Secure your place at the Digiday Publishing Summit in Vail, March 23-25

In the early days of social media, companies began to roll out their own branded communities, or social hubs, that ultimately failed. Remember Pepperidge Farm’s “Art of the Cookie” social hub from 2007? No? Doubt you’re alone.

That phase of social media ended in a swift death, as brands adopted the fish-where-the-fish-are approach advocated by your favorite social media guru. But now brands like Dell and Procter & Gamble are finding ways to roll out social hubs, learning from the mistakes of the past and not treating social as a zero-sum game.

Dell, for instance, has built out its Dell IT Social Hub. It’s basically a one-stop shop online that pulls in feeds of the most recent IT-related news and updates from Dell’s social media channels and blogs, keeping everything in one place and connecting with customers and technology enthusiasts.

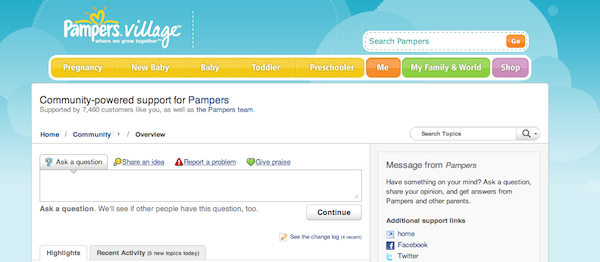

Procter & Gamble’s Pampers brand is another example. The brand just rolled out its Pampers Village community, where moms can connect with one another and with Pampers. The idea behind this initiative is: Build a community, and the brand will be stronger.

In both cases, the social hubs aren’t intended to replace Facebook or Twitter, as these destinations obviously have more scale than a built-from-scratch branded community. The simple numbers dictate that. Brands don’t stand a chance of drawing the kind of numbers on their own social properties as on a platform like Facebook. Pampers’ branded social hub boasts approximately 7,000 members, which is peanuts compared to its 1 million fans on Facebook.

“With the past efforts of building branded communities online, a lot has changed since 2007,” said Wendy Lea, CEO of Get Satisfaction. “One angle to consider is the discoverability of content. A lot of the problems with these sites [back then] was they were all about pushing out information and not really focused on the interaction aspect. The momentum has shifted because the conversations are now indexed and then discoverable by other consumers who go to Google and ask a question or reference a product. And the sharing features have improved. These are two big movements that can affect a brand’s community and connecting to the consumer. Nowadays it is completely different. It’s the open-network effect.”

Consumers are much more conditioned today to share then they were five years ago. However, their Facebook, Twitter and Pinterest are their top platforms of choice. Even a big behemoth like Google is having trouble getting people to participate on its Google Plus social media destination. It’s hard to tell whether or not brands are going to be able to capture the attention of consumers with these branded social hubs.

More in Marketing

Yahoo pauses IAB membership amid a series of quiet cost-saving measures

Yahoo pulls IAB board memberships, following job cuts as PE-owner reportedly reconsiders ad tech investments.

Target looks to e-commerce, advertising investments to help grow the business

Technology is one of the most important areas in which Target will invest with the hopes of returning to profit growth.

‘The conversation has shifted’: The CFO moved upstream. Now agencies have to as well

One interesting side effect of marketing coming under greater scrutiny in the boardroom: CFOs are working more closely with agencies than ever before.