Secure your place at the Digiday Publishing Summit in Vail, March 23-25

This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at the perpetual question of whether advertisers consider YouTube on par with traditional TV and streaming services.

- YouTube TV

- YouTube, Tubi lead TV watch time gains in February

- TikTok’s potential new parent, WTF is a podcast and more

YouTube TV

Is YouTube TV? It’s a question that’s hovered around the Google-owned video platform for the past few years as people spend more time watching YouTube videos on TV screens. The latest answer? Yes — and not quite.

For audiences, yes, YouTube is TV. It’s the top streaming service on TV screens by watch time as measured by Nielsen. And in February, YouTube announced that people spend more time watching YouTube on TV screens than any other device.

For advertisers, though — well…

“I don’t necessarily think there’s a straightforward answer to that question,” Toby Katcher, svp of video investment at CMI Media Group.

“We’re debating that every year,” said an agency executive who spoke on condition of anonymity.

“I do think they’re poised for that perception to continue to shift in their direction. But today it’s definitely not viewed as running on Disney+ and Max et cetera. It is a little bit different, for sure,” said Skyler McGill, head of programmatic and video at Wpromote.

OK, probably not the answers YouTube would be hoping for. But agency executives are not dismissing the idea of YouTube being considered on par with TV-level streaming services, such as Hulu, Netflix and Peacock. So to paraphrase the immortal words of Lloyd Christmas, ad buyers are saying there’s a chance for YouTube to be TV.

“I do think people are starting to think more seriously about if it fits within CTV,” said the agency executive.

Right now, though, YouTube remains a round peg in the rectangular hole of CTV.

“I would definitely say that it’s not viewed equal to a Hulu or a Max or a Netflix. There’s still a hurdle there,” said Hermelinda Fernandez, svp of digital investment at Canvas Worldwide.

Actually, there are multiple hurdles. One being YouTube’s CTV ad offering. It’s not yet on par with the likes of Hulu et. al, according to agency executives interviewed for this article.

“When you’re thinking about more so like pause ads and some other really interesting integrations that are still trying to take shape around dynamic content insertion, I think some other networks are a little bit further ahead in that regard. So I do think there’s more work to do with YouTube CTV, and catching up with the marketplace,” said McGill.

“YouTube is still a different consumer experience and ad experience than a traditional CTV platform, like a Hulu or Peacock or Netflix,” said the agency executive.

YouTube is working to close that gap, though. The platform added pause ads last year, and starting in May, it will update its mid-roll ad slots to group more ads together into traditional multi-ad pods in order to lessen interruptions.

“We want ads to be well integrated into the overall viewing experience, and we have been launching products that seem more native,” said Romana Pawar, senior director of product management for YouTube Ads at Google.

YouTube is also working to make its CTV viewing experience more on par with traditional streaming services.

Case in point: later this year YouTube will roll out a way for creators to stitch videos into enhanced playlists called Shows so that viewers can binge them in order as they would a series on Amazon or Netflix. This would also open up a more traditional-style sponsorship opportunity for advertisers, in which a brand could sponsor a YouTube creator’s Show in the same way it would sponsor a show on a traditional TV network or streaming service.

Pawar acknowledged the opportunity to sell sponsorships against YouTube creators’ Shows. “We’re still thinking through the exact plan on that,” she said.

Nonetheless, the primary hurdle YouTube faces when it comes to this question of “Is YouTube TV?” in the eyes of advertisers and agencies remains its content.

Advertisers and agencies still view YouTube videos as user-generated content, not TV-quality programming. They acknowledge that creators like MrBeast and Michelle Khare are producing videos on par with traditional TV and top-tier streaming services and that YouTube’s NFL Sunday Ticket Package and YouTube TV streaming pay-TV service are rounding out the platform’s actual-TV library. But they still see the breadth of YouTube’s content library leaning heavily toward UGC.

“People will differentiate between a MrBeast TV show and a MrBeast YouTube show. Maybe that’s just legacy assumptions and stereotypes,” said the agency executive.

Again, probably not what YouTube would want to hear. But here’s the thing: The same could have been said about reality TV two decades ago when YouTube had just launched. In fact, the agency executive used reality TV as an analogy when describing the YouTube content conundrum, with there being a divide in advertisers’ minds between reality TV and scripted shows. But then “it’s hard because people are buying reality TV on CTV apps as well,” said the agency executive.

CMI’s Katcher also drew the reality TV analogy to the point of describing reality TV as “basically highly produced UGC.” A definition that 20 years ago would have been appended to “Survivor” on CBS or a decade ago to “Keeping Up With the Kardashians” on Bravo.

And a definition that today could just as easily be applied to Michelle Khare’s “Challenge Accepted” or Natalie Lynn’s “Borderless.”

What we’ve heard

“I feel safer on Twitch than I do on other platforms.”

– Twitch streamer Joseph “Halfmoonjoe” Birdsong on Twitch’s moderation standards

YouTube, Tubi lead TV watch time gains in February

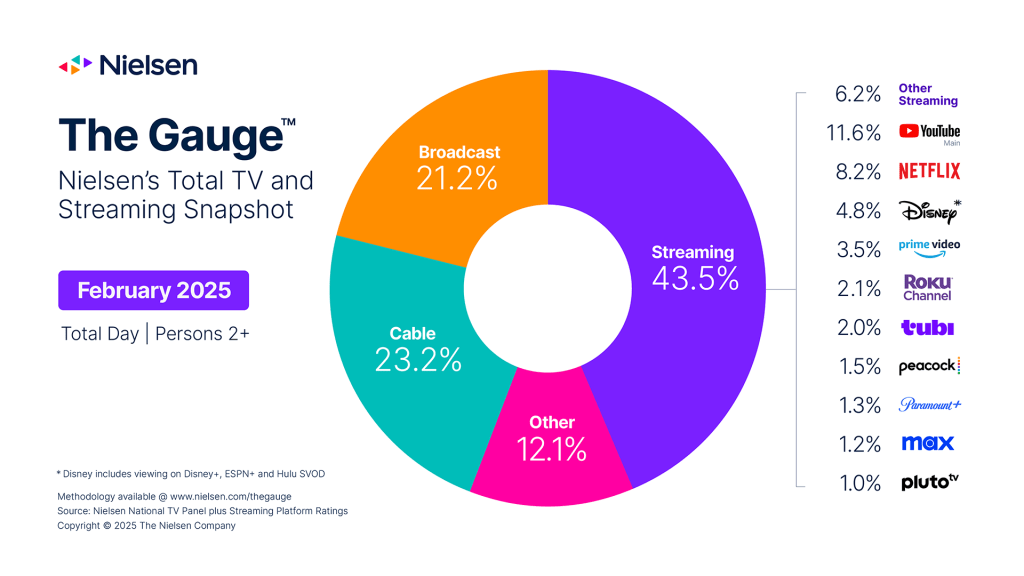

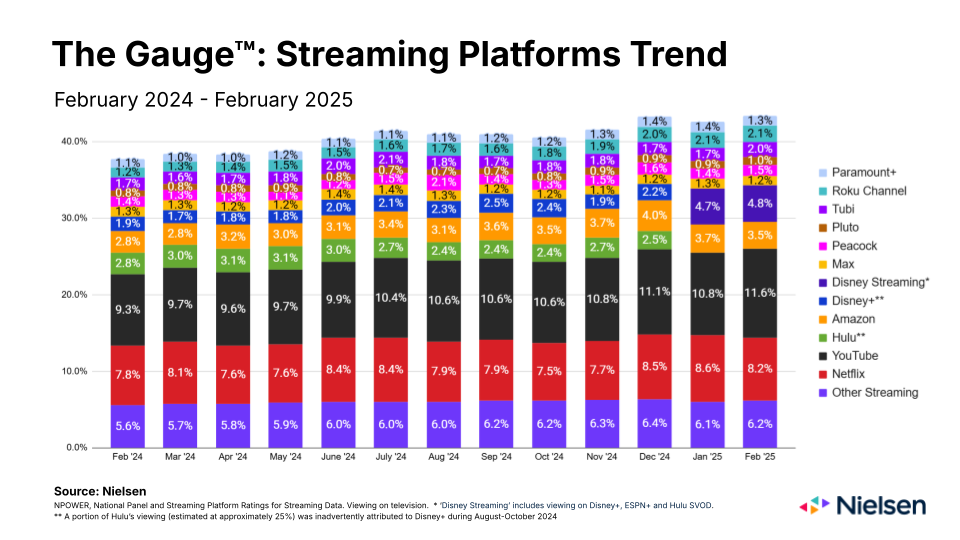

People spent less time in front of their TV screens in February compared to January, but more of the time they did spend was spent watching streaming, with an emphasis on YouTube and Tubi, according to Nielsen’s latest The Gauge viewership report.

Streaming’s share of watch time increased by 0.9 points month over month, while broadcast TV and cable TV ceded share. And the biggest streaming gainer was the service that already holds the biggest share of watch time: YouTube, which saw its share increase by nearly a full percentage point.

Fox-owned Tubi also saw a boost in watch time share thanks to its stream of this year’s Super Bowl, which helped it notch the second-biggest month-over-month share increase. On the flip side, Netflix ceded the most share among streaming services, dropping 0.4 percentage points. Other than that, the streaming watch time rankings stayed pretty steady. Oh, but Paramount-owned Pluto TV finally reached the 1.0% threshold for the first time since the September 2022 rankings.

Numbers to know

$244.4 million: How much money advertisers spent on women’s sports in 2024.

$3 billion: How much money Comcast will pay to retain NBCUniversal’s Olympic rights through 2036.

21%: Percentage share of surveyed Gen Z members who consume podcasts through YouTube.

What we’ve covered

TikTok ban looms closer, leaving more questions than answers in its wake:

- This week’s Digiday Podcast recaps what has transpired since TikTok’s ban deadline was extended in January.

- Digiday platforms reporter Krystal Scanlon provides the state of play among advertisers, creators and TikTok competitors.

Listen to the latest Digiday Podcast episode here.

As YouTube turns 20, here are the numbers you need to know:

- Every minute, 500 hours of video, on average, is uploaded to the Google-owned video platform.

- More than a third of those videos are in 4K resolution.

Read more about YouTube here.

How Substack creators are pooling audiences with live video co-hosting:

- Creators have seen subscription spikes after co-hosting livestreams on the platform with other creators.

- One in three of creators’ live videos this year are co-hosted with other creators.

Read more about Substack creators here.

How ad-supported streaming services stack up for marketers, from Amazon to YouTube:

- The latest Digiday+ Research report surveys ad buyers’ on what share of their ad budgets the streamers receive.

- The brand and agency respondents also weighed in on the streaming services’ ad placements.

Read more about ad-supported streamers here.

A look at the state of social marketing as the TikTok ban draws near:

- Instagram and Facebook retain the majority of advertisers’ social marketing budgets.

- YouTube and TikTok came in third and fourth place, respectively.

Read more about TikTok here.

What we’re reading

TikTok’s potential new parent:

Oracle has emerged as the frontrunner among the suitors that have stepped up to acquire TikTok’s U.S. business, according to The Information.

If Spotify is putting out more video podcasts and YouTube has become the primary platform for some people to consume podcasts — and I’m having to write “consume” instead of “listen” or when referring to people “checking out” podcasts — then what even is a podcast anymore and, more importantly, what does that mean for how advertisers allocate ad dollars for podcasts, according to Bloomberg.

YouTube is TV on other streamers:

Amazon, Netflix are NBCUniversal’s Peacock are among the streaming services loading up on shows starring YouTube creators in the wake of Amazon’s success with MrBeast’s “Beast Games,” according to The Wall Street Journal.

Want to discuss this with our editors and members? Join here, or log in if you're already a member.

More in Future of TV

Long-form creators eye taking over TVs – and chasing bigger brand budgets

Long-form episodic creator content is drawing in large numbers of highly engaged viewers, but ad budges are lagging behind. We explore why.

Future of TV Briefing: How Paramount’s and Warner Bros. Discovery’s ad tech stacks stack up

This week’s Future of TV Briefing breaks down Paramount’s and Warner Bros. Discovery’s ad tech stacks now that the companies seem set (finally) to combine.

Future of TV Briefing: Netflix’s in-house ad platform launch has led some advertisers to double spend

This week’s Future of TV Briefing looks at how the streamer’s expanded ad targeting and measurement options has resulted in increased advertiser spending.