Secure your place at the Digiday Publishing Summit in Vail, March 23-25

With debit card, Venmo eyes retail partnerships as path to monetization

PayPal-owned Venmo is using a debit card to work with retailers — and (finally) make money.

This week, it rolled out a limited-release Venmo debit card issued by the Bancorp Bank that customers can use anywhere Mastercard is accepted. It’s a lever the company can use to elevate the Venmo brand’s reach from the digital to the physical world — an entry point for profitable tie-ups with retailers.

“A card familiarizes [Venmo’s] brand with merchants as a payment mechanism – and merchants are going to be the biggest factor in Venmo achieving profitability,” said Rachel Huber, payments analyst at Javelin Strategy and Research. “Think marketing and loyalty tie-ins, integration fees, and promotional deals. Venmo has access to an extremely desirable consumer segment – expect them to use that to their advantage.”

While rolling out a physical card may seem odd for a mobile-first payment platform, it’s a recognition that mobile payments aren’t quite mainstream yet, and most transaction activity still occurs in physical stores. According to Huber, nine out of 10 transactions are still carried out at the physical point of sale, allowing PayPal to bridge the gap between physical and online transactions.

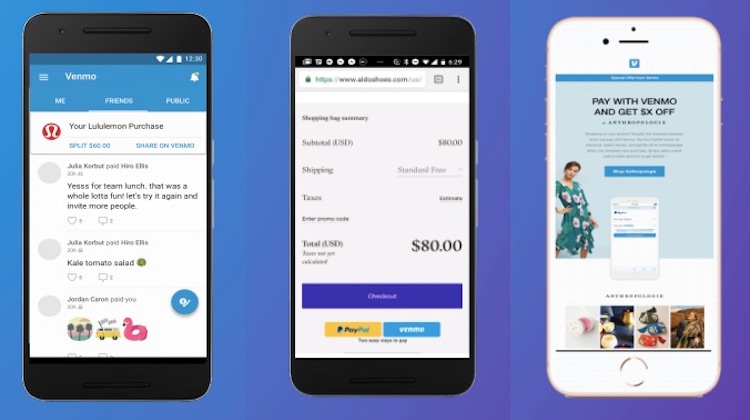

Venmo’s social feed is of particular interest to retailers. Transactions that take place through the debit card will be logged in Venmo’s user history, much in the same way peer-to-peer payments are recorded — adding possibilities to promote purchase activity through Venmo’s social feed. It’s a largely untapped method for consumer companies to acquire social endorsements from the Venmo feed, and push targeted ads to users based on their behavior.

“The unique social aspects of Venmo could provide a path to advertising revenue — few other payment platforms make it fun for users to share their payment activity with friends,” Morningstar analyst Jim Sinegal wrote in a recent report.

Over the past year, PayPal has accelerated its efforts to profit from Venmo through partnerships with e-commerce brands. Last year, it launched Pay with Venmo, which let customers use Venmo as a payment method with 2 million online retailers, including Grubhub, Seamless and Williams Sonoma. In January, it rolled out instant transfers for a $0.25 fee, but growth of Venmo as an e-commerce vehicle has been slow. Between January and April of this year, just 11 percent of Venmo users engaged in a “monetized experience” — in other words, used Venmo to pay for consumer goods — according to the company.

Venmo wouldn’t comment on its broader monetization strategy, but a company spokesperson said it’s been focusing on offering customers more ways to use Venmo. A physical card may generate some interchange revenue, but it’s not likely to be significant; the objective is to expand Venmo’s reach, which in turn, can set the stage for new types of revenue-generating partnerships.

“[The thinking is] ‘let’s solve the scale problem first and deal with monetization later,” said Omri Dahan, chief revenue officer of Marqeta, an API platform that powers prepaid debit and credit cards.

By putting a physical card in the customer’s hand, it opens up additional revenue streams beyond charging transaction fees to merchants and consumers, including co-brand relationships and customer incentives.

Despite the growth of bank-backed peer-to-peer payments tool Zelle, PayPal is banking on Venmo’s stranglehold over the millennial market to grow its reach among consumer brand partners. During the first quarter of 2018, Venmo processed $12.3 billion in payment volume.

More in Marketing

Why one brand reimbursed $10,000 to customers who paid its ‘Trump Tariff Surcharge’ last year

Sexual wellness company Dame is one of the first brands to proactively return money tied to President Donald Trump’s now-invalidated tariffs.

WTF is Meta’s Manus tool?

Meta added a new agentic AI tool to its Ads Manager in February. Buyers have been cautiously probing its potential use cases.

Agencies grapple with economics of a new marketing currency: the AI token

Token costs pose questions for under-pressure agency pricing models. Are they a line item, a cost center — or an opportunity?