Secure your place at the Digiday Publishing Summit in Vail, March 23-25

For Elizabeth Arden, marketing is friendship.

The brand’s president, JuE Wong, is making that a core tenet of the beauty giant’s e-commerce strategy, which she says is more high-touch than high-tech. The strategy combines user-generated photos with in-store digital and may help Arden gain a growing foothold in e-commerce.

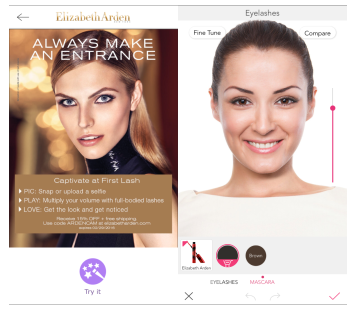

One big part of the e-commerce strategy is a partnership with popular beauty app YouCam Makeup. Arden will be the only brand on YouCam Makeup, which has 100 million users, to use facial recognition to let people virtually try on lipsticks and other makeup products. The app will also provide the option to buy directly from the Elizabeth Arden e-commerce site.

One reason for the partnership: resources. Wong said that it takes, on average, close to a year for a brand like Arden to develop an app from scratch. Integrating with YouCam took closer to 90 days, and since its launch in December, the brand has seen 58 million impressions and a click-to-buy rate of 0.8 percent (a hair below the average of 1.18 percent). “I believe the future for brands is to partner with app companies,” she said. “Building your own thing is basically like asking people to delete your app eventually.”

The brand is also following the footsteps of beauty giant Sephora, which has integrated digital into its stores, by providing customer service reps at Arden counters with tablets that feature the app. So if someone comes into a store, they can try on lipsticks, mascaras or other products, then either buy them right there at the counter or opt-in to an option to be emailed details of their order.

The in-store activations will also encourage customers to sign into YouCam and join its “social network” where beauty aficionados share tips and product secrets. The “Social Circle” will also feature content created by Arden’s ad agency and social team, including beauty tutorials. “We’re hoping that this will mean that instead of inundating her with emails, we’re only reaching out the way a friend would when we have something she might be interested in.”

One big reason for the omnichannel approach is that Arden’s average customer is active on many platforms. The key for Arden has been to go where its customers are — on social media, that’s usually Instagram or Facebook, the counters and, now, the app. “We have to make it about convenience, because if she defers, we’ve lost her. If we don’t give her an option everywhere to buy us or talk to us, we lose her,” said Wong.

Giulia Prati, an analyst at L2 said that Elizabeth Arden hasn’t done enough in digital to keep up with the rest of the industry, especially on mobile. “This app partnership may indeed be an attempt to pick up speed in the mobile category while latching on to some key trends in digital beauty to virtually recreate the in-store experience,” said Prati.

Pushing people to ElizabethArden.com versus letting them buy from other retailers is also a key part of the strategy — and it’s been a challenge for retailers in general. E-commerce in beauty represents only about 8 percent of the $32 billion U.S. beauty industry, and retailers like Amazon account for the lion’s share of purchases. For Arden and other brands, getting people to buy from them is important — for branding as well as loyalty. “Brand sites have become the journey, but not the destination, for purchase,” according to L2’s 2015 beauty report.

The idea of letting customers create their own beauty looks, then share them inside the app to their circle of friends is also taking off in the beauty world. For example, affordable makeup brand Nyx, which sells at a lower price point than Arden, has made user-generated images a key part of its digital strategy. And Sephora has been experimenting with in-store screens and apps that let users “try-on” makeup and share results with friends. L2 analyst Jenny Shen said that while the app partnership is definitely a good move, it may be more of an awareness driver rather than a commerce driver, and it will help Arden use this as a “test-and-learn” to figure out how consumers are engaging with its products on mobile.

For Arden, Wong hopes that being the first brand on an already-popular app will give it the boost it needs to compete with other brands. And it will also keep things personal, one thing experts say has been lacking in the beauty industry’s e-commerce efforts. “We have to really make the conversation in a way that’s personalized and authentic,” said Wong. “This gives us more authenticity and credibility.”

More in Marketing

‘Nobody’s asking the question’: WPP’s biggest restructure in years means nothing until CMOs say it does

WPP declared itself transformed. CMOs will decide if that’s true.

Why a Gen Alpha–focused skin-care brand is giving equity to teen creators

Brands are looking for new ways to build relationships that last, and go deeper than a hashtag-sponsored post.

Pitch deck: How ChatGPT ads are being sold to Criteo advertisers

OpenAI has the ad inventory. Criteo has relationships with advertisers. Here’s how they’re using them.