Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

Retailers that trade in quickly produced, mass-market clothing have been running circles around iconic legacy brands like American Apparel, Abercrombie & Fitch, J. Crew and Gap lately. Among the most prolific so-called fast-fashion brands is H&M. The Swedish retailer has mastered the art and combined it with engaging social and digital experiences.

Fast-fashion retailers “know how to bait their customers and are very good at feeding their desire for originality,” said Jessica Navas, chief planning officer at Erwin Penland. “Their tone makes you feel like they’re with you; they’re more like the all-in girlfriend as opposed to a distant cousin.”

And they have outpaced their competitors, with H&M leading the pack: H&M’s net sales increased 8 percent in the first quarter of 2015. American Apparel saw a decline of 9 percent in the same period, and Gap saw a 3 percent dip.

Here, then, is the H&M guide to killing it on digital.

Get creative on social media.

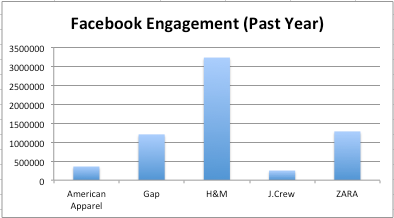

H&M leads the pack when it comes to social interactions, according to data provided by Socialbakers. The brand has received the most engagement on Facebook compared with American Apparel, Gap, J.Crew and even Zara. It similarly boasts the highest number of interactions with customers on Instagram.

H&M leads the pack when it comes to social interactions, according to data provided by Socialbakers. The brand has received the most engagement on Facebook compared with American Apparel, Gap, J.Crew and even Zara. It similarly boasts the highest number of interactions with customers on Instagram.

H&M’s content on social takes a highly visual approach: picture collages featuring its latest products, blog posts on fashion trends and seasonal lookbooks. It has over 22 million followers on its Facebook page, over 7.8 million followers on Instagram and nearly 6 million followers on Twitter.

“These brands realize that their social channels aren’t an advertising medium; they use them to provide inspiration to their customers, get closer to them and use them to glean insights toward creating more relevant products in the future,” said Jason Goldberg, vp of strategy at Razorfish.

Become a publisher.

H&M Life, a digital content hub on the retailer’s website, is dedicated to fashion, beauty and culture. It is designed to give H&M fans daily updates and inspiration from all over the world.

As such, H&M Life takes its content cues from fashion magazines. The site features seasonal fashion guides, evergreen “how-to” articles, beauty tutorials and tête-à-têtes with models. Some recent stories include, for instance, beauty secrets from Brazilian supermodel Isabeli Fontana, summer horoscopes and a yellow dress lookbook featuring Solange Knowles.

As such, H&M Life takes its content cues from fashion magazines. The site features seasonal fashion guides, evergreen “how-to” articles, beauty tutorials and tête-à-têtes with models. Some recent stories include, for instance, beauty secrets from Brazilian supermodel Isabeli Fontana, summer horoscopes and a yellow dress lookbook featuring Solange Knowles.

“Brands like H&M have mastered a variety of touchpoints and are spot-on on the trends they cover and the imagery that they use to present them,” said Navas.

Partner with renowned tastemakers.

Just because your brand is affordable doesn’t mean it has to be downmarket. H&M frequently partners with designers, models and celebrities who sport the label. The brand has collaborated with designers like Alexander Wang and Isabel Marant on its products, but it also frequently recruits popular bloggers, such as Man Repeller‘s Leandra Medine, to hype the brand to readers. This may have contributed to a heightened sentiment score among customers, who have tended toward positive words like “beautiful” and “stylish” in social chatter about H&M over the past year, according to social data intelligence firm Talkwalker. “These fast-fashion brands are all about making fashion accessible,” said Navas. “All these partnerships further contribute to that sense of access.”

Create experiences.

Millennials love a good experience. H&M has been the official sponsor of Coachella since 2009, producing Coachella-inspired collections and providing experiential activities at the venue itself. This year, it hosted a virtual reality installation at the festival that invited participants to interact with fabrics, colors and textures of its new collection. It also, naturally, included a 360-degree “Mirrored Selfie Station” with lighting and visual effects to enhance festival-goers’ photos.

More in Marketing

WTF are tokens?

When someone sends a prompt or receives a response, the system breaks language into small segments. These fragments are tokens.

AI is changing how retailers select tech partners

The quick rise of artificial intelligence-powered tools has reshaped retailers’ process of selecting technology partners for anything from marketing to supply chain to merchandising.

YouTube’s upmarket TV push still runs on mid-funnel DNA

YouTube is balancing wanting to be premium TV, the short-form powerhouse and a creator economy engine all at once.