With the rise of e-commerce come associated challenges: Retailers must not only increase customer engagement but also drive sales in a highly competitive online environment.

Data — historical and real-time — is key. And there’s never been more of it to go around. The problem is that most retailers aren’t using it right.

“Everybody is good at collecting mountains of big data, but very few e-commerce retailers are actually using it to give consumers a better shopping experience,” said Jason Goldberg, svp of commerce strategy at Razorfish. “Execution is what differentiates the top e-commerce retailers from others.”

Retailers should use mobile retargeting as well as increased personalization, said Goldberg, which can also help drive sustained engagement and purchases within their apps. Ultimately, it also helps to have highly differentiated products and brand experiences.

Here is what else e-commerce retailers should keep in mind, in 5 charts:

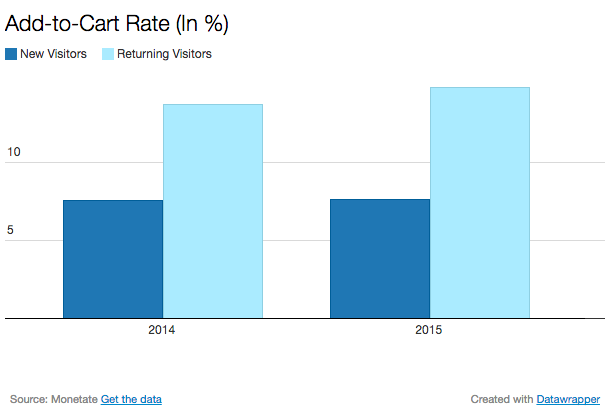

Target new consumers, but not at the cost of returning ones

Top e-commerce retailers understand the value of a loyal customer base. According to a recent study by experience marketing platform Monetate, returning visitors are twice as likely to add an item to their cart than new visitors. While returning visitors spent nearly $5.3 billion online in the fourth quarter of last year, new visitors spent only $2.7 billion during the same timeframe.

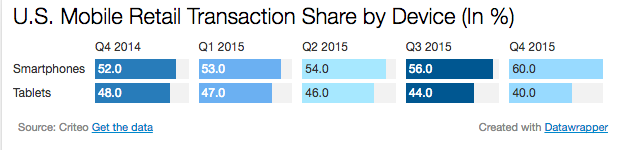

Smartphones are king for mobile transactions

Smartphones are now used in over 60 percent of all mobile transactions, with a 15 percent year-over-year growth between the fourth quarter of 2014 and 2015, a recent report by Criteo found. The study also revealed that even among non-mobile transactions, nearly four out of 10 cross-device desktop transactions included mobile browsing at some step.

“Mobile is growing and its influence is increasing,” said Goldberg. “But overall in e-commerce, it is important to remember that mobile isn’t the biggest channel as yet.”

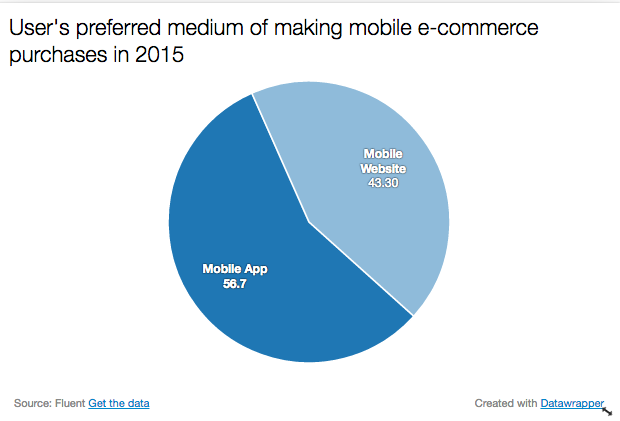

It’s better to place your bets on mobile apps than mobile websites

Dedicated mobile shopping apps not only lead to higher conversions than mobile websites but also a to higher average order value. According to the Fluent survey, of the 37 percent of Americans who used smartphones for e-commerce purchases in 2015, 57 percent made them through mobile apps rather than websites (43.3 percent). This can be attributed to a more native and personalized environment as well as a more controlled purchase path.

“The caveat here is that only your most valuable consumers are actually going to go through the trouble of downloading your app and using it to make a purchase,” said Goldberg. “I would caution against overlooking mobile websites as a way to target new consumers.”

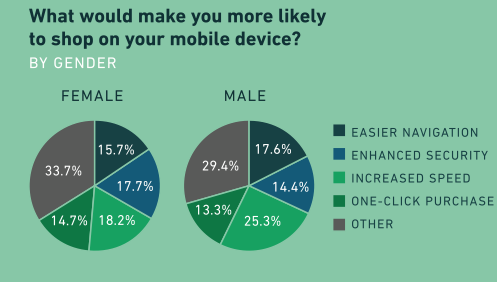

Speed, navigation and security are all important to different consumer sets

To enhance their consumers’ mobile shopping experience, brands and retailers should prioritize increased speed (21.6 percent), easier navigation (16.6 percent) and enhanced security (16.1 percent). A recent study by Fluent, however, found that while men prioritized navigation over security, women chose security over easier navigation. And when it comes to demographics, younger shoppers preferred speed over older shoppers, who preferred security.

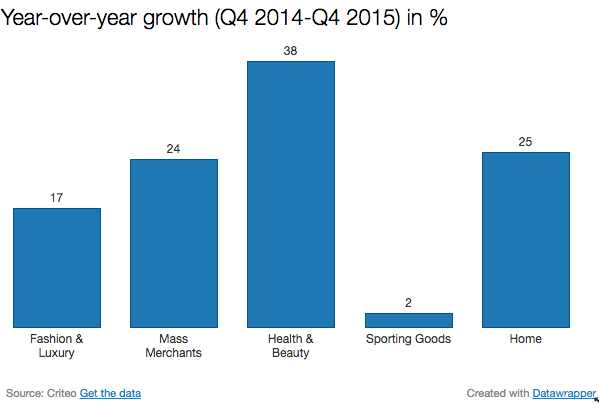

Mass retailers and fashion and luxury retailers have the most to gain

While mobile is emerging as an integral channel for shopping broadly, its growth is more explosive in some categories than others. Mass merchants as well as fashion and luxury have always been popular e-commerce categories, but health and beauty was the fastest-growing space in terms of transactions in 2015 with a 38 percent increase, followed by home.

More in Marketing

Star power, AI jabs and Free Bird: Digiday’s guide to what was in and out at the Super Bowl

This year’s Big Game saw established brands lean heavily on star power, patriotic iconography and the occasional needle drop.

In Q1, marketers pivot to spending backed by AI and measurement

Q1 budget shifts reflect marketers’ growing focus on data, AI, measurement and where branding actually pays off.

GLP-1 draws pharma advertisers to double down on the Super Bowl

Could this be the last year Novo Nordisk, Boehringer Ingelheim, Hims & Hers, Novartis, Ro, and Lilly all run spots during the Big Game?