. Among the confectionary brands observed in such instances were several signatories to the Children’s Food and Beverage Advertising Initiative, a self-regulatory scheme promoting children’s health.

On several occasions, Adalytics observed that the delivery method for brand search ads on the sites in question was one of Google’s hero products: Performance Max. Popularly known as “Pmax,” the tool is a performance advertising product made widely available in late 2021 and uses AI to optimize ad campaigns across different ad formats and in different environments.

Despite Google’s public assertions, many feel Pmax is essentially a “black box” offering, with buyers often claiming they have little insight into where their ads have run in post-campaign reporting.

According to a statement in Adalytics’ report, Netherlands-based MEP Paul Tang said the findings are cause for government investigations into how the algorithms of Big Tech operate. “It’s the first time in history we face the unsettling reality of AI committing crimes. Google’s advertising algorithms demand scrutiny,” he said.

“This report unveils a very inconvenient double standard: by having the [European] Commission’s ads displayed on websites of sanctioned Russian and Iranian companies, the Commission may be defying the very sanctions it has proposed.”

Transparency concerns

Ruben Schreurs, chief strategy officer at Ebiquity, noted how brands often overlook search advertising when exploring brand safety concerns. For example, Google Ads’ documentation indicates that it “doesn’t provide any information detailing the website where your ad was shown on the search network.”

For Ebiquity, this is a level of risk the media consultancy outfit was uncomfortable with, and it has advised its clients against using it since 2020. “It was similar to what Facebook did with its audience network, whereby it’s just [an] extension [of campaign reach] beyond their own real estate, and that’s risky by its very nature,” he added.

Ratko Vidakovic, the founder of consultancy service AdProfs, told Digiday the Adalytics report highlights the power of defaults when it comes to such platforms and that he deemed it implausible that a company with the vast resources of Google was unaware of such sites on its network.

“There’s a certain negligence here that seems inexcusable,” he said, “when you’re dominant, and there’s no scaled alternative to your product, you can effectively ignore problems.”

Google Ads maintains that the opt-out feature is a prominent tool in an ad campaign’s set-up stages on its Search or Shopping offering. It also highlighted how brands only have to pay for ads on the network after a user clicks on their ad.

Default settings

Google’s documentation notes that when advertisers create a campaign for the search network, it includes GSP websites by default, with the online advertising giant maintaining that most traffic generated on the network comes from premium properties such as YouTube.

Adalytics’ report does highlight how it is possible to turn off this feature, but several sources approached by Digiday feel that it takes more work to do so; some believe this is by design.

One source, who works at a large financial services institution and requested anonymity per their employer’s PR policy, told Digiday their team regularly attempts to switch off GSP in account settings, which is often cumbersome.

“Our policy is not to run it, and every time you set up a campaign, it turns itself on, but it’s not always easy,” said the source. “You have to think that if they truly believed in it, they’d show you all the URLs where your ad campaigns run.”

However, the Google Ads team maintains that advertisers can exclude their ads from showing on specific SPN sites by speaking to their account representative.

Despite this, a separate media agency source, who similarly requested anonymity because of their employer’s relationship with Google, noted to Digiday how there is a “don’t ask, don’t tell” attitude to the black box offerings from the online advertising giant.

“Google has so many brands hypnotized with special teams just to service that brand or vertical – so the brands feel special and think Google is looking out for their best interest,” added the source. “Google does a lot of education, but it’s almost never on the settings and finer points. It’s very high level.”

Greg MacDonald, founder of media consultancy service Chelsea Strategies, noted that while Google does try to police its network products, such as GSP and Pmax, the issue of scale comes into play.

“They are trying to be good actors, but as they’re facing pressures [to show continued revenue growth], I think they’re perhaps pushing the boundaries in ways they haven’t tried before,” he added. “It sounds like they’ve got a problem, and they need to work out where the failure in the system is.”

Google’s response

Google responded specifically to the findings in Adalytics’ latest report by maintaining that it is committed to complying with all applicable sanctions. Dan Taylor, vp of global ads at Google, brandished them as inaccurate and containing misrepresentative, wildly exaggerated claims of its offering.

“We’ll, of course, review the report, but our analysis of the sites and limited information already shared with us did not identify ad revenue being shared with a single sanctioned entity,” he stated.

Taylor’s statement continued, “The examples shared are from our Programmable Search Engine (ProSE) product (a minuscule part of our Search Partner Network), which is a free search tool we offer to small websites so that they can present a search experience directly on their sites. Ads may appear based on the user’s specific search query; they are not targeted to, or based on, the website they appear on. Websites who merely implement ProSE do not get any ad revenue from those ads.”

More in Marketing

Future of Marketing Briefing: AI’s branding problem is why marketers keep it off the label

The reputational downside is clearer than the branding upside, which makes discretion the safer strategy.

While holdcos build ‘death stars of content,’ indie creative agencies take alternative routes

Indie agencies and the holding company sector were once bound together. The Super Bowl and WPP’s latest remodeling plans show they’re heading in different directions.

How Boll & Branch leverages AI for operational and creative tasks

Boll & Branch first and foremost uses AI to manage workflows across teams.