Secure your place at the Digiday Media Buying Summit in Nashville, March 2-4

‘We don’t want an opportunistic approach’: How Coty is shaking up its innovation teams

Digital innovation is hard for a corporation the size of Coty. But it got even harder when the $9 billion (£7.4 billion) company acquired 41 new brands including Covergirl, Wella and Max Factor as part of its deal with P&G last year.

Now, as it eyes up bigger geographic reach and sustained growth under new CEO Camillo Pane’s five-year plan, Coty is rethinking how it approaches new technologies and trends in-house.

Elodie Levy, global head of digital innovation and new products, is helping to shape Coty’s approach.

Tell me about the challenges you face in tackling innovation with 41 new brands.

The more brands you have, the bigger the need to streamline your innovation operations to find efficiencies. We also need to ensure that each brand has a very unique and differentiated approach to innovation, based on their specific DNA, positioning and target audience.

In the past, there was a lot more emphasis on the tech-first approach, with each brand wanting to be first in one area. But now, our focus is not necessarily about piloting technology but piloting a service for the consumer and reaching them at the right moment. We don’t want an opportunistic approach.

How do you choose what to keep in-house?

We’re still in constant evolution. We have significantly ramped up our in-house capabilities in many digital areas so there is a lot that we can do in-house. At the same time, we are always looking externally to see who is doing interesting things and where we can partner. Take artificial intelligence, for instance. We all know it’s not a fad, it’s now a key part of any data science program. But should you partner or build in-house ? We’re making these decisions all the time.

How will the new digital innovation structure look at Coty?

When a brand comes with an idea, firstly we’ll make sure their request is strategic and not tactical. It’s about making sure there is a benefit for the brand itself and that the technology is the right fit.

Once we’ve agreed there is an interest in exploring it, we’ll assemble a task force of around five people from across the business and consider what it would look like to build a minimum viable product and how long it would take. The aim is to make sure there is no big barrier between the idea and the execution. Then we’ll speak to focus groups to see if there’s traction for the idea. After the pilot has run, we can showcase it to the rest of the company.

And this is inspired by the pilot you ran with the Rimmel Get The Look app?

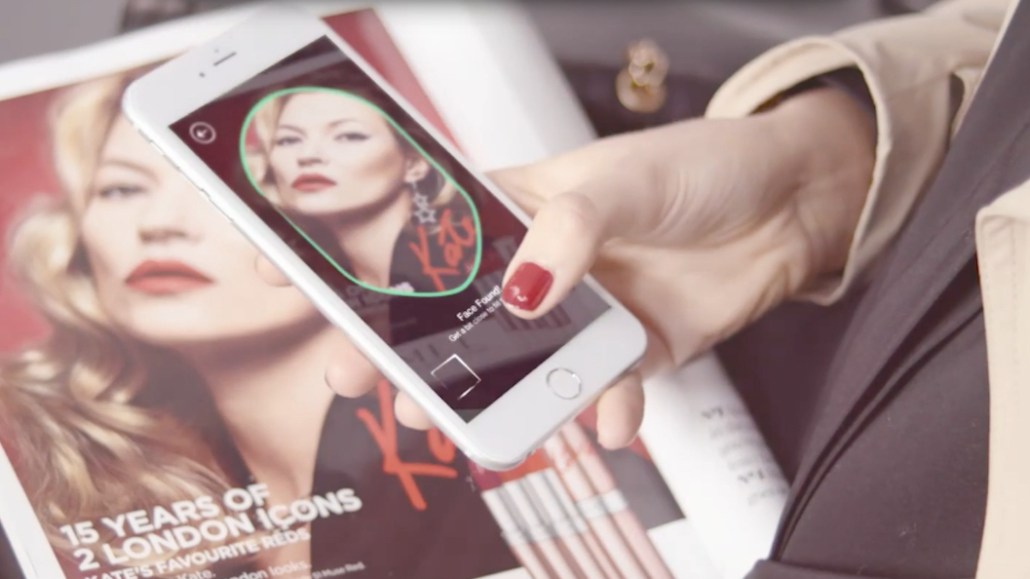

Yes. This was the story that helped define our approach. We launched it last June to let users to steal makeup looks and see them on their own face via augmented reality software. It is the perfect example of an underlying tech being pioneered by a brand. It was first to market, but it was grounded in a consumer need. There are already powerful multibrand apps to try on shades of makeup virtually, so we took a different angle. It was something which was totally in line with Millennial behaviors today; you see something on Instagram, and you want to try it on yourself.

Following the Rimmel launch, we later rolled the technology out to Germany via the Manhattan brand. Then there was evolution of the platforms landscape, so now we’re thinking how can we insert this AR technology into new shells.

We always make sure there is an uniqueness in our technology, and it is answering a consumer need, not duplicating efforts from other brands.

Hear more from Elodie Levy who is speaking at Digiday’s Brand Summit Europe this May in Berlin, Germany.

More in Marketing

Thrive Market’s Amina Pasha believes brands that focus on trust will win in an AI-first world

Amina Pasha, CMO at Thrive Market, believes building trust can help brands differentiate themselves.

Despite flight to fame, celeb talent isn’t as sure a bet as CMOs think

Brands are leaning more heavily on celebrity talent in advertising. Marketers see guaranteed wins in working with big names, but there are hidden risks.

With AI backlash building, marketers reconsider their approach

With AI hype giving way to skepticism, advertisers are reassessing how the technology fits into their workflows and brand positioning.